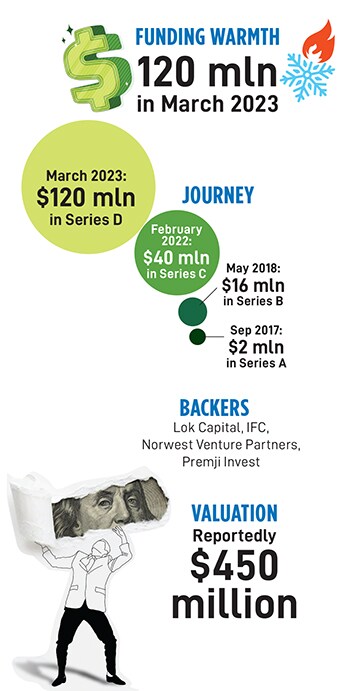

After 20 rejections, here's how Mintifi raised $120 million in the funding winter

Back in 2017, Anup Agarwal wanted to raise $2 million for funding his maiden venture Mintifi. He got rejected by 20 funds. In 2023, he raised $120 million on the back of a profitable and thriving fintech venture

Anup Agarwal, Co-founder and CEO, Mintifi

Image: Mexy Xavier

Anup Agarwal, Co-founder and CEO, Mintifi

Image: Mexy Xavier

Mumbai, 2017. The investment banker was bemused. “How is it possible,” wondered Anup Agarwal, who had spent eight years at Jefferies, and five years at Kotak Investment Banking. Now, when he was taking the entrepreneurial plunge, the greenhorn met with a spate of stunning rejections. “Are they serious,” the chartered accountant pondered as he tried to make some sense of the “utter nonsense” that was happening around him. “Guys, what I am asking for is just $2 million,” the rookie founder pleaded his case and flaunted his enviable background where he helped umpteen founders raise millions of venture and private equity dollar, stitched innumerable mergers and acquisition deals, and closed countless high-ticket transactions.

Nothing worked, though. For close to two decades, Agarwal wielded power, framed the rules of the game and adjudged the winners during his investment banking career. Now, the tables turned, a bunch of Ivy School hotshots made the banking veteran feel like an amateur, and nobody was keen to take a punt on the seasoned professional who had so far faced 20 rejections. “I don’t think your startup can ever mint money,” snubbed one of the VCs. “At times, you have to swallow your pride and ego,” says Agarwal, who was dejected by incessant rebuffs.

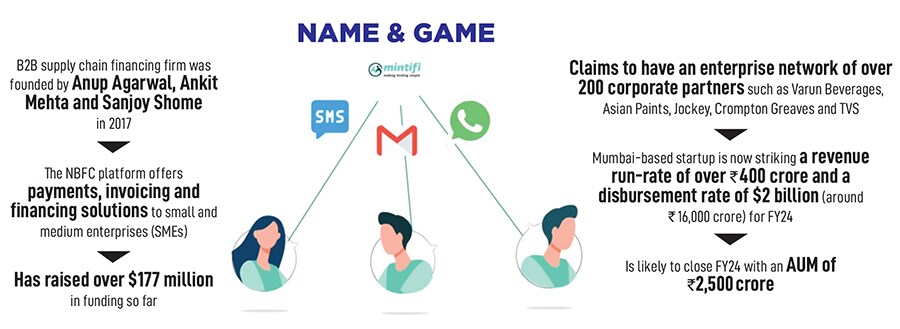

Meanwhile, time was running out for the fledgling venture. Mintifi, a B2B supply chain financing firm that was started by Agarwal, Ankit Mehta and Sanjoy Shome in 2017, had so far managed to run the show by using half a million dollars that Agarwal had pumped into the business. After almost a year of bootstrapped life, Mintifi now needed venture money to grow. Though the idea behind Mintifi was freshly minted, the funding pitch unfortunately was viewed by the VCs from a stale lens: Yet another fintech, yet another NBFC, and yet another clone in a cluttered market. There were no takers.