Mrs Bectors Food's dream run continues

In the late 70s, Rajni Bector enchanted Ludhiana with her scrumptious ice creams, pudding and cakes. Over four decades later, Mrs Bectors Food Specialities stunned the IPO market with a sensational listing in 2020. The dream run of the bakery firm continues

(From left) Suvir Bector, whole-time director, Anoop Bector, managing director, and Rajni Bector, founder and chairperson emeritus, Mrs Bectors Food Specialities Ltd

Image: Amit verma

(From left) Suvir Bector, whole-time director, Anoop Bector, managing director, and Rajni Bector, founder and chairperson emeritus, Mrs Bectors Food Specialities Ltd

Image: Amit verma

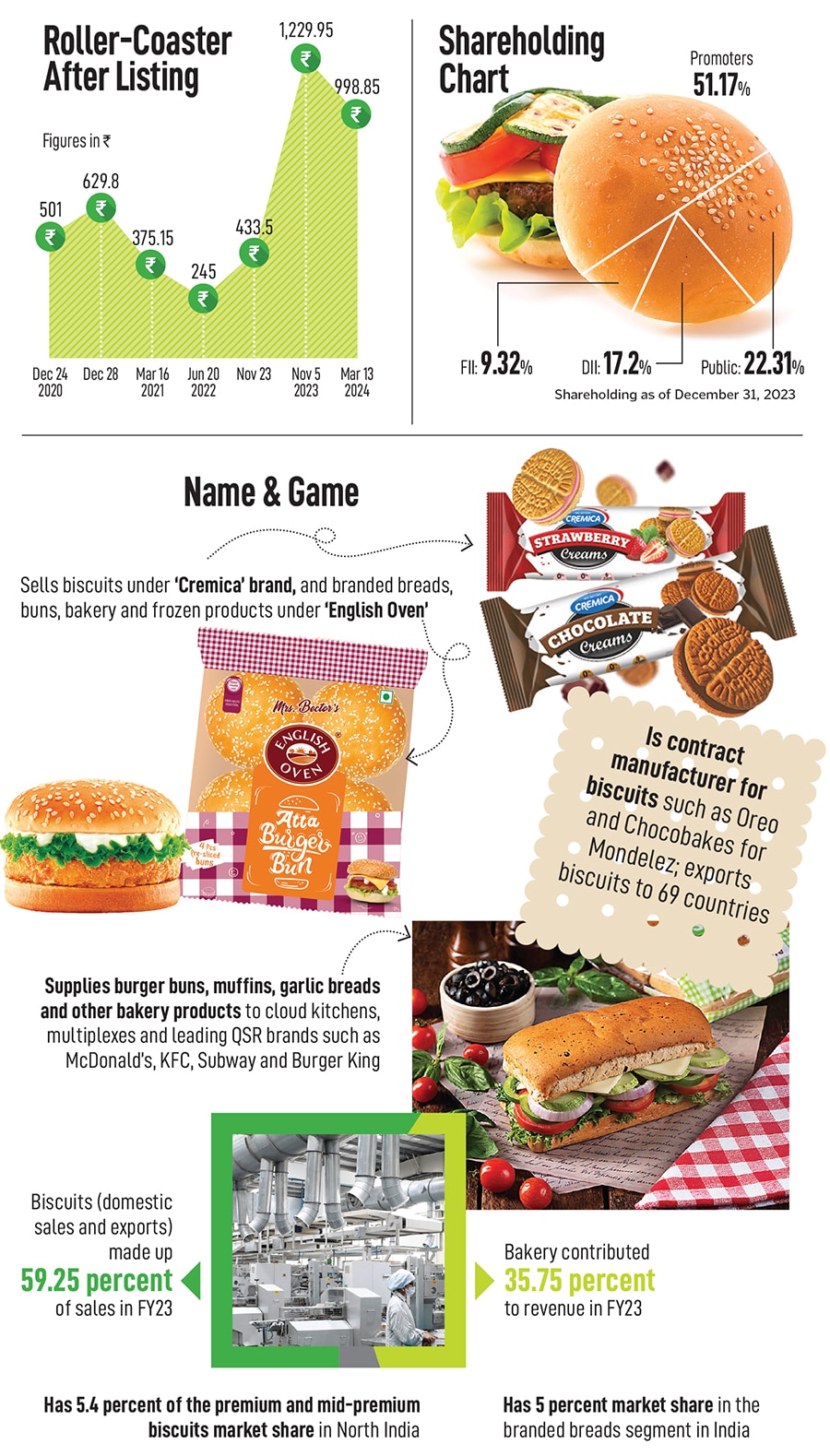

Was it an act of God?” I lobbed the first question to Anoop Bector, alluding to the blockbuster public market listing of Mrs Bectors Food Specialities on December 24, 2020. “Your Christmas Eve turned out to be Christmas Day. It was an early Merry Christmas for you,” I smiled at the managing director of the premium biscuits and bread maker, which counts leading QSR brands such as KFC, Burger King and Subway among its long list of B2B customers. “We believe in God. We pray every day,” reckons Bector, who joined the family business in September 1995. A year later, he started supplying buns and other products to McDonald’s, and aggressively scaled the consumer side of the business of the Ludhiana-based company with own brands—Cremica and English Oven—over the next decade.

The journey from Ludhiana to IPO was incredible. “It (IPO) indeed was unbelievable,” recounts the beaming entrepreneur who was on a video Zoom call along with mother Rajni Bector, who started a small ice cream unit from the backyard of her Ludhiana house in 1978. “God indeed has been kind,” underlines Bector. The ₹541-crore IPO generated bids worth more than a staggering ₹40,000 crore. To put things in context, for IPOs of over ₹200 crore in size, Mrs Bectors Food notched the highest-ever subscription in 2020.

