Duroflex: Bouncing back

Mattress maker Duroflex is regaining lost ground by ramping up product development, and expanding into new geographies

(Clockwise from top) Mathew Chandy, Mathew Joseph and Mathew George of mattress-makers Duroflex

(Clockwise from top) Mathew Chandy, Mathew Joseph and Mathew George of mattress-makers Duroflex

Image: Nishant Ratnakar

Mathew Chandy knows well the importance of having professionals in a family business. After all, the 42-year-old had already seen the flipside, quite early in his family business. A graduate of the National Law School of India University, Chandy was witness to his 57-year-old family venture, mattress maker Duroflex, reach soaring highs and brutal lows largely as a result of a family feud. Now, in firm control of the company, the former lawyer is en route to reclaiming what Duroflex had lost during the turbulent times.

“We lost about 10 years between the mid-1990s and 2000s,” says Chandy. “The opportunity cost was huge, and that’s actually when many of our rivals grew quite well. Over time, we realised that if we had to improve productivity and win the bigger battles, we had to bring in professionals.”

But, bringing in more professionals into a traditional, family-owned business is only one part of winning the battle. Since taking charge as the managing director of the Bengaluru-headquartered company in 2012, Chandy has digitised much of its operations, expanded into new geographies, ramped up its online presence, and is developing personalised products to give Duroflex a much-needed push in the Rs 10,000-crore mattress market in India. Over the next five years, he aims to be a Rs 2,000-crore company, from about Rs 500 crore at present.

India’s mattress industry is largely unorganised, with branded companies such as Duroflex, Kurl-on and Sleepwell controlling just about 30 percent of the market. “I am less focussed on the final turnover number,” Chandy says. “I have kept it flexible. But the focus is more on the vision and where we want to take Duroflex.”

As a result, unlike a decade ago, the mattress maker is visibly more aggressive in its approach, increasing its advertising spend and partnering with cricket teams Royal Challengers Bangalore and Chennai Super Kings in the Indian Premier League.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

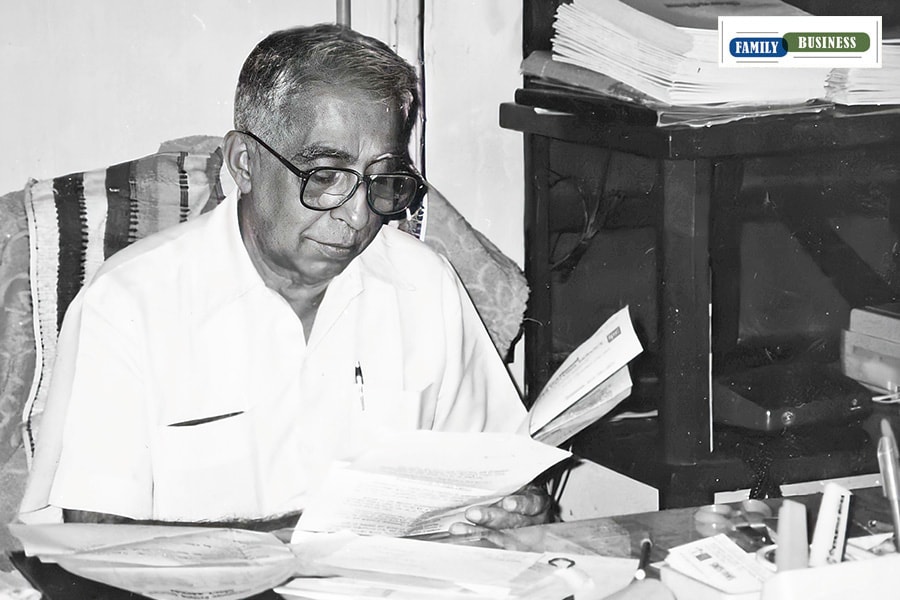

PC Mathew at his work desk in Alleppey, the first office where the Duroflex story began in 1963. The picture is from the early 1970s

PC Mathew at his work desk in Alleppey, the first office where the Duroflex story began in 1963. The picture is from the early 1970s