How 'bed-in-a-box' made Sleepyhead India's second-largest online mattress brand

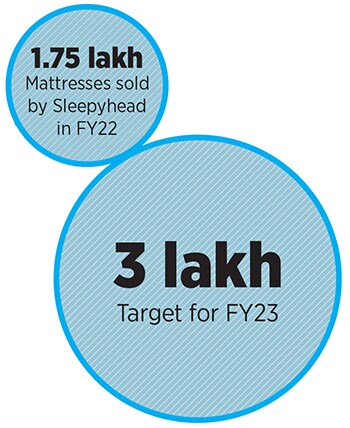

Catering to the needs of digial-native Millennials and Gen Z, Mathew Joseph's D2C brand has brought excitement back to the segment while taking care of the bottom line

Mathew Joseph, CEO & Co-Founder, Sleepyhead

Image: Selvaprakash Lakshmanan for Forbes India

Mathew Joseph, CEO & Co-Founder, Sleepyhead

Image: Selvaprakash Lakshmanan for Forbes India

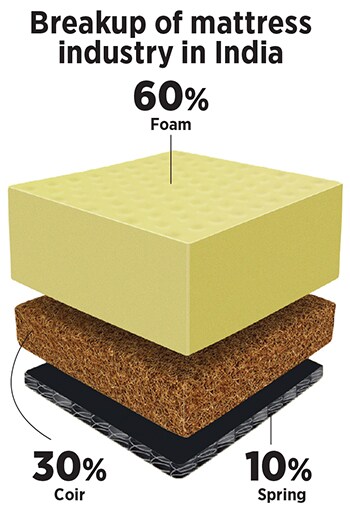

Did these guys get up on the wrong side of the bed?” wondered Mathew Joseph. It was January 2017, and on one peppy morning in Bengaluru, the 32-year-old entered the office with a spring in his step. His excitement was understandable. The marketing director of Duroflex, the second-largest mattress brand in India with around 20 percent value market share, had to make a morning presentation to the board of directors explaining the pressing need to roll out an online-only mattress brand.

“What’s the need?” quizzed one of the members. “You already have an established brand,” he quipped, dampening the fiery spirit of the marketing honcho who was trying to nudge the over five-decade-old family business out of the comfort zone.

Pushed to the back foot, Joseph tried to foam up the argument. An online-only brand, he stressed, could cater to the needs and tastes of the digital-native millennials and Gen Z. The board, though, didn’t budge. The meeting stretched out over the next few hours. Not willing to back off, Joseph was ready to go to the mattresses. “I was trying hard to convince them,” recounts Joseph, who had earlier had stints with JPMorgan Chase and Tesco, and had completed a dual master’s in advertising and marketing from Leeds University Business School in England. “Duroflex was a very mature brand,” he reasoned. The online audience, he underlined, is very young and needed something they could relate to.

