Motilal Oswal Financial Services: The house that Raamdeo Agrawal and Motilal Oswal built

In the 30 years since Motilal Oswal Financial Services was born, it has grown far beyond its broking origins. Now, co-founders Motilal Oswal and Raamdeo Agrawal are focusing on a vertical climb

Raamdeo Agrawal (left), co-founder and joint MD of Motilal Oswal Financial Services, with Motilal Oswal, who is chairman. They have built successful asset management and housing finance businesses together

Image: Joshua Navalkar

Three decades make for a long partnership by any measure. For Raamdeo Agrawal, 60, co-founder and joint managing director, and Motilal Oswal, 55, chairman, it has been a particularly interesting one, and not without its share of ups and downs. By their own account, the learnings have been plenty in their journey towards building a successful homegrown financial services firm.

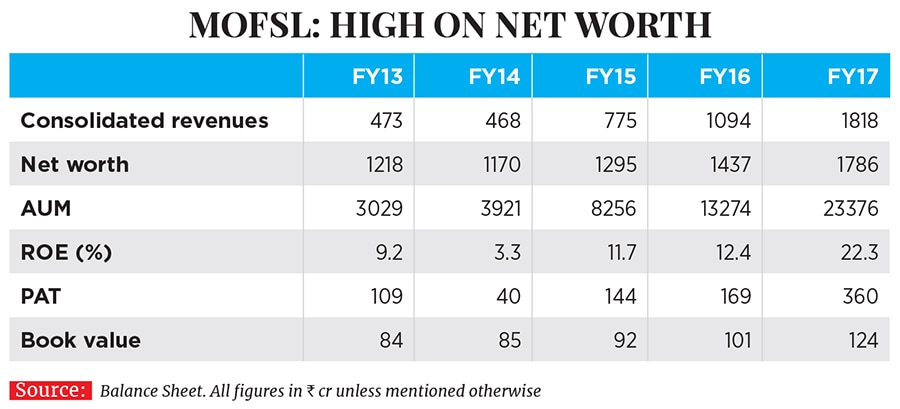

When Motilal Oswal Financial Services Ltd (MOFSL) was set up as a broking house in 1987, it was one of the few professionally managed broking companies to concentrate on research and it went on to become a non-banking financial company. Apart from its traditional business of broking, the company also entered the asset management (AMC) business in 2008 and later set up a housing finance company (HFC) in 2013. Both these businesses have grown at a brisk pace over the last three years and make up a substantial part of the net profit of the company. Not surprisingly, over the last two years, MOFSL has seen its market capitalisation go up by 245 percent to Rs 16,000 crore. For FY17, the company had a consolidated revenue of Rs 1,818 crore over a net profit of Rs 360 crore; its return on equity (ROE), at 22 percent, is a significant climb from 9 percent in FY13.

In an interview with Forbes India, Oswal and Agrawal speak about how they built the company, what worked for them and, importantly, what didn’t. Edited excerpts:

In an interview with Forbes India, Oswal and Agrawal speak about how they built the company, what worked for them and, importantly, what didn’t. Edited excerpts:Q. How was the start with Motilal Oswal? What were the initial challenges?

Raamdeo Agrawal (RA): Every company has a genesis. This had equity at its heart. Our earlier visiting card said we have to help people make money in the stock markets. This was in 1987 and that was our mission statement. [But] money-making is not that easy. Now, if we make money for someone, the client will see to it that we [MOFSL] also benefit. We kept on improving the returns for our clients. We did this through a process of accumulating knowledge. We studied money-making in the stock market from [following iconic investor Warren] Buffett and also our wealth creation study which is a report on India’s fastest and the biggest value creating companies. We wanted to answer how to make money faster and better in the stock market and use that skill to make money for others.

We started as a broking company. [For that] there is no entry barrier and no capital requirement. And it is a seller’s market. During that time, there was a shortage of quality brokerage houses. It was all traditional business. There were no professionals then. Two chartered accountants starting a broking house was unheard of. It was revolutionary in 1987.

Motilal Oswal (MO): In the first four years, we made little money. Then there was the Harshad Mehta bull run. At that time, we made Rs 30 crore in 20 months by investing Rs 15 lakh. This was because we were at the right place at the right time. [Without the Harshad Mehta bull run] we would have parted ways and taken up jobs. There was not enough on the table.

