VIP Industries' business woes could delay promoters' stake sale plan by a year

Arresting a fall in market share to smaller rival Safari, need to strengthen ecommerce business revenues and retaining talent in its middle management are challenges the company needs to resolve in coming quarters

VIP has been losing market share to a smaller, but more aggressive, luggage rival, Safari Industries, for nearly five straight financial years.

Image: Shutterstock

VIP has been losing market share to a smaller, but more aggressive, luggage rival, Safari Industries, for nearly five straight financial years.

Image: Shutterstock

VIP Industries, India’s largest luggage and travel accessories manufacturer, is facing challenging times ahead, over the next two-three quarters. A possible move of the promoters selling their stake in the company is now likely to be delayed, by at least a year, a person aware of the development, said.

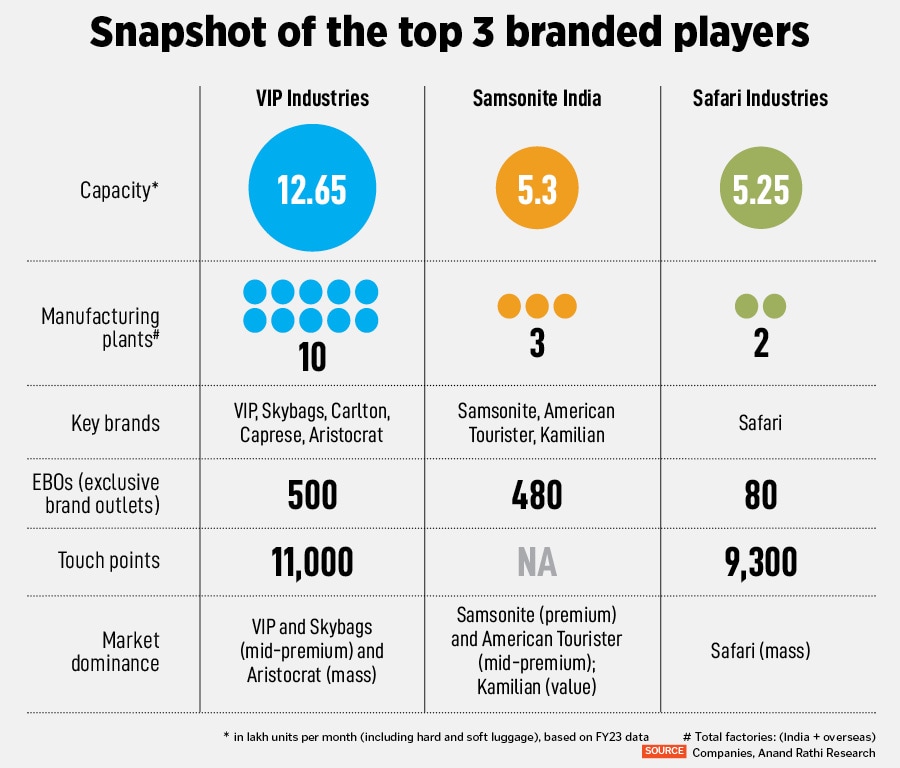

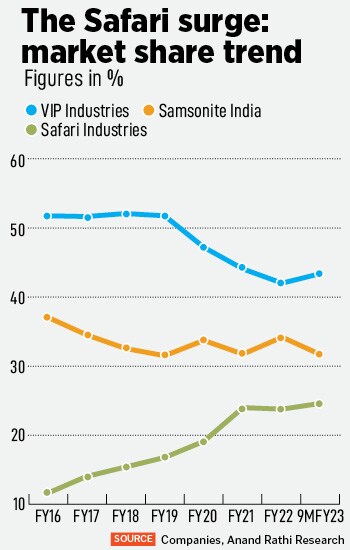

VIP has been losing market share to a smaller, but more aggressive, luggage rival, Safari Industries, for nearly five straight financial years. Safari, under its chairman and managing director Sudhir Jatia—a former director at VIP—has, in recent years, focussed on the mass market, increasing product designs and offering a new range of backpacks and laptop bags, besides strengthening the distribution channel.

Safari’s market share in the branded space has risen to 24 percent in April-December 2022, from 16.7 percent in the year-ended March 2019. In the same period, VIP Industries has seen its market share fall to around 44 percent from 51.5 percent while another rival Samsonite India’s market share hovers around 32 percent.

VIP got a jolt in August 2023, when its then managing director Anindya Dutta resigned citing personal reasons, which led to the elevation of its then CFO Neetu Kashiramka as MD and CFO in November 2023, when Dutta’s term ended. News that the company had announced in its analysts meet in October 2023 that it will keep a Rs 200 crore capex plan for soft luggage expansion on hold has also hurt investor sentiment.

The loss of market share, inventory optimisation, tackling changes in the top management and inability to scale up its ecommerce business are challenges which VIP has faced and needs to resolve, analysts have said. VIP Industries stock now trades at Rs 570.5 at the BSE, its lowest point in FY24.

Besides travelling returning in a big way and schools and colleges reopening—boosting bagpacks demand—there has been a structural factor driving its growth, which includes “the accelerated consumer preference shift from non-branded luggage to labels, ownership of many bags and shorter replacement cycles”, Rathi’s analysts Shobit Singhal and Pranay Shah have said in an April 2023 report while initiating coverage for the luggage sector.

Besides travelling returning in a big way and schools and colleges reopening—boosting bagpacks demand—there has been a structural factor driving its growth, which includes “the accelerated consumer preference shift from non-branded luggage to labels, ownership of many bags and shorter replacement cycles”, Rathi’s analysts Shobit Singhal and Pranay Shah have said in an April 2023 report while initiating coverage for the luggage sector.