SBI MF: Betting big with AIFs

India's largest fund house continues to gain in AUM and market share, finding interest in the unlisted marketplace. As it focuses on AIFs to drive growth, it now needs to set the rules as a leader to leapfrog to the next level

Shamsher Singh (Right), MD and CEO with DP Singh, Deputy MD, SBI Funds Management Image: Nayan Shah for Forbes India

Shamsher Singh (Right), MD and CEO with DP Singh, Deputy MD, SBI Funds Management Image: Nayan Shah for Forbes India

Last week, SBI Mutual Fund, India’s largest fund house by assets under management (AUM), completed an exercise which typified what the Indian financial sector values it for. SBI Funds Management—the asset management company (AMC) of SBI Mutual Fund—completed the mandate of liquidation of securities of six wound-up Franklin Templeton mutual fund schemes, directed by the Supreme Court in 2021.

In 2020, Franklin Templeton Mutual Fund had cited unprecedented redemption pressures, leading up to a freeze by the regulator Securities and Exchange Board of India (Sebi), after finding serious lapses and a breach of its mutual fund guidelines.

SBI Fund Management liquidated 217 securities and disbursed around Rs27,508 crore which constituted 109 percent of the value of the securities as on date of winding up. “We have done it in a judicious way without hitting the liquidity in any of the segments or products. There had to be someone who could take care of the issue,” Shamsher Singh, managing director and CEO of SBI Mutual Fund, tells Forbes India. Singh, on deputation from parent State Bank of India, is a veteran SBI banker with over 32 years of experience.

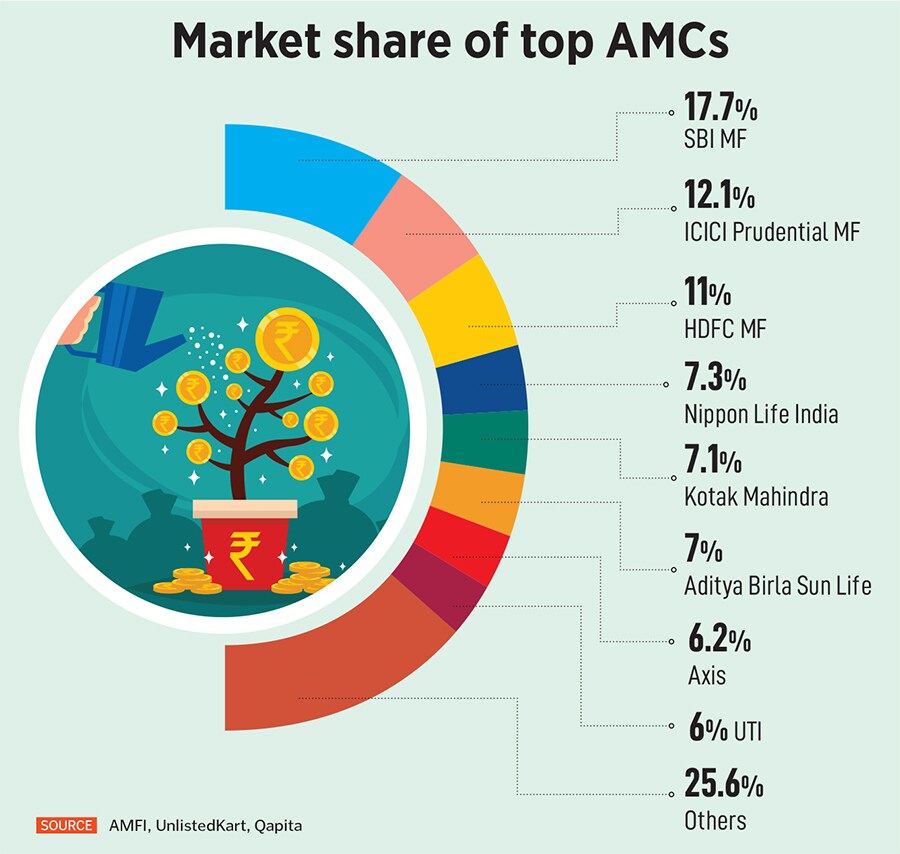

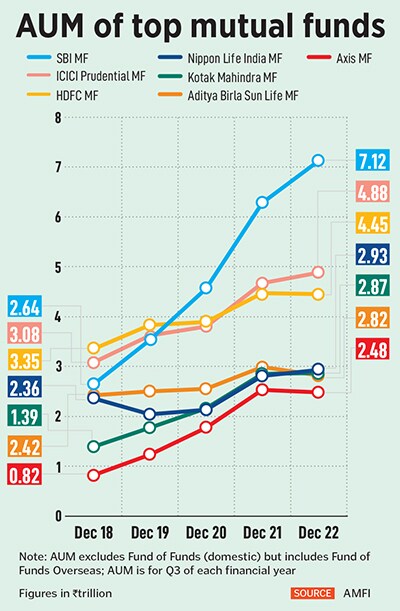

SBI MF holds the top position with average assets under management (AAUM) of around Rs8 lakh crore ($98.5 billion) from an industry total of Rs46 lakh crore, which works out to an AUM market share of just under 18 percent (see infographic).

While private sector mutual funds, from ICICI Prudential AMC, HDFC AMC to Nippon Life and Edelweiss AMC, have grown in size and mutual fund distributors have aggressively sold their schemes, particularly through systematic investment plans (SIPs) in the past two decades, SBI MF has been able to occupy leadership position thanks to the parentage, managing the EPFO money and adoption of technology. SBI MF today covers 95 percent of the PIN codes in India.

While private sector mutual funds, from ICICI Prudential AMC, HDFC AMC to Nippon Life and Edelweiss AMC, have grown in size and mutual fund distributors have aggressively sold their schemes, particularly through systematic investment plans (SIPs) in the past two decades, SBI MF has been able to occupy leadership position thanks to the parentage, managing the EPFO money and adoption of technology. SBI MF today covers 95 percent of the PIN codes in India.