Stock markets' dream rally: Is there more room to run?

Abundant liquidity and a bullish sentiment have pushed markets to new highs in June, rising nearly 10 percent from March-end. Will this rally sustain, even if monsoon remains erratic, hurting earnings and consumer demand overall?

Sensex and Nifty sparked off a rally starting March-end, as institutional investors started buying stocks.

Image: Shutterstock

Sensex and Nifty sparked off a rally starting March-end, as institutional investors started buying stocks.

Image: Shutterstock

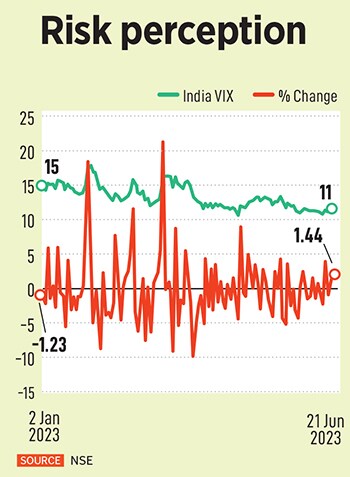

Gushing liquidity driving markets around the world higher has not made investors uncomfortable so far, as fears of a global recession have been gradually ebbing. The bullish sentiment of investors around domestic macroeconomy, receding inflationary concerns and expectations of the interest rate cycle peaking out are promoting them to pump more money into equities and hedge their bets against risks.

But what could derail that bull run of Indian markets outperforming global peers are delayed monsoon and weak consumption demand. Of course, political uncertainty will also come knocking as general elections are expected in May next year.

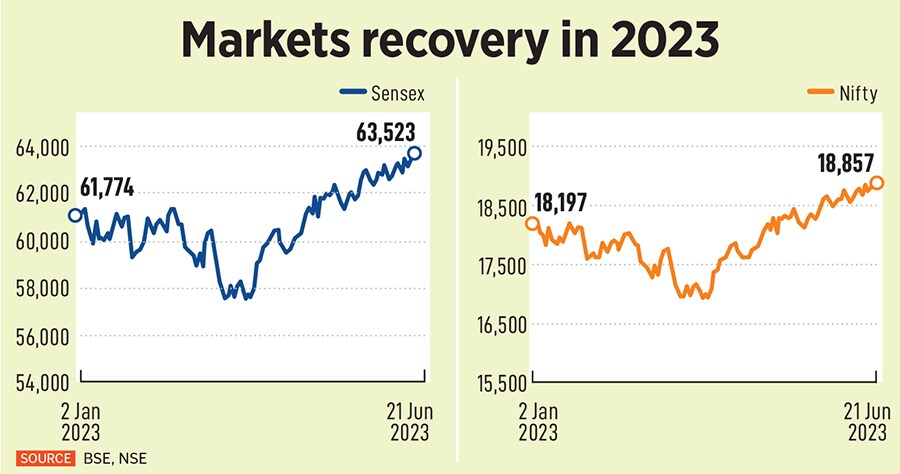

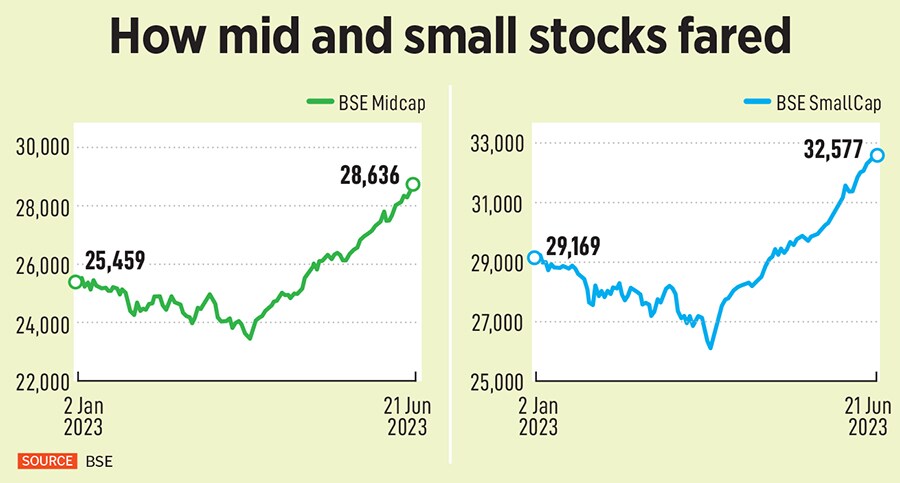

Indian markets hit a record high, with the benchmark Sensex hitting a high of 63,601.71 on June 22, while the Nifty is just shy away from its previous high of 18,888. What is interesting is both the indices were struggling in the beginning of this year, after the peak in December 2022. Both the Sensex and Nifty sparked off a rally starting March-end, as institutional investors started buying stocks. Even as both the Sensex and Nifty have rallied around 4 percent from January till now, they have surged around 10 percent from March-end which has led to a bull-run. Smaller stocks in the BSE Midcap and BSE Smallcap also participated in the rally with both the indices jumping nearly 13 percent this year so far.

“Markets’ rally is a function of earnings trajectory, market sentiments, participation structure and liquidity. We are witnessing a confluence of all the four factors simultaneously,” says Jiten Doshi, co-founder & chief investment officer, Enam Asset Management Company. According to him, unlike its global peers, India used every crisis as an opportunity.

However, the concern remains: How much is too much? Will this rally sustain?