SaaS startups: India-born, US-focussed

Strong cloud-based enterprise software product companies are emerging in India, but are quickly moving to the US, drawn by customers, ecosystem and the IPO dream

Image: Shutterstock

Image: Shutterstock

Postman started as a side project for Abhinav Asthana. He was the technical founder of an earlier startup after finishing college in India, and was grappling with the complexities of making disparate pieces of software connect with each other. The software that do that are called application programming interfaces (APIs) and they are becoming increasingly important to software development.

Eventually, the side project became the main interest, after an early piece of software that Asthana put up on the Chrome Web Store drew a lot of attention from software developers, and suggestions about features that could be added to it, and how it could be expanded. That gave birth to Postman in 2014, with backing from early stage investor Nexus Venture Partners.

Eventually, the side project became the main interest, after an early piece of software that Asthana put up on the Chrome Web Store drew a lot of attention from software developers, and suggestions about features that could be added to it, and how it could be expanded. That gave birth to Postman in 2014, with backing from early stage investor Nexus Venture Partners.

By 2016, Postman had employees in the US, and Asthana himself moved to San Francisco in 2017. This year, Postman raised $150 million in its series C funding at a valuation of $2 billion.

Postman is one of a new generation of software product companies that started in India, but quickly moved to the US. Often they are companies that build software as a service (SaaS) for businesses. While they are building world-class software products and platforms, typically on the cloud, the move to the US is almost inevitable. Early-adopter customers are Americans, and the ecosystem of product development is still several years ahead in Silicon Valley.

The big change in India, however, is that the combination of talent availability and early funding, and the broader interest in software development—from ecommerce giant Flipkart to Dream 11, the fantasy cricket gaming startup—has matured to a point where software product companies are emerging that are able to make the transition to becoming global companies. In the process, not only are they attracting investor interest at an early stage in India, but are going on to successfully raise money from US backers at the growth stage, says Sameer Brij Verma, a managing director at Nexus Venture Partners.

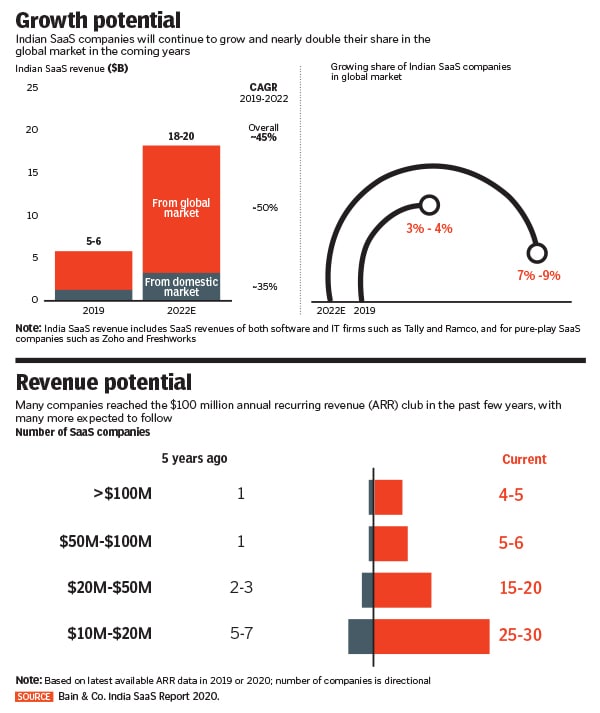

SaaS investments rose to 20 percent of venture capital and growth equity funding in the first half of 2020, versus 15 percent in the same period in 2019. SaaS also emerged as the top priority technology sub-sector of focus in an investor survey that Bain conducted in 2019, says Reddy.

SaaS investments rose to 20 percent of venture capital and growth equity funding in the first half of 2020, versus 15 percent in the same period in 2019. SaaS also emerged as the top priority technology sub-sector of focus in an investor survey that Bain conducted in 2019, says Reddy.