Small to Mall: How CarDekho is giving a new-car experience to used-vehicle buyers

The recently-minted autotech unicorn has opened India's biggest used-car mall in Jaipur and plans to replicate more such outlets across India. Can its offline gambit pay off?

Anurag (left) and Amit Jain are operating a world-class tech company like CarDekho out of Jaipur

Anurag (left) and Amit Jain are operating a world-class tech company like CarDekho out of Jaipur

In early November, when Ramesh Gupta decided to buy a used car, he didn’t think small. “I was curious to see how it is like to buy from a mall,” says the kirana owner in Jaipur. “I wanted to explore options.” The 40-year-old travelled 15 kilometres from his home to reach a sprawling 40,000 square feet facility located at Poddar Circle in Sitapura industrial area of Jaipur, Rajasthan. The mall had some 500 used cars of all shapes and sizes—small, sedan, compact SUVs, hatchbacks—neatly parked, spruced and ready for sale.

If Gupta was dazzled by the massive fleet on display, he was set to be astonished by a bunch of enticing offers. The salesman at the mall started dangling the carrots, one by one. The first selling hook was a seven-day ‘no questions asked’ money-back guarantee. Then came six months of comprehensive warranty on the engine and all parts. It was followed by a year of free roadside assistance cover, seamless paperwork in a few minutes, hassle free transfer of RC (registration certificate) and free service. All the cars, the salesman stressed, have undergone a 217 point-evaluation process which includes checks on ownership, challan and accident history, and odometer tampering. “We also provide finance and insurance,” he sweetened his pitch.

Gupta was floored. “Local dealer se khareedna bekaar hai (It’s useless buying from a local car dealer),” he says, as he drove away in a Hyundai i20. The salesman, too, was excited to have one more delighted customer buying from CarDekho Mall, which was opened in the last week of October. “They are not used to such experience in buying a used car,” he says.

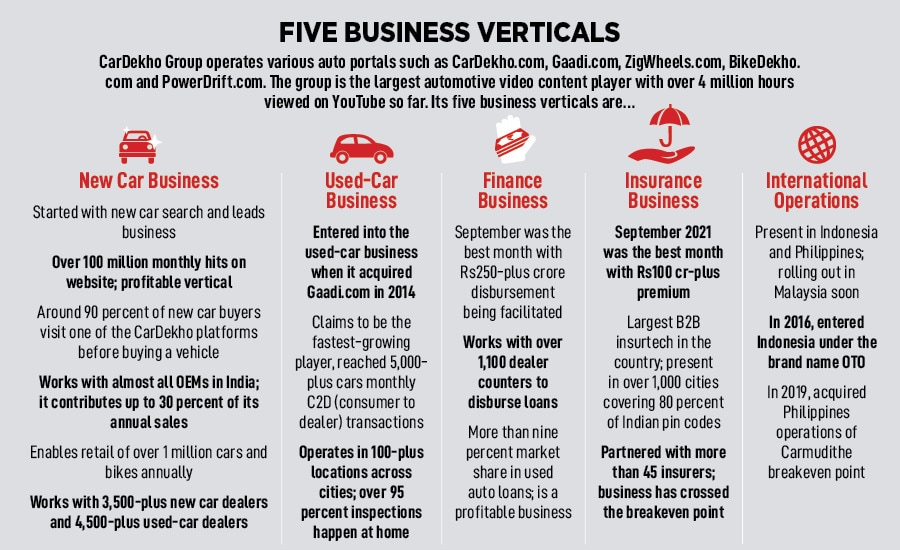

Around nine kilometres from the mall, Amit Jain explains why a mall for pre-owned cars makes ample business sense. The most crucial thing missing in a used-car transaction, underlines the co-founder of recently-minted autotech unicorn CarDekho, is trust. Consumers have to grapple with scanty options, abject quality, deflated prices for selling and an inflated tag while buying vehicles. “We want to change the playbook by providing exceptional experience in choice, quality and trust,” he says. CarDekho plans to roll out 30 to 40 malls across top cities and Tier II towns over the next 18 months. The idea is to give a new-car experience to a used-car buyer. The company is about to open refurbishment centres across the country, and get into service of the cars.

