DHFL: Building on current enthusiasm around affordable housing

DHFL, an early entrant in affordable housing finance, has grown by targeting the hinterland with a dedicated task force

Kapil Wadhawan became chairman and managing director of DHFL in 2009

Image: Joshua Navalkar

When 35-year-old Rajesh Wadhawan started Dewan Housing Finance Limited (DHFL) in April 1984, it was with the intention of providing housing finance options to low-income clients. The first few loans that the company—based in Bassein (now Vasai), a far-flung suburb of Mumbai—gave out were funded by the Wadhawan family, which had a business of township development.

“He realised at that time that the deficit lay not only in providing affordable housing for the social segment with low incomes, but also in giving them access to affordable financing options,” says Kapil Wadhawan, 43, Rajesh’s son, who became chairman and managing director of DHFL in 2009.

By 1996, when the company had 30 offices across the country, 80 percent of the loans that it gave out were for homes that cost between Rs 1.5 lakh and Rs 2 lakh (‘affordable housing’ was not a term that had still gained currency); the company would finance 85 percent of the cost.

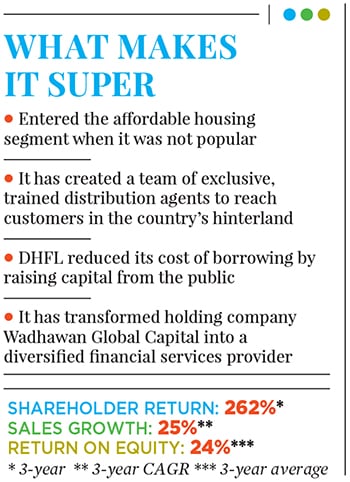

Today DHFL is India’s second largest private housing finance company—after HDFC—by assets under management (Rs 83,560 crore, as of March 2017), and is growing at 18-20 percent year-on-year for five years. It has 352 branches across 22 states and two Union Territories. The price of DHFL’s stock (the company was listed in July 1984), as of July 12, 2017, was Rs 434.55 on the BSE, double its price from Rs 217.65 last July. In FY17, its profits jumped by 27 percent to Rs 927 crore and net income rose by 21 percent to Rs 2,217 crore.

The holding company, Wadhawan Global Capital Private Limited, has three housing finance companies under it, each catering to a different income segment: DHFL, the flagship company and brand, has an average loan ticket size of Rs 16 lakh to Rs 17 lakh, with a customer profile comprising, among others, owners of trading or micro-, small- and medium enterprises; Aadhar Housing Finance, operating in northern and western India offers an average home loan of Rs 7.5 lakh, DHFL Vysya Housing Finance’s profile is similar to Aadhar’s, but it operates in southern India.

Between DHFL and Aadhar, the group targets 67 percent of India’s population, says Harshil Mehta, CEO, DHFL.

These companies find themselves in a sweet spot because of the current enthusiasm around affordable housing within the realty sector, which has been fuelled further by the government’s push to provide “housing for all (by 2020)” through the Pradhan Mantri Awas Yojana (PMAY), launched in 2015. This government scheme focuses on slum rehabilitation projects, providing subsidies on interest rates on loans between Rs 1 lakh and Rs 5 lakh, and subsidies for beneficiary-led individual housing constructions.

In the 2017 budget, the government gave another push to affordable housing by according it infrastructure status, thus enabling realty developers to access cheaper sources of finance, such as institutional credit, and reduce the cost of borrowing; affordable housing projects now also get priority sector lending status.

About three-fourths of the loans that DHFL disburses qualifies as relating to affordable housing under several government schemes that are linked to slum rehabilitation projects, housing for low and middle-income groups, and the government’s Golden Jubilee Rural Housing Finance Scheme that deals with rural credit.

Image: Joshua Navalkar

Over the last two to three years, the home loan market is being driven by affordable housing with even HDFC Chairman Deepak Parekh telling CNBC-TV18 in an interview in May that “affordable housing will be the biggest growth engine that India will have in the next five years”.

HDFC has seen its average loan size drop below Rs 26 lakh over several quarters, with growth being led by affordable housing loans instead of luxury homes, as was the case in the previous decade. “The affordable housing space will be a Rs 6-trillion opportunity by 2022; it will become a large segment in the housing finance space, with an estimated market share of 37 percent in FY22,” says Harshal Patkar, senior analyst at India Ratings and Research.

According to Crisil, in developed economies like the United States, the ratio of outstanding housing loans to GDP is about 30 percent, in China it is 18 percent, and in India just 10 percent. Wadhawan quotes this statistic to demonstrate the penetration of housing finance in different economies which, in turn, implies, among other social changes, rising incomes, improving affordability, and widening reach of financiers.

In this rising tide of financing for affordable homes, the lenders that are rapidly gaining market share are not banks—they are not focusing on affordable housing due to factors such as high operating cost structures and concerns over asset quality management—but non-banking finance companies (NBFCs). These finance companies, which have specialised credit underwriting competencies tailored for low-income segments, have business models that give them a competitive edge across different segments.

A May 2017 report by Crisil and the Reserve Bank of India says the market share of NBFCs in the housing loans segment rose from 35 percent in 2011 to 40 percent in 2016, compared to banks.

