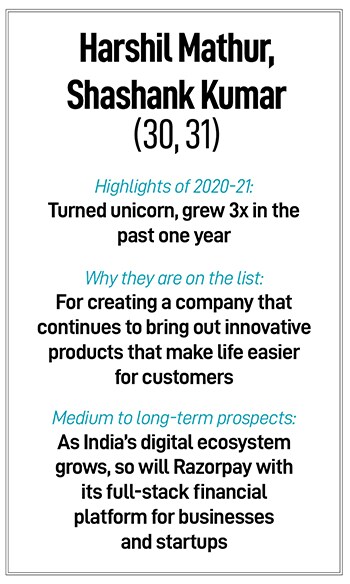

Harshil Mathur, Shashank Kumar: Simplifying the financial lives of customers

Solving for digital payments was just the first step for Razorpay co-founders Harshil Mathur and Shashank Kumar. As they have scaled, they continue to look for ways to simplify the financial lives of customers

Razorpay Co-founders Harshil Mathur (left) and Shashank Kumar say entrepreneurs starting out must be able to think on their feet on a daily basis

Razorpay Co-founders Harshil Mathur (left) and Shashank Kumar say entrepreneurs starting out must be able to think on their feet on a daily basis

Image: Nishant Ratnakar for Forbes India

In 2014, while working on side projects in their free time in the US, IIT-Roorkee graduates Harshil Mathur and Shashank Kumar found that it was difficult to accept digital payments in India. The duo realised that most young startups faced the same challenge, and it was time to solve for enabling payments for small businesses and young startups. It was also a clear opportunity to grow big and scale.

Seven years later, it seems like not just an opportunity well-spotted, but also well-executed. Their company, Razorpay, is the payments partner of choice for about five million SMEs, MSMEs, and large enterprises like Flipkart, Zomato, Airtel, BookMyShow and Swiggy. In just the past year, several companies like Meesho, Groww and PharmEasy, among others, that are powered by their payments platform, turned unicorns.

Building the payments gateway—a sort of POS machine equivalent in the online world—was not simple. “Digital payments is not something you can just build and deploy. We had to get bank approvals, regulatory approvals, etc.,” recollects Mathur, CEO and co-founder of Razorpay. And since then, with their agility, ability to innovate and a sharp focus on the customer, they have managed to stay ahead in the game.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Razorpay has consistently found newer problems to solve for businesses, often drawing from their own experiences as a

Razorpay has consistently found newer problems to solve for businesses, often drawing from their own experiences as a