Antler India: Finding Steve Wozniaks for every Steve Jobs

Antler is nudging aspiring founders to live their business dream. Will its 'day zero' investment strategy keep paying off?

Rajiv Srivatsa, Partner, Antler India

Image: Selvaprakash Lakshmanan for Forbes India

Rajiv Srivatsa, Partner, Antler India

Image: Selvaprakash Lakshmanan for Forbes India

Bengaluru, July, 2022. As a climate consultant, Hitesh Bhuraria knew that the outlook was bright and sunny. Working with Bain & Company for five years, the INSEAD alum figured out that corporates were grappling to address carbon emission challenges. For months, Bhuraria worked on understanding the market landscape, mapped existing solutions and uncovered the whitespaces. He realised that there was a massive opportunity in leveraging technology to uncover deeper insights into how companies can be decarbonised. The wannabe entrepreneur has been itching to take the plunge.

What dampened Bhuraria’s fire was his futile hunt for a tech co-founder. He spoke to dozens of engineers, found a few potential matches with the right technical skills but most of them either lacked the founder mindset or sounded non-committal. Meanwhile, Nishant Singh was also in a state of entrepreneurship limbo for a while.

Passionate about climate, the software engineer at Google had been tinkering with ideas and people he could work with, but struggled to find the right partner.

Orthopaedic surgeon Karan Raj Jaggi too was wresting to find a cure for his entrepreneurship itch. Coming from a family of doctors—Jaggi was the third generation in the profession—he always yearned for ‘high impact and high scale’. A medical practice had high impact but hospitals were a low-scale space to be in. The doctor failed terribly in his balancing act: A full-time job and trying to roll out a startup. One of the main reasons, Jaggi diagnosed, for failed ‘Operation Startup’ was his ‘can do everything on my own’ approach. It sadly didn’t work and Jaggi now started scouting for a partner.

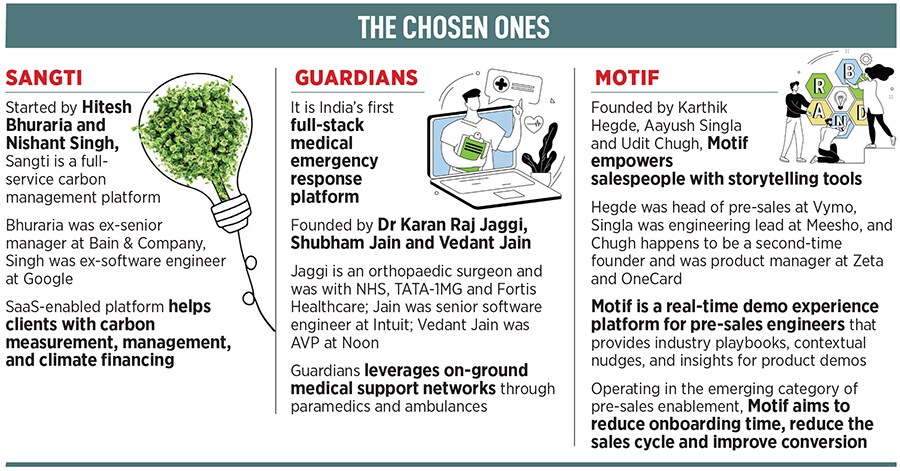

Fast forward to October. Bhuraria and Singh have co-founded Sangti, a SaaS-enabled carbon management platform that helps with carbon measurement, management, and climate financing. Meanwhile, Jaggi found his co-founders in Shubham Jain (a former software engineer at Intuit,) and Vedant Jain (ex-assistant vice president at Noon). The trio rolled out Guardians, India’s first full-stack medical emergency response platform. “From not knowing Vedant and Shubham to chalking out a five-year plan for Guardians, it has been the most exhilarating ride of my life,” says Jaggi, adding how spotting a LinkedIn post about the Antler India Residency programme helped in starting his entrepreneurial journey. “Their approach of engineered serendipity in finding exceptionally gifted, motivated and ambitious folks was sheer magic,” he reckons.

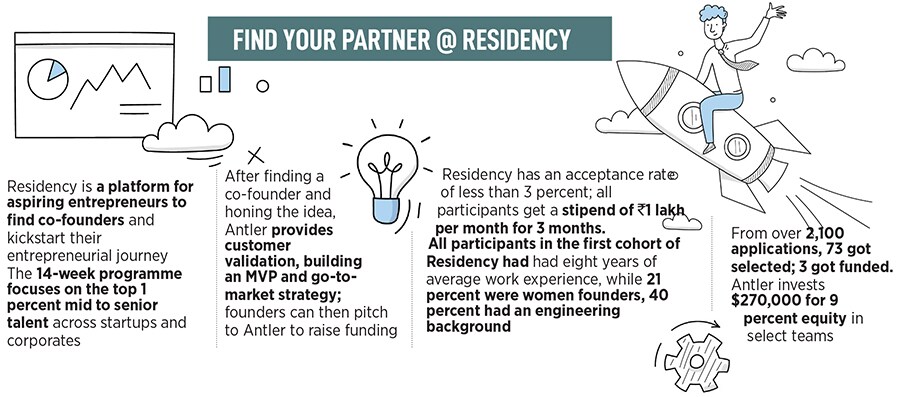

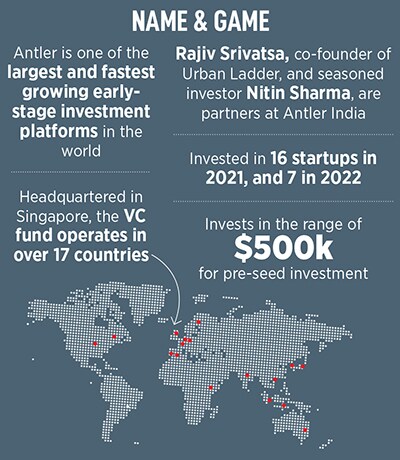

An exclusive platform for aspiring entrepreneurs, Residency is a 14-week programme run by Antler, one of the largest and fastest growing early-stage global investment platforms headquartered in Singapore. With an acceptance rate of less than 3 percent, the programme plays matchmaker in finding a co-founder, hones the business idea, provides support with customer validation and building a minimum viable product (MVP) and go-to-market strategy, and invests $270,000 for a 9 percent equity in pre-seed stage startups that make the cut.

An exclusive platform for aspiring entrepreneurs, Residency is a 14-week programme run by Antler, one of the largest and fastest growing early-stage global investment platforms headquartered in Singapore. With an acceptance rate of less than 3 percent, the programme plays matchmaker in finding a co-founder, hones the business idea, provides support with customer validation and building a minimum viable product (MVP) and go-to-market strategy, and invests $270,000 for a 9 percent equity in pre-seed stage startups that make the cut.