FILA 2023, Lifetime Achievement Award: AM Naik - The old-world leader and crisis man

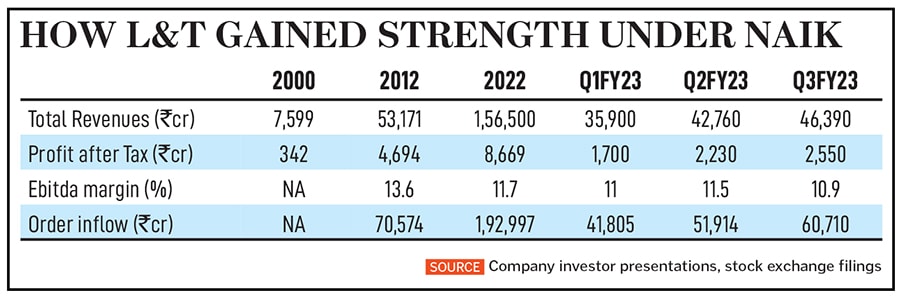

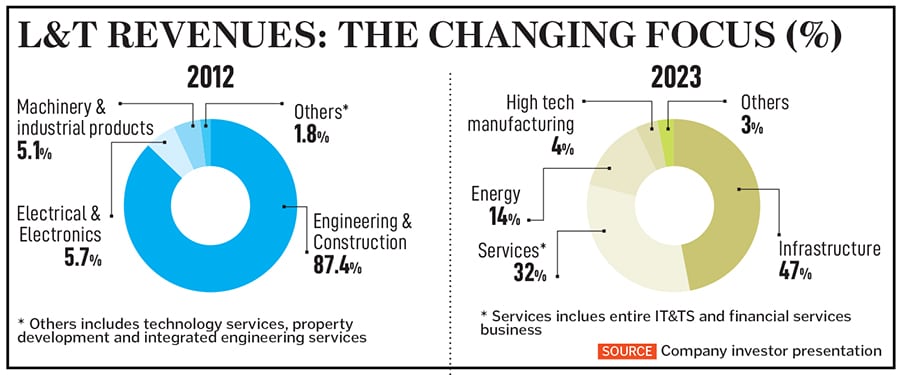

The journey of Naik and L&T's ascendency as a force to be reckoned with run parallel. Naik follows the old-world style of leadership, and he's built L&T to its impressive size, incubated fresh revenue lines and implemented a complex succession plan

AM Naik, non-executive chairman, L&T

Image: Mexy Xavier

AM Naik, non-executive chairman, L&T

Image: Mexy Xavier

The narrative about how, in 2001, Anil Manibhai Naik, Larsen & Toubro’s (L&T) then-managing director and CEO, battled and thwarted Aditya Birla Group (ABG) Chairman Kumar Mangalam Birla’s attempt to take over L&T’s cement division is part of India’s corporate history. Birla had emerged as a serious acquirer after Reliance Industries [owner of Network 18, the publisher of Forbes India] sold its 10 percent stake to Birla, who had been purchasing L&T shares, resulting in a near-16 percent stake.

Forced to take a swift decision, Naik created the L&T Employees Welfare Foundation—the company had no active promoter earlier—and with the help of government circles devised a scheme through which L&T’s cement division was demerged and sold to Birla. The foundation (later renamed L&T Employees Trust) was allowed to buy the 14.95 percent stake which Grasim held in L&T and, by 2003, the deal was struck. ABG got control of the L&T cement business which helped it increase its share in the sector, and L&T—after selling a non-core business—became a stronger, professionally-run company after avoiding a takeover.

The L&T Employees Trust’s stake is now 13.88 percent, and the value of the trust was estimated at ₹42,000 crore as of 2020, according to Naik.

L&T is not unfamiliar to being tracked. Dubai-based businessman, the late Manu Chhabria, in 1987, and Reliance Industries founder, the late Dhirubhai Ambani, had been picking up stakes in the company. Narottam Desai, L&T’s chairman from 1979 to 1989, saw Ambani as a ‘white knight’ to stall Chhabria, which did happen. Though Ambani wanted to play a more active role in L&T, it did not happen, as political forces did not support it, and after 1990, they were investors until the stake sale.

Minhaz Merchant’s 2017 book The Nationalist chronicles Naik’s journey as a leader and the transformation of L&T into a diversified multinational from its early years. Around 15 percent stake was with the foundation and another 15 percent through phase-wise stock options issued to individual employees, resulting in a 30 percent stake in L&T. “We thus ring-fenced it from future takeover attempts,” Naik, 80, tells Forbes India, recounting the deal, at his first-floor office at his residence, High Trees in Bandra, Mumbai.

Through this one strategic move, Naik became recognised within the company, to the corporate world outside and policymakers as an iconic and fearless leader who cannot be taken lightly when pushed to the wall.

Through this one strategic move, Naik became recognised within the company, to the corporate world outside and policymakers as an iconic and fearless leader who cannot be taken lightly when pushed to the wall.