Later, we started research where the team was three times bigger than our corporate office team. Our budget for research was 30 percent of the gross revenue. Then we began talking to institutions and FIIs before going global. Later, the norms on distribution and broking services were relaxed. Earlier, the system was such that Bombay Stock Exchange [BSE] members could not open offices anywhere outside Mumbai. [Because] there were many regional stock exchanges, you could not open a branch in Jaipur or Kanpur because they had their own stock exchanges. Then NSE came in 1994. Till 2002, we were in Mumbai. Also, in 1998, the dematerialisation of shares happened and Sebi came into the picture.

Q. You were a strict taskmaster. We have heard stories of you walking on the research floor and grilling analysts on quarterly results and company strategies.

RA: Those stories are absolutely true. I do that even now. We were known to keep our analysts on their toes all the time during our broking days. Today we do that in the AMC business. I sit with my AMC team on the same floor. That way I remain on my toes and they remain on theirs.

Q. While you built the broking business, it also had to face some tough challenges…

RA: After the collapse of y2k [because of the bug which derailed the new formatting and storage of calendar data entering the new millennium], between 2003 and 2007, we actually had our golden period. We went from Rs 10 crore to Rs 1,000 crore in the broking business during this time. We also listed the company on the stock exchange in 2007. We did not realise that demat and computerisation were actually going to finish the broking business as brokerage rates fell from 1.5 percent to 5 basis points (0.05 percent). Whenever the underlying business gets destroyed because of technological change, but volume expansion happens and entry barriers remain, you cannot build a very big business. Motilal Oswal earned its name in research and made money, but in 30 years that was not the kind of reward we deserved. Then, post 2008, we started asking what can we do with the Rs 1,200 crore that we have? Either we can stay as a brokerage house, making some Rs 100 crore and keep building investment portfolios or invest in new businesses or, to put it better, become entrepreneurs. And so, in 2008, we built our AMC.

Q. But even the AMC faced difficult times…

MO: The first five years were tough. In 2014, we launched our active products in the mutual fund business and then the markets went up. This benefited us. For every business to take off, we need one tailwind to push growth. In the bull run of 1992, we got broking right and now we got the AMC business right. Over the last three years, we have moved from Rs 1,500 crore to Rs 24,000 crore in terms of AUM. Now the second piece is built. These businesses are free-cash generating and don’t require capital. So what do you do with the money? We decided to build an HFC. In banking, it is the safest segment where the loan-loss ratio is the lowest. We allocated Rs 500 crore to the HFC.

RA: ASPIRE, our HFC, is like an equity investment. But we are not doing mortgage. It is done by a professional team. But the heart of our company is broking and investing. The biggest [piece of the] pie of MOFSL is the reinvestment of our free cash-flows into our own products. Actually 60 percent of the balance sheet is reinvested in our own products. If you look at how Rs 100 of MOFSL is invested in the group, AMC requires Rs 5, broking Rs 10, HFC Rs 45 and Rs 40 is in treasury. The treasury further invests the capital into the AMC.

Q. How did you go about building the HFC?

RA: We had around Rs 1,200 crore in treasury of which Rs 600 crore as free cash was available for us. When the markets go down, we need a Rs 1,000-crore balance sheet to stay afloat. But what to do with this money? I’m extremely bullish on HFC. Our country needs 100 million houses. I could see the possibility of making money out of HFC. I could have bought an HFC stock or, say, purchased HDFC from the stock market and remained invested, or I could have gone in for a promotional company; we thought we would buy four to five small HFCs and one of them will work. Buy Rs 20 crore worth of equity in each company and see which one goes up. That was the thought process. We also tried investing into this business through Motilal Oswal Private Equity but that didn’t work out.

Then we decided to seed a company. We told the team that we will give you Rs 100 crore. If it works out, we will give you Rs 400 crore more. If it didn’t, we were ready to bear a Rs 100-crore loss. But they did well and now they have Rs 400 crore more from MOFSL. HFC consumes capital, but I have a lot of free cash flow from all sides—our profit is good.

MO: As we look at our businesses, we have four streams—treasury, HFC and the traditional business of broking which includes investment banking. Then the fourth one is asset management; this includes mutual funds, portfolio management services and private equity.

Q. How do you get into new businesses?

RA: At the board level, we have decided that there will be no more new businesses. Those that we have invested in, we will exit from them if they don’t work. In the last three years, we have not got into anything new. Moti loves to get into new businesses, but I have told him that I won’t come for the board meeting if you start anything new. We have decided ourselves that we will grow vertically, not horizontally.