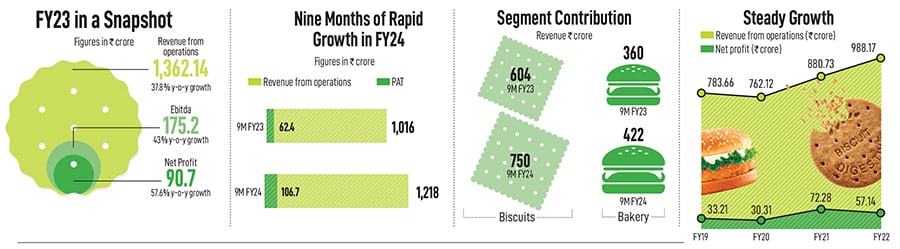

The share was listed at a 73.9 percent premium over the issue price of ₹288. And, on the final day, the IPO was subscribed 199.4 times, which helped Mrs Bectors Food trump two other stellar listings of 2020—Mazagon Dock Shipbuilders and Burger King India—which drew equally big subscription numbers. Also, close to 40 months after the IPO, the stock is now trading at double the listing price (₹1,053.7, as on March 15). “You asked me if it was the act of God. It was the hand of God,” reckons Bector, adding that just a little over seven months after the Covid lockdown, Mrs Bectors Food Specialities filed DRHP (draft red herring prospectus) in October 2020. The country was limping back to some sort of normalcy after the first wave of the pandemic, but a thick cloud of uncertainty was still looming over the business. “God held my arm and sailed me through the IPO,” he adds.

To understand the ‘hand of God,’ one needs to decode the ‘act of man, and God’. “I tried my first IPO in 2018,” says Bector. Back in August 2018, Mrs Bectors Food Specialities filed the DRHP for a ₹800-crore IPO. “Things were moving in the right direction, and we were about to list,” he says. Then the markets tanked. “We decided to pull out,” recalls Bector, who wanted to give his initial set of backers an exit. In September 2010, Motilal Oswal Private Equity Advisors reportedly picked up a 20 percent share in the Ludhiana-based company by buying out the stake of Jade Dragon, a unit of Goldman Sachs, which had invested in 2006.