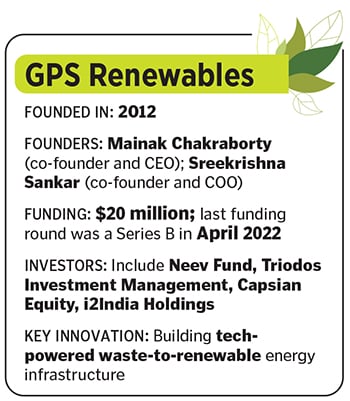

GPS Renewables: Converting waste to bioenergy, the tech way

The founders of the Bengaluru-headquartered company—who run what is reportedly Asia's largest bioCNG plant in Indore, among 100 other tech-led captive biogas plants—believe India has barely scratched the surface of the multi-billion dollar biofuels industry

(L to R) Mainak Chakraborty, Co-founders and CEO, and Sreekrishna Sankar COO, of GPS Renewables

Image: Vikas Babu for Forbes India

(L to R) Mainak Chakraborty, Co-founders and CEO, and Sreekrishna Sankar COO, of GPS Renewables

Image: Vikas Babu for Forbes India

Mainak Chakraborty did not opt for campus placements at the end of his postgraduate management diploma course at the Indian Institute of Management Bangalore (IIM-B). He wanted to start something on his own, a for-profit venture that was environment-facing, but was not sure what to do. Soon enough, along with a senior from IIM-B, Sreekrishna Sankar, he realised there was a business opportunity in a problem that was staring IT city Bengaluru in the face: Waste management. This led them to think about converting waste to bioenergy, where they realised technology could play a role and help the engineers put their skillsets to good use.

At the time [around 2010-2011], their idea was to “product-ise and decentralise biogas production for an urban setting”, Chakraborty says, by helping commercial spaces like hotels or corporate campuses convert their organic waste into energy. The duo launched GPS Renewables, a biofuels technology and execution company, in 2012. Until then, they had only seen solutions like gobar gas plants that were designed to provide low-cost waste management solutions to rural areas. These were large, often smelly structures with a large footprint and involving a lot of civil work.

For urban settings, they had to find a way to make these plants smaller, smell was a no-no, and feeding of waste into the plants had to be as less messy as possible. In the absence of huge swathes of land, they also had to find a way to build the plant vertically, spread across many floors. The health of these plants also needed to be monitored and tracked remotely. The non-profit Akshaya Patra helped them set up their first commercial pilot. They also catered to corporate campuses and luxury hotels, often retrofitting their solutions to fit the available space.

From then to now, GPS Renewables has set up close to 100 captive biowaste-to-energy plants across the country. “We have an original artificial intelligence (AI) solution called the BiogasBot with patented hardware, which keeps track of the bio-health of all our 100 plants across India,” says Chakraborty.

From then to now, GPS Renewables has set up close to 100 captive biowaste-to-energy plants across the country. “We have an original artificial intelligence (AI) solution called the BiogasBot with patented hardware, which keeps track of the bio-health of all our 100 plants across India,” says Chakraborty.

They also run two large, functional bioCNG plants. One in Indore, reportedly Asia’s largest bioCNG plant that processes about 500 tonnes of organic waste; and the second in Lucknow, Uttar Pradesh. “We are also setting up multiple plants that convert paddy straw, which is often burnt in the North and is a source of smog every winter, into bioCNG for vehicular applications,” Chakraborty says, adding that at Haji Ali in Mumbai, they run one of the world’s first biogas-powered electric vehicle (EV) charging station.