Rupee on slippery slope may hit margins of companies

A depreciating rupee, combined with slowing demand and growth in developed economies, could hit the revenues of export-oriented sectors such as IT, pharma and auto components

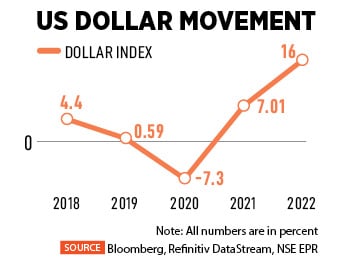

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation

Illustration: Chaitanya Dinesh Surpur

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation

Illustration: Chaitanya Dinesh Surpur

The continuing slide in the Indian rupee is anticipated to be a double whammy for companies that draw a major chunk of their revenues from exports. Weakness in the Indian currency is likely to be followed by lower demand, as most developed economies are apprehensive of witnessing significant slowdown in growth, which may hit revenues of information technology (IT) firms and auto exporters, say experts.

Indian IT, pharmaceutical and select auto ancillary companies earn a large part of their revenues in US dollars. Typically, these companies see their margins improve with currency depreciation. “Rupee depreciation has been generally beneficial for exporters, including IT services firms, pharma firms, textiles, and auto exporters. Generally, most firms in these sectors hedge at least part of their exposure, so the benefits of the rupee depreciation should accrue after two quarters of depreciation,” says Nishit Master, portfolio manager, Axis Securities PMS. However, he adds that this time around the rupee depreciation is expected to be followed by lower demand, with developed economies looking at a slowdown in growth.

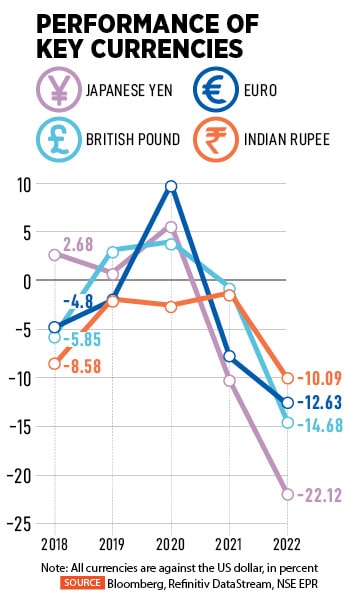

The Indian rupee, and other emerging market currencies, have been on a slippery slope for the past few months due to a strong US dollar index, which has been pumped up by aggressive tightening