The Tata Group has built an electric vehicle universe. Can it help its global ambitions?

The Mumbai-headquartered group's plan assumes significance as global automakers, including Tesla, are firming up plans to set up operations in India

Tata Tiago electric car. Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

Tata Tiago electric car. Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

From languishing at the bottom as a fleet taxi operator, ignored by personal car buyers, Tata Motors has staged an exceptional turnaround that only mirrors a similar story by another homegrown automotive giant, the Mahindra Group, in recent years.

With a renewed product portfolio, cost optimisation, better distribution network, affordability, and a host of features alongside impeccable safety offerings, the automaker has once again caught the fancy of private car buyers, propelling it to India’s third-largest carmaker, almost neck-and-neck with South Korean behemoth, Hyundai Motors.

Between April 2020 and July 2023, the automakers’ market capitalisation surged a staggering 821 percent, while the benchmark Sensex only grew 142 percent. During that time, the company’s market share also grew from around 5 percent to 13.5 percent, with sales of nearly 40,000 vehicles a month.

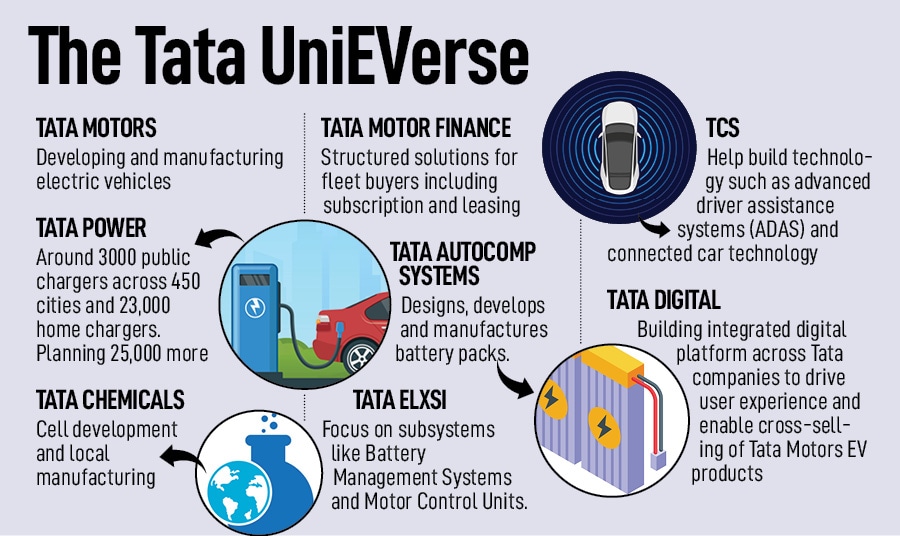

Now, the Mumbai-headquartered automaker is gunning for more. This time around, with its headstart in the electric vehicle ecosystem—Tata Motors has emerged as India’s largest electric car maker, cornering over 80 percent of the market—the company is setting up an ecosystem that will build everything from batteries to charging stations to financing vehicles and finally putting them on the road.

No other automaker in India can currently counter that proposition from the automaker. That project, known as Tata UniEVerse, is an ecosystem that will leverage group synergies, from companies such as Tata Power, Tata Chemicals, Tata Autocomp, Tata Consultancy Services (TCS), Tata Digital, Tata Elxsi and Tata Motors Finance.