IT and ITES see big fall in private and venture investments

Specialist solutions providers such as iBus, and those offering applied AI expertise, like Kore.ai, have attracted interest

PE and VC firms invested $1.6 billion across 114 deals in the January-March period, a significant decline from the $2.7 billion they invested across 145 deals in the same three months in 2023.

Image: Shutterstock

PE and VC firms invested $1.6 billion across 114 deals in the January-March period, a significant decline from the $2.7 billion they invested across 145 deals in the same three months in 2023.

Image: Shutterstock

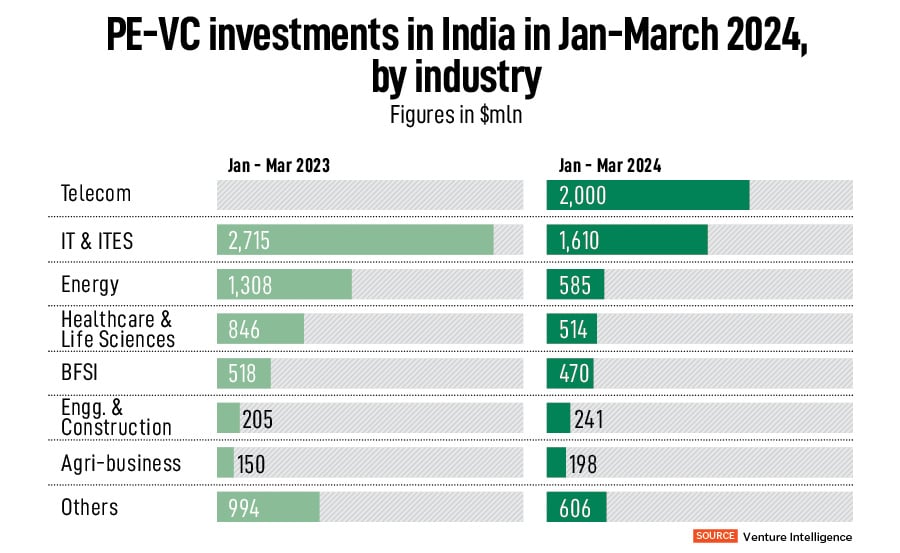

The Indian information technology (IT) and IT-enabled services sector, a traditional topper in private equity (PE) and venture capital (VC) investments, saw a big drop in investments in the first three months of 2024, says data from Venture Intelligence. The sector saw a 40 percent drop, Venture Intelligence, a private markets researcher and consultancy, notes in a blog post on March 31. And companies that scored new funding reflect investors’ preference for specialists offering solutions that target specific problems for customers and those with strong applied AI expertise.

PE and VC firms invested $1.6 billion across 114 deals in the January-March period, a significant decline from the $2.7 billion they invested across 145 deals in the same three months in 2023. Top deals included the $200 million majority stake acquisition by NIIF in iBus, and the $150 million investment in Kore.ai.

iBus operates at the intersection of technology and telecom, offering “in-building” mobile network services, managed wifi services, and Internet of Things (IoT) and data solutions for enterprise customers. The company was founded in 2010 by Sunil Menon, a telecom industry veteran, who’s also its CTO. He was joined by two former senior executives from Infosys—Ram Sellaratnam, the current CEO of iBus, who previously led Infosys’s cloud business in Europe, and Subash Vasudevan, previously a principal technology architect at the IT services company. iBus’s backers included Consolidated Technical Services, Nomura, Morgan Stanley, Manipal Group and a clutch of angel investors, according to Tracxn, a private markets intelligence provider.

Kore.ai, founded 10 years ago by serial entrepreneur Raj Koneru, is an Indo-US cross border enterprise AI software company. It offers AI assistants in verticals including banking, retail and health care, and horizontals including IT, HR, cognitive search and contact centre agent support. The $150 million Series D investment was backed by existing investors as well as AI chip leader NVIDIA.