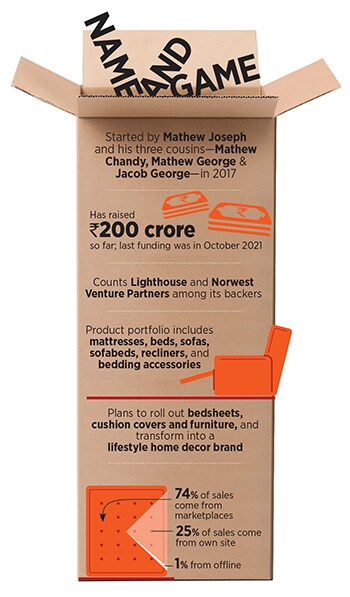

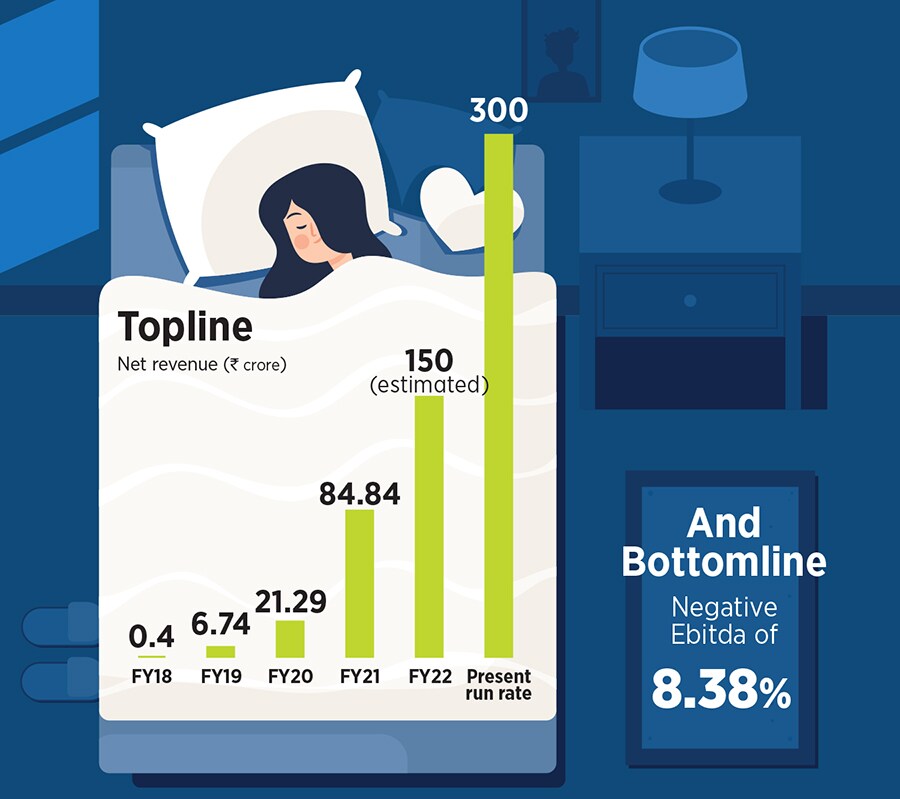

The task, though, was not going to be a sleep walk. Being one of the promoters of Duroflex—which was set up in 1963 by Joseph’s grandfather PC Mathew—was of little help. Reason: The young third-generation entrepreneur didn’t want to use the mother branding. “I didn’t have the Duroflex cushion,” recalls Joseph, who also didn’t want to use a ‘From the house of Duroflex’ branding on the products. “For the first three years,” underlined the co-founder and chief executive officer (CEO) of Sleepyhead, “the company will post around 5 percent negative Ebitda.” The loss talk triggered bedlam.

For the next few minutes, there was a deafening silence. “It was not minutes. They remained mum for a few hours,” recalls Joseph, adding that the marathon meeting went on for six hours. The 10-member board, which had been used to 10-11 percent positive Ebitda in Duroflex for years, was staring at potential losses. What exaggerated the odds for Sleepyhead was its business model. It was being positioned as a direct-to-consumer (D2C) brand. What this meant was that it would bypass the traditional retail footprint and channels of Duroflex, and would only be made available online. Though the idea and concept didn’t look too comforting, Joseph got backing on the basis of his stellar track record as marketing director of Duroflex. Sleepyhead got a seed capital of ₹70 lakh from the company, and Joseph was about to get what he didn’t hope for: Sleepless nights.

For the next few minutes, there was a deafening silence. “It was not minutes. They remained mum for a few hours,” recalls Joseph, adding that the marathon meeting went on for six hours. The 10-member board, which had been used to 10-11 percent positive Ebitda in Duroflex for years, was staring at potential losses. What exaggerated the odds for Sleepyhead was its business model. It was being positioned as a direct-to-consumer (D2C) brand. What this meant was that it would bypass the traditional retail footprint and channels of Duroflex, and would only be made available online. Though the idea and concept didn’t look too comforting, Joseph got backing on the basis of his stellar track record as marketing director of Duroflex. Sleepyhead got a seed capital of ₹70 lakh from the company, and Joseph was about to get what he didn’t hope for: Sleepless nights.

The second boring aspect was the entire process of buying a

The second boring aspect was the entire process of buying a  For Anshul Jain, taking a leap of faith made sense. The managing director at Lighthouse bought the box and the Sleepyhead story even before the product was officially rolled out. The reason was simple: The team. “When we invest, the most important thing is the team,” she says.

For Anshul Jain, taking a leap of faith made sense. The managing director at Lighthouse bought the box and the Sleepyhead story even before the product was officially rolled out. The reason was simple: The team. “When we invest, the most important thing is the team,” she says.