The point was to do something meaningful. Money was not the motive. How do you bring in excellence and what is the aspiration? It takes around seven years to build a robust business. We might look great in the HFC business after three years, but that’s not how we look at it. To build a good business, you need to build strong roots and that takes time. In AMC, we struggled for the first five years. From 2013 onwards, we did well. Now, in the last two years, we have tasted success.

Q. What were your learnings from Buffett’s Berkshire Hathaway?

RA: Moti has different learnings. Mine was how to conduct the business. For me, what really matters is the recruitment of people and the ethics in the business. What is a good business? What is the importance of growth and of market cap? How do you look at dividend policy?

MO: My biggest learning was how to look at capital allocation.

RA: Till about 2014, we were doing arbitrage in derivatives and the cash market, but then we stopped it. We were not comfortable with that. We closed that division when [Narendra] Modi became prime minister.

Q. How do you hire people?

RA: I look at competence. I put stress on academics, particularly when the candidates are from IITs and IIMs. You cannot get into these institutions unless you are competent. I also look at whether a person has grown through the ranks. Then I look at passion. Do you have that ambition and drive?

MO: I normally look at qualities that make you a good leader and a team player. People management is important. Is he process driven? That is what is really important for us.

RA: When we hired Anil Sachidanand [as MD and CEO] for our HFC business, we must have met almost everybody that mattered in the HFC segment. In that process, we learnt so much about HFCs.

MO: We have created a good cultural environment here. We give respect to our people and that is the reason they last with us for a long time. We give them ownership of the business. We are delegating our responsibilities. We don’t have operating responsibilities, but we are here every morning. We have an entrepreneurship culture and partnership culture. We believe in empowerment. We gave shares of ASPIRE, our HFC, to everybody—from those at the bottom to the top employees of MOFSL.

RA: In 2003, we said one-third will be the operating cost, one-third employee cost and one-third will be the company’s profits. So when we grew by 100 times, our employee cost also went up by 100 times.

Q. What do you make of the new fintech companies that are disrupting everything in finance?

MO: We have aligned with some fintech companies. We have met a lot of fintechs to understand if the idea is relevant to us. We are not looking at investing in fintech, but acquisition is a possibility. We have 180 people and they work with lots of vendors and keep us abreast about what is happening in that space. Buffett never invested in businesses he did not understand. We follow the same thing.

Q How do you look at the world in the times of Artificial Intelligence and machine learning?

RA: Where there is no advice, the business will go digital. If you talk about broking, it was execution with advice. Advice is still human. We got hurt by the digitalisation of execution and, in the process, it demolished the business. In investing, if computers can pick stocks and invest and allocate, we are not needed. Then the AMC business will also become a commodity business.

MO: Innovation and ideation is difficult to do through computers.

RA: Markets are about reasoning. You are buying the future. Machines can build machines, but they cannot build human beings.

“ Markets are about reasoning. Machines can build machines, but they cannot build human beings.

Q. How do you look at the Indian software sector? The industry is in a spot.

RA: It went through a good phase, but now is in trouble. In 1996, the sector was very small. By 2000, it was $5 billion [in size]. Today that number is $120 billion. It is still growing at 8 percent on such a high base. The Infosys or Wipro model is probably under threat because the businesses underlying them are going through change. Now the robotics and machine learning model is disrupting the model of headcount-driven businesses. That is 80 percent of their business which is not growing for them. Maybe the India or world digitalisation business is growing, but it doesn’t have the size. So I think these companies will grow at a slow pace.

In fact, the world economy is growing at a slow pace. In the next ten years, if the world economy takes off, we will see growth. And Indian companies will do well. But traditional companies are not the best companies to bet on. They are great companies, but are they great investments? They have cash. They have dominance. They are running the banks. Growth and annuity is there. If we look at it from our investing framework of quality, growth, longevity and price, we see that growth is missing. IT is classical value. But we buy value plus growth (VG).

I’m running public money and if I don’t perform, I will close shop. I can’t take the risk of a value trap. The base is big now. Underlying changes are happening. But on the face of it, we are looking at low growth. It is a B2B business. Information technology is a contrarian buy. My style is not contrarian. My style is VG.

Q. What are you reading now?

RA: I’m reading Eating The Big Fish by Adam Morgan. It is about how challenger brands can compete against brand leaders. How do you position yourself as a new HFC or a new AMC? It [the book] helps us in two ways.

One is for our own company and two, you can also find the next multi-bagger in the market. When someone builds a new challenger brand, you can pick it up. Challenger brands are expensive, but the potential is also high and that is what you buy. You don’t buy performance. You buy potential.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)