How FreshToHome tightened its ship to woo investors in the funding winter

Shan Kadavil knew that the 'growth-at-all-cost' story would not make investors fall hook, line and sinker. The fisherman, therefore, sailed into the choppy waters with a sticky bait, and the gambit worked out for the seafood-to-meat platform

Shan Kadavil, Co-founder and CEO of FreshToHome

Image: Nishant Ratnakar for Forbes India

Shan Kadavil, Co-founder and CEO of FreshToHome

Image: Nishant Ratnakar for Forbes India

Just as the saying “you fish only as much as you need”, Shan Kadavil was under the impression that a founder only raises the amount that is needed for the venture. “You don’t raise money when you don’t need it,” says the co-founder and CEO of FreshToHome, an ecommerce platform for fish, seafood and meat that he co-founded with seven others in 2015. For all his life—the software engineer was the India head of global social gaming company Zynga, had an eight-year stint at California-based company SupportSoft where he led the enterprise business unit, and a couple of other gigs since 1999—and a good part of his entrepreneurial stint at FreshToHome, Kadavil was always committed to the philosophy of ‘need and deed’.

Come 2022, and his philosophy turned out to be a rotten fish. He explains by taking us back to the pandemic year of 2020.

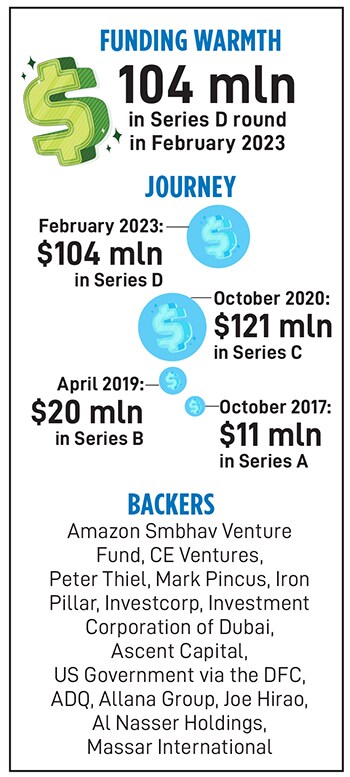

In October that year, FreshToHome raised $121 million in Series-C round of funding. In hindsight, the number looks low. Reason? “The market was too hot in 2020. It was buoyant, and dollars flowed freely,” he recalls. What this meant for the D2C player was a problem of plenty. It was wooed by many, it declined a lot from the pack, and remained selective in its approach.

Kadavil persisted with his orthodox approach in 2021, a year when the startup ecosystem was at the peak of funding glut.

It was also the year when rival Licious turned unicorn. Interestingly, its $1 billion-valuation round came just four months after Licious reportedly raised a staggering $192 million in Series-E round of funding and was furiously narrowing its gap with the leader in the space.

With competition heating up, Kadavil was faced with some uncomfortable questions. The biggest: Why was FreshToHome not casting its net wide? Says Kadavil: “We were well capitalised because of the funding in 2020. So we never felt the need,” he says. A few months down the line, he rued the missed opportunities. “In hindsight, it (not raising money) was quite a bad decision,” he admits. “It was really a wrong move.”

With competition heating up, Kadavil was faced with some uncomfortable questions. The biggest: Why was FreshToHome not casting its net wide? Says Kadavil: “We were well capitalised because of the funding in 2020. So we never felt the need,” he says. A few months down the line, he rued the missed opportunities. “In hindsight, it (not raising money) was quite a bad decision,” he admits. “It was really a wrong move.”  Retail—going offline—seemed to be the silver bullet. Kadavil opened a grand store in Yelahanka, Bengaluru. In terms of aesthetics, interiors, appeal and look, it was nothing less than the Starbucks of fish and meat. The move, though, was a flop show. “We had no clue about retail because we were not coming from a retail DNA,” confesses Kadavil, who tried to find out what went wrong. The discovery was startling. Customers, revealed a user-survey undertaken by FreshToHome, perceived stores to be costly. “If a fish shop had an AC, consumers considered that to be pricey,” says the founder, who spent over a crore in building two stores, and decided to tone down the premiumness and branding to make the outlets more palatable to the consumers.

Retail—going offline—seemed to be the silver bullet. Kadavil opened a grand store in Yelahanka, Bengaluru. In terms of aesthetics, interiors, appeal and look, it was nothing less than the Starbucks of fish and meat. The move, though, was a flop show. “We had no clue about retail because we were not coming from a retail DNA,” confesses Kadavil, who tried to find out what went wrong. The discovery was startling. Customers, revealed a user-survey undertaken by FreshToHome, perceived stores to be costly. “If a fish shop had an AC, consumers considered that to be pricey,” says the founder, who spent over a crore in building two stores, and decided to tone down the premiumness and branding to make the outlets more palatable to the consumers.