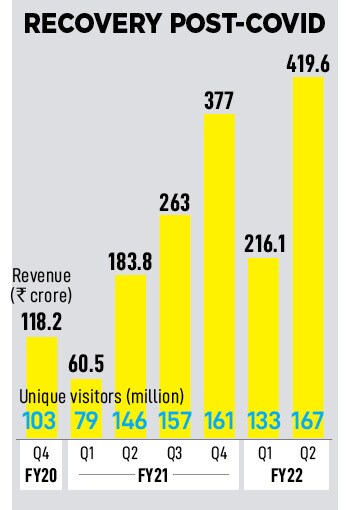

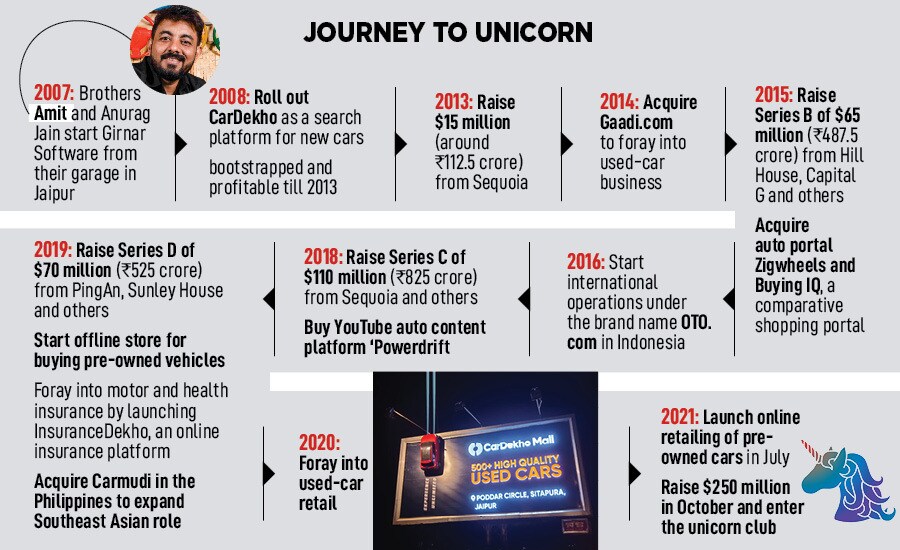

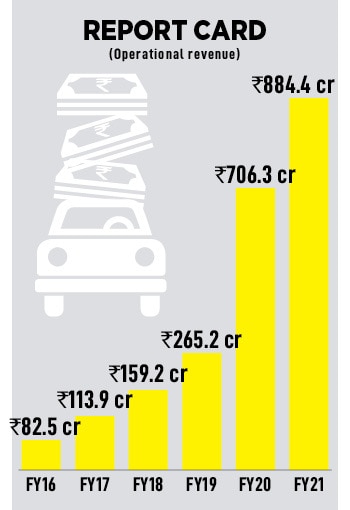

Eight years later, Jain reckons the timing is right to step on the gas. The reasons are many. First, the company has grown at a fast clip. The operating revenue has jumped from Rs82.5 crore in FY16 to a staggering Rs884.4 crore in FY21. Second, the new car and finance business are profitable, the insurance vertical is at a breakeven point, and the international operations in Indonesia and Philippines have taken off. Third, the company is planning to get listed in 18 months. Jain wants to keep his foot on the accelerator. “We have found the right place, it’s an exciting time and we have to play it right,” he says.

Eight years later, Jain reckons the timing is right to step on the gas. The reasons are many. First, the company has grown at a fast clip. The operating revenue has jumped from Rs82.5 crore in FY16 to a staggering Rs884.4 crore in FY21. Second, the new car and finance business are profitable, the insurance vertical is at a breakeven point, and the international operations in Indonesia and Philippines have taken off. Third, the company is planning to get listed in 18 months. Jain wants to keep his foot on the accelerator. “We have found the right place, it’s an exciting time and we have to play it right,” he says.