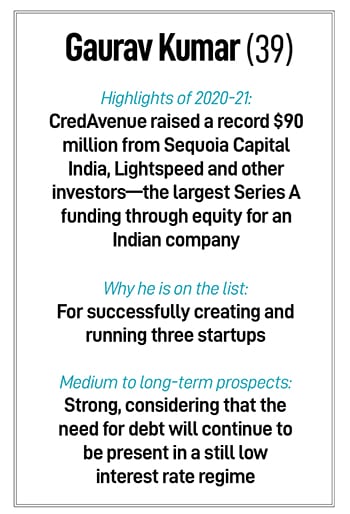

Gaurav Kumar and CredAvenue: Lending a helping hand to SMEs

With CredAvenue, Gaurav Kumar is enabling capital for the neediest and revolutionising the space

Gaurav Kumar, Founder and CEO, CredAvenue

Gaurav Kumar, Founder and CEO, CredAvenue

Image: Balaji Gangadharan for Forbes India

The pandemic has further exposed the failure of the debt financing ecosystem in servicing small and medium enterprises (SMEs). Most were, and remain, starved of capital. This has rarely been a problem for large (and often better rated) corporates, which have found it easier to raise debt from large banks and other financial institutions, besides also private placement of debt.

India’s debt market remains underdeveloped, being valued at 65 percent of GDP, much lower than the global average of 150 percent of GDP. The lack of finance, besides the irregularity of cash flows due to clients not paying up, has meant that SMEs have been unable to ride out of the crisis after the second wave of Covid. Non-food bank credit growth stood at ₹108 lakh crore in September, up 6.7 percent compared to a year earlier, according to RBI.

Union Minister for Electronics and Information Technology Ashwini Vaishnaw, in December, suggested the creation of a UPI-like digital platform to provide credit to micro- and SMEs.

Despite the obvious demand for debt by companies, this segment of the market failed to grow due to the lack of infrastructure. “A two-sided market place has to be present,” says Gaurav Kumar, founder and CEO of CredAvenue, a technology platform that connects lenders and borrowers looking for term and working capital loans, supply chain financing, bond issuances, securitisation and co-lending.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

In the eight months from April to November, the gross transaction value totalled $2.94 billion, with an aim to end FY22 at $5.5 billion value. CredAvenue’s revenues were at ₹47 crore in FY21 and are estimated to more than triple to ₹160 crore by March 2022, a source says.

In the eight months from April to November, the gross transaction value totalled $2.94 billion, with an aim to end FY22 at $5.5 billion value. CredAvenue’s revenues were at ₹47 crore in FY21 and are estimated to more than triple to ₹160 crore by March 2022, a source says.