Over the past six years, 17 new NBFCs have entered the affordable housing space, while most of the existing lenders, such as Lodha Ventures, Centrum Housing Finance and JM Financial, are expanding their distribution channels to smaller cities, where loan sizes are smaller.

DHFL is India’s second largest private housing finance company. It is growing at 18-20% year-on-year for five years

But providing low-income segments with housing finance did not always attract such enthusiasm. Wadhawan, who studied for an MBA at Edith Cowan University in Australia, and joined the family business in September 1996, remembers the early days vividly.

Although DHFL was an established name by the mid-1990s, its positioning as a lender to low-income segments did not always inspire confidence in bigger lending institutions. “Even though we had a large franchise on the ground, the perception was that if we lent to the low- and middle-income segments, the credit quality of our customers would be weak and defaults would be high,” Wadhawan recalls. But, he adds, the low-income segments are, in fact, more diligent in repayments.

Wadhawan talks of a time around 2000, when, just after his father had passed away, he was waiting outside the office of a large public sector bank, hoping to get a loan sanctioned. At that time DHFL had assets worth around Rs 400 crore, and business was more about sustenance than growth. “We were asking for a Rs 5-crore credit. This happened at a time when repayments had to be made, and we had to hold back some disbursements. The times were clearly different and hence the treatment was different… like we were suspects,” he recalls. Although the credit did come through, it taught Wadhawan valuable lessons.

DHFL has, over the years, reduced its dependence on banks as a chief source of funds and has explored new avenues to raise money: In 2016, it raised Rs 14,000 crore through two non-convertible debenture (NCD) issues; in 2017, it added Rs 1,969 crore to its net worth by selling its entire 50 percent stake in DHFL Pramerica Life Insurance Company to DHFL Investments, a wholly owned subsidiary.

“The capital infusion is sufficient to drive growth of DHFL’s affordable housing finance business for the next two to three years,” Wadhawan says.

DHFL has also managed to stay ahead of competitors such as State Bank of India, Indiabulls Housing Finance and LIC Housing Finance by having their exclusive distribution agents—instead of independent direct selling agents, which some other financing companies operate with—who are vital to reaching low-income segments in tier 2 and 3 cities. In DHFL’s case, they are similar to what business correspondents are in a bank.

“We are not dependent on third party direct-selling agents, and have our own sales and distribution teams. They are residents of the areas they operate in and have a strong relationship with local brokers, and contractors,” says Mehta. DHFL’s team of 2,553 distribution agents—trained in-house—acquire new clients, report to the sales teams and execute all sales leads. DHFL’s sales teams also pitch in to help clients understand loan applications and financial processes.

Another factor that has helped DHFL stay ahead are the regions it operates in. While competition such as Indiabulls Housing Finance, LIC Housing Finance and HDFC operate in large metros and towns, DHFL operates in tier 2 and 3 cities, where it has a first-mover advantage.

“DHFL has a differential through the geographies it operates in. Where it will stand out will be by continuing to reduce the cost of funds,” says Alpesh Mehta, analyst with Motilal Oswal Securities.

The two NCD issues in 2016 and a renegotiation of the pricing of its bank loans helped DHFL reduce its cost of borrowings by 84 basis points on the entire book in FY17 to 8.83 percent. Industry data shows that DHFL’s cost of funding reduced by 0.84 percent in FY17, while for HDFC it was 0.62 percent, LIC 0.55 percent, Can Fin Homes 0.4 percent and Repco 0.34 percent in the same period.

Besides continuing with its focus on affordable housing, the group is capitalising on the retail franchise it has built up through housing finance over the past three decades. In 2012, the group started Avanse Financial Services, a non-banking finance company focussed on education loans. It also has a mutual funds company, DHFL Pramerica Asset Managers, which started in 2015.

In 2009, the Wadhawans split the family-run businesses, with Kapil taking charge of DHFL, and brother Dheeraj, 38, who graduated in construction management from the University of London, managing real estate development through RKW Developers; Dheeraj is also the non-executive director on the board of DHFL. Their uncle Rakesh Wadhawan and cousin Sarang took charge of the real estate company HDIL.

There are rapid developments being introduced in Kapil Wadhawan’s businesses to streamline operations. Group company Aadhar Housing is set to be merged with DHFL Vysya Housing in the coming months; the merged entity would cover 19 states. Wadhawan also plans to expand Avanse Financial Services into a consumer finance company catering to low- and middle-income segments; a general insurance business is expected to start this October, while a wealth management business is likely to start by next March.

“We are now in the process of evolving into a diversified financial services group, after being a monoline housing finance company for several years,” says Wadhawan.

To keep the DHFL flagship housing finance company on track, the company will need to keep doing more of what it has done for decades: Offer loans with favourable interest rates, train its sales and distribution staff, and expand on its digital drive.

But Wadhawan has a different concern—of the “frenzy” that now surrounds affordable housing. As new players enter this crowded space, it increases the fear of an unsolicited exit of many of them. The sector could well do without anything similar to the crisis in the microfinance sector a few years ago, which led to tighter regulations and limited credit limit from banks.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)