Tata Communications' new avatar: Stronger, independent, profitable

In just three years, Tata Communications has shed the heavy cloak of a government-backed, loss-making telco. It is now a financially stronger and profitable commtech, selling holistic digital solutions globally

Amur Swaminathan Lakshminarayanan, Managing director and CEO, Tata Communications

Image: Neha Mithbawkar for Forbes India

Amur Swaminathan Lakshminarayanan, Managing director and CEO, Tata Communications

Image: Neha Mithbawkar for Forbes India

Kabir Ahmed Shakir, Tata Communications’ chief financial officer, is on roadshows across New York, Boston and San Francisco, meeting long-standing investors such as Baron Capital and Eastbridge Capital, besides new ones. Nearly three years ago when Shakir, a Unilever veteran across European geographies, joined Tata Communications—alongside newly appointed managing director and CEO Amur Lakshminarayanan—the investor feedback was that they could not position the company clearly and earnings growth was inconsistent.

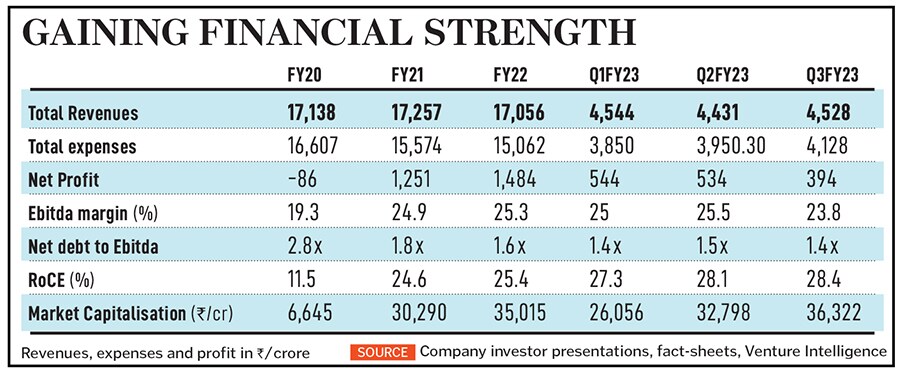

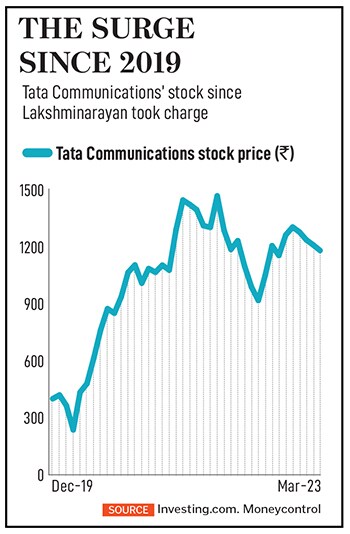

But now, investors cannot ignore the company. Almost every financial parameter in recent quarters has been “the best in its recorded history”, Shakir tells Forbes India. The company has recorded 11 successive quarters of net profit, and Ebitda margins, which hovered around 14 to 15 percent, are now 24 to 25 percent. Return on capital employed (RoCE), which was 8.3 percent in 2019, is now at 28 percent. Improved earnings have seen retail investor confidence return, with the stock up by nearly 200 percent or 3x at ₹1,177 at the stock exchanges, since Lakshminarayanan’s taking charge.

Before Lakshminarayanan and Shakir joined, Tata Communications was trying to shrug off several negatives, including a weakening balance sheet, inability to raise fresh equity due to government presence in the company and selling commoditised-type products with voice telephony contributing 37 percent to revenues in 2017. This was, after all, the sleepy, erstwhile Videsh Sanchar Nigam Ltd (VSNL)—it became Tata Communications in 2007—which had a large range of products, but could not channelise them to generate revenues.

By the time Lakshminarayanan’s predecessor Vinod Kumar left in 2019, two of the big hurdles had been dealt with: The demerger of surplus land held by VSNL to a new entity, and the selling of the South African Neotel unit and a 74 percent stake in its data centre business to a unit of Singapore’s Temasek Holdings. After the land sale, the government, by March 2021 exited Tata Communications completely.

Swifter, Fitter, Stronger

This meant that Lakshminarayanan could focus only on business without any distractions. There was no time wasted, and after a string of meetings with strategic investors and several customers, he launched the ‘Reimagine Strategy’, which was approved by the board and officially launched when the pandemic broke in India in 2020.

Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing,” he tells Forbes India.

Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing,” he tells Forbes India.  Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.

It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.