Of credit and credibility: Why Madhusudan Ekambaram and KreditBee get a strong vote of approval from investors

When the VC world was down with severe cold, private equity stepped in and gave full marks to Madhusudan Ekambaram and KreditBee. The NBFC too got its wish list: Cash, credit and credibility of a bunch of cherished backers

Madhusudan Ekambaram, Cofounder and CEO, KreditBee

Image: Hemant Mishra for Forbes

Madhusudan Ekambaram, Cofounder and CEO, KreditBee

Image: Hemant Mishra for Forbes

It was crazy,” recalls Madhusudan Ekambaram. No marks for guessing. The ‘crazy’ year was 2021, and it seemed the startup world was busy churning out a blockbuster sequel of Alice in Wonderland. Dollars started flowing freely from the tap, a rarest of rare mythical animal—unicorn—suddenly multiplied and fluttered majestically in all its glory, and venture capitalists turned into King Midas—whoever they touched turned into gold. And the founders—even those with meagre revenue, questionable business models and dubious corporate governance—got a makeover with a heavy glitter of valuation. Entrepreneurs immersed themselves in scripting a fairytale of chasing crazy growth at all costs, raising money became the most glamorous and rewarding act, and valuations were generously pegged on multiples of revenue. The real world turned surreal.

Ekambaram, though, was not daydreaming. “It was indeed crazy,” says the first-time founder, who started his professional innings with TCS in 2004, spent the next dozen years in the software, telecom and ecommerce industries, and finally took the entrepreneurial plunge in 2016 when he co-founded KrazyBee, an NBFC which lends through its digital lending platform KreditBee. In 2016, Ekambaram was 35, had a home loan and the startup ecosystem in India was still largely untouched by the curse of heady valuations.

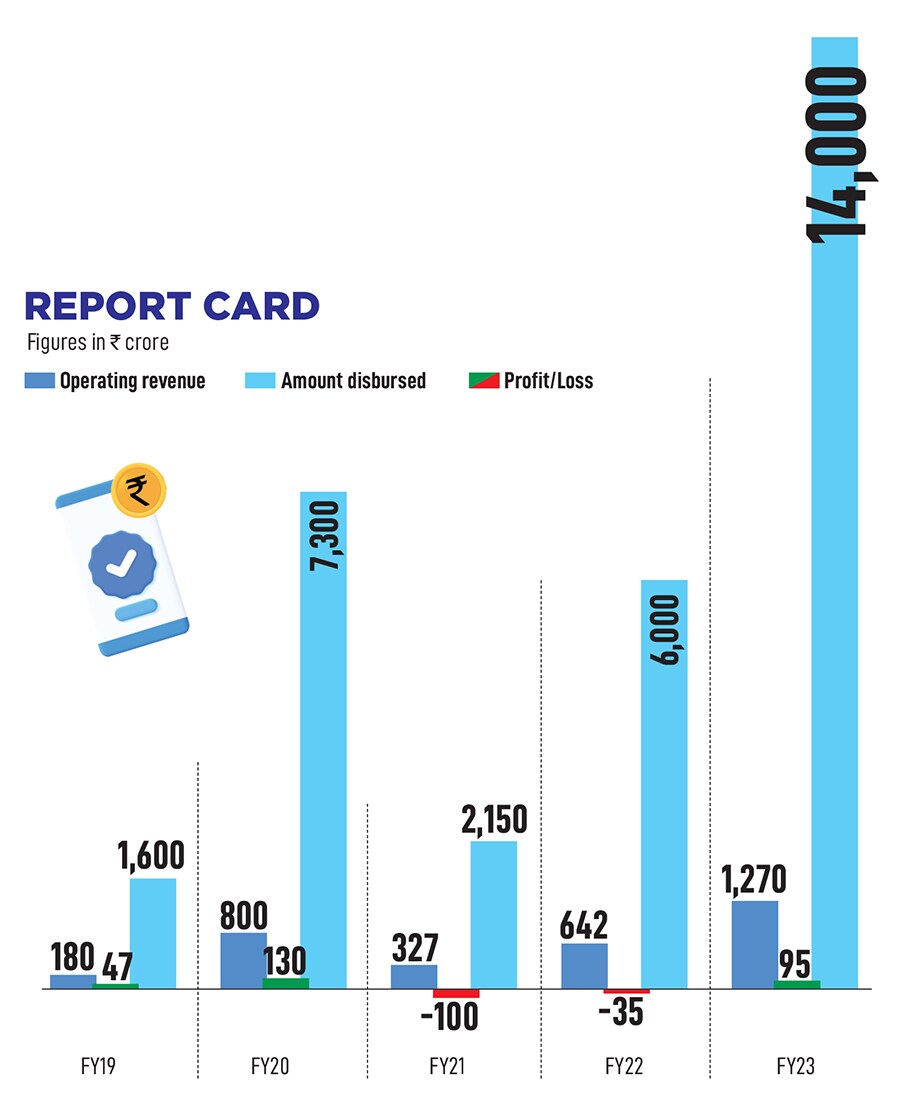

Five years later, things changed in a flash. “I got 11 terms sheets when I hit the market for the Series C round of funding,” recalls Ekambaram, who was then 41. “Don’t you find this crazy?” he asks. The founder shares reasons for his deep scepticism. In early 2021, the world, including India, was struggling with the pandemic, the clouds of uncertainties still gripped most of the ventures, and the business of lending was the riskiest of the entire lot. And it reflected in the way the revenues of KreditBee crashed: From ₹800 crore in FY20 to ₹327 crore in FY21.

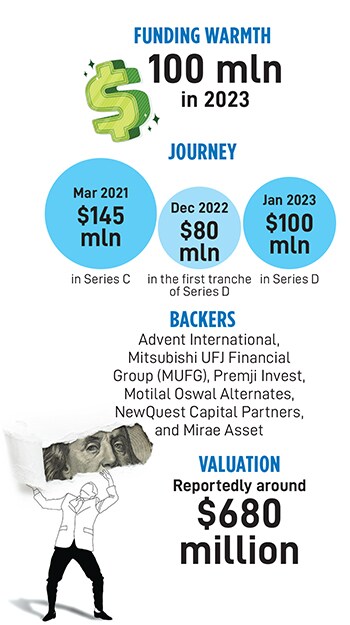

What was even more damaging was the fact that the venture slipped into loss for the first time—from a profit of ₹130 crore to a loss of ₹100 crore during the same period. “Amidst all this, 11 term sheets was how the market responded,” says Ekambaram, who went with four funds—the TPG-backed NewQuest Capital Partners, Premji Invest, Motilal Oswal Alternates and Mirae Asset Naver Asia Growth Fund—when he closed $145 million in the Series C round of funding in March 2021.

What was even more damaging was the fact that the venture slipped into loss for the first time—from a profit of ₹130 crore to a loss of ₹100 crore during the same period. “Amidst all this, 11 term sheets was how the market responded,” says Ekambaram, who went with four funds—the TPG-backed NewQuest Capital Partners, Premji Invest, Motilal Oswal Alternates and Mirae Asset Naver Asia Growth Fund—when he closed $145 million in the Series C round of funding in March 2021.

Two years later, in January 2023, Ekambaram managed to get just three term sheets in his Series D round of funding. Interestingly, two out of three—private equity major Advent International and Mitsubishi UFJ Financial Group (MUFG), Japan’s largest bank—pumped in money. Interestingly, there were no offers from VC funds. “The market was cold,” recalls the founder, who started the fundraising process in May 2022, got the term sheets in a month, and closed the process over the next seven months in January 2023. Apart from the funding winter, there were other reasons for the absence of venture capitalists.