What Tiger Global's bet on CoinSwitch Kuber means to India's crypto startup story

The US firm's first investment in a cryptocurrency company in India, having earlier backed global crypto leader Coinbase, suggests investors are confident that the Indian government will eventually regulate the industry instead of blocking it

Scott Shleifer, Partner, Tiger Global. Image: Ben Gabbe/ Getty Images

Scott Shleifer, Partner, Tiger Global. Image: Ben Gabbe/ Getty Images

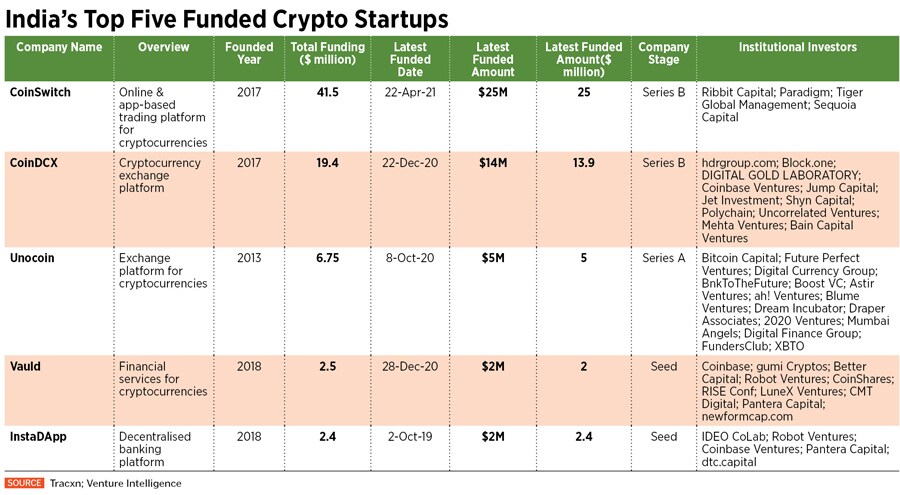

Tiger Global Management’s $25 million investment in BitCipher Labs last week marked the first investment in an Indian crypto startup for the New York-based investment firm, which is famous for its early backing of Flipkart, India’s most successful startup. Bengaluru’s BitCipher operates one of India’s most popular cryptocurrency buy-and-sell exchanges, CoinSwitch Kuber.

While Tiger Global is known for backing many big tech names including Facebook, Uber, Airbnb, Stripe and Coinbase, in India, it is known for its investments in companies including Flipkart, Ola, Zomato and Byju’s. It has now added an Indian crypto startup to its portfolio. With Tiger’s investment, CoinSwitch’s valuation jumped five-fold to more than $500 million in just four months.

"As they build India’s leading cryptocurrency platform, CoinSwitch is well-positioned to capture the tremendous growing interest in crypto among retail investors. We are excited to partner with CoinSwitch as they innovate in this emerging asset class,” Scott Shleifer, partner at Tiger Global, says in a press release on April 22.

CoinSwitch will use the money in three ways. First, to spread awareness about what crypto is and why it could be useful, because there are still many misconceptions about cryptocurrencies, Ashish Singhal, co-founder and CEO of the company tells Forbes India in an interview on April 24. Second, the company, which has about 135 employees today, is looking to go up to 300 by adding top-notch product development talent. Third, it will invest much more in its security infrastructure and in ensuring its operations are stable.