Be prepared for the worst while you are building a business at scale: Bizongo cofounder & CEO Sachin Agrawal

It's rare to miss the unicorn tag by a whisker. This is exactly what happened with Bizongo, which fell short of $20 million. As the gloomy forecast of a parched funding spell looked imminent, the pragmatic CEO opted to stockpile dry powder rather than fuss overvaluation

Sachin Agrawal, Co-founder and CEO, Bizongo

Image: Madhu Kapparath

Sachin Agrawal, Co-founder and CEO, Bizongo

Image: Madhu Kapparath

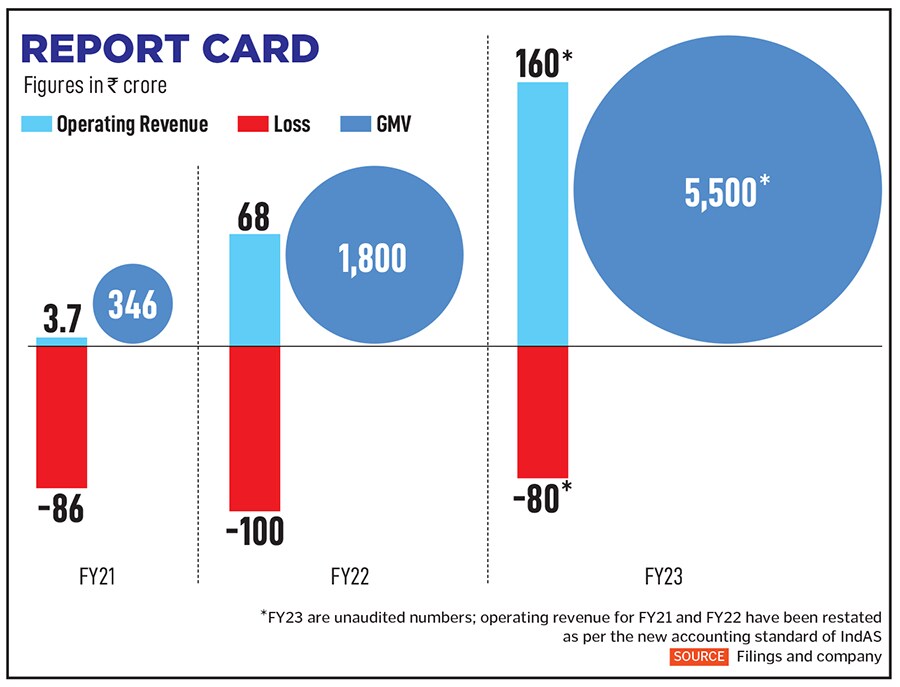

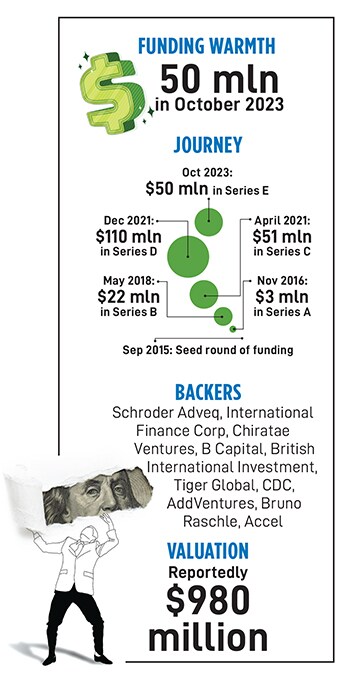

The first four letters came as easy as ABC. Have a look. Series A in November 2016, Series B in May 2018, Series C in April 2021, and Series D in December 2021. The progression of the four funding amounts was heady. Sample this. $3 million, $22 million, $51 million and $110 million. The trajectory of the first four valuations defied earth’s gravity. Check it out. Negligible, still miniscule, $130 million, and $600 million.

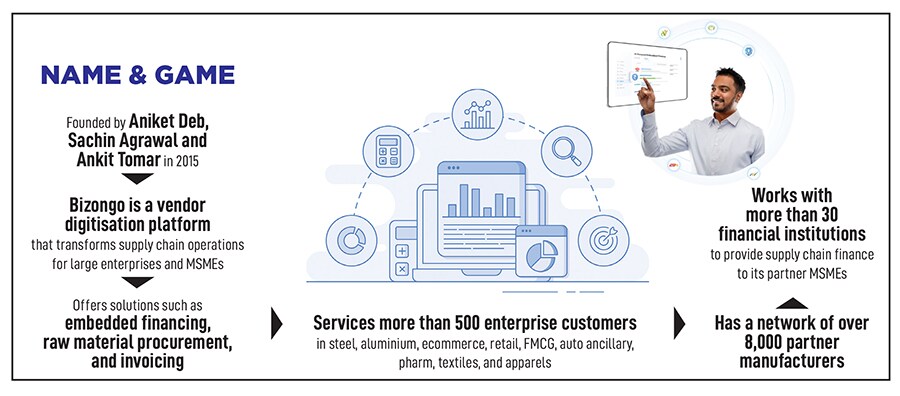

And then came Series E in 2023. And for Sachin Agrawal, ‘E’ was not easy. The letter stood for ‘evaluation’. The co-founder of Bizongo explains. “Judged on business fundamentals, I have no hesitation in accepting that we were overvalued,” the CEO of the vendor digitisation platform makes a candid confession. “But that’s how growth startups are valued in a growth economy like India,” he underlines. “Right,” asks Agrawal who co-founded Bizongo with Aniket Deb and Ankit Tomar in 2015. “We knew we were over-valued,” he says.

Agrawal is right. But he was not the only founder who lived with unrealistic valuations. From a dozen unicorns produced in India in the pandemic year, the numbers galloped to 44 in 2021, a year of funding deluge. The following year—especially the second half—the bull started to turn bearish. There were only 26 unicorns in 2022. Getting stratospheric valuations was fast becoming a thing of the past, and a funding winter proclaimed its unwelcome presence last July, when monthly funding dipped to $870 million from a high of $4.57 billion in January. When contrasted with the corresponding funding number notched up in July 2021—$4.65 billion—the forecast was definitely numbing.

Agrawal is right. But he was not the only founder who lived with unrealistic valuations. From a dozen unicorns produced in India in the pandemic year, the numbers galloped to 44 in 2021, a year of funding deluge. The following year—especially the second half—the bull started to turn bearish. There were only 26 unicorns in 2022. Getting stratospheric valuations was fast becoming a thing of the past, and a funding winter proclaimed its unwelcome presence last July, when monthly funding dipped to $870 million from a high of $4.57 billion in January. When contrasted with the corresponding funding number notched up in July 2021—$4.65 billion—the forecast was definitely numbing.

The founder, though, stayed bullish when he decided to hit the market to raise funds in October 2022. And this time his optimism was realistic, and was founded on strong performance churned out by his venture. Gross merchandise value (GMV) jumped from ₹346 crore in FY21 to ₹1,800 crore in FY22, and operating revenue during the same period leapfrogged from ₹3.7 crore to ₹68 crore. Though losses remained on the higher side—₹86 crore and ₹100 crore in FY21 and FY22, respectively—Agrawal had been running a tight ship, was confident of more than doubling the revenue and GMV, and was certain that Bizongo was on track to generate maiden free cash flow in FY23. Well, things indeed looked promising, and the mood was euphoric. “We were quite relaxed, and we went into the process with a lot of enthusiasm,” he recalls. The plan was to reach out to the top 10 investors and get a few on the board.