VCats & 9Unicorns: A sibling revelry

An incubation platform and accelerator fund are fuelling early-stage investing from 0 to 1 stage. Can the gambit pay off?

Apoorva Ranjan Sharma, President & Co-founder, Venture Catalysts private limited

Apoorva Ranjan Sharma, President & Co-founder, Venture Catalysts private limited

In December 2020, Carl Pei had an idea. The investors, though, knew nothing about it. Yet they went ahead and pumped $7 million into Pei’s undisclosed venture. The co-founder of OnePlus had stayed tight-lipped about his future project after quitting OnePlus in October last year. It wasn’t long before he found sound backers in Tony Fadell, inventor of the iPod, Kevin Lin, co-founder of Twitch, Steve Huffman, CEO of Reddit, and Josh Buckley, CEO of Product Hunt. It is only after the funding was tied up that, in end-January, Pei revealed the name of his smart connected consumer technology brand, Nothing, which is set to roll out wireless earphones soon. In India, it has partnered with Flipkart to sell the product.

Back in India, early last year, Nilay Mehrotra too had an idea, but little else. The Bengaluru-based entrepreneur was planning a unique offering to disrupt the men’s fertility market. The problem was, investors knew nothing about this sector. The founder rolled out Janani in June, but his reproductive health and sexual wellness solutions startup had no product to sell. Unlike Pei, who had a long queue of babysitters eager to pamper his yet-to-be-born baby, Mehrotra had nothing. Till 9Unicorns came into the picture in October.

Fast forward nine months. Janani launched India’s first, at-home DIY (do it yourself) semen testing kits in June this year. What helped Mehrotra was finding a funder who believed in the idea, vision and conviction of the founder. “I didn’t have a proof of concept. I just had an idea. They backed it,” he says.

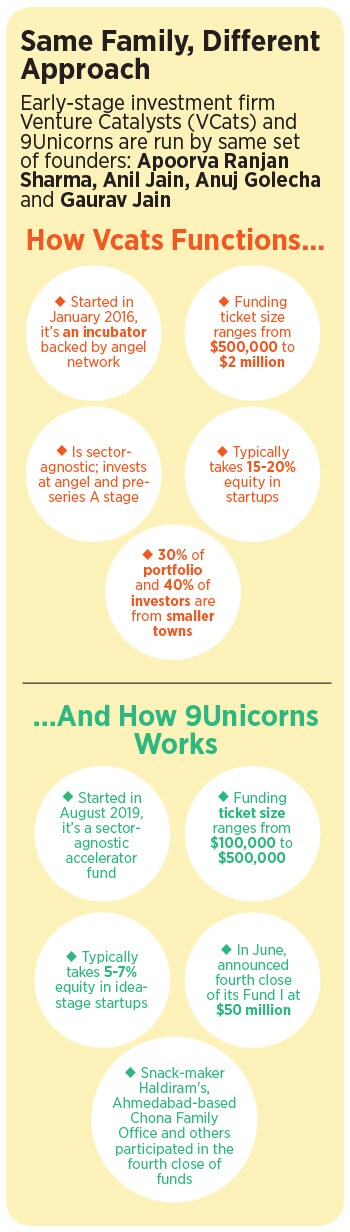

Apoorva Ranjan Sharma explains why early-stage investments in startups need to start from the ideation stage. “Many brilliant ideas die young. You need to spot and nurture, much like a sapling,” reckons Sharma, who co-founded 9Unicorns in August 2019, along with Anil Jain, Anuj Golecha and Gaurav Jain. The sector-agnostic accelerator fund invests in the range of $100,000 to $500,000, and typically takes 5-7 percent equity in idea-stage startups. In a little under two years, 9Unicorns has closed 68 deals; 30 percent of the startups are from tier 2 and 3 cities, and most of them are in the ideation mode when the fund cuts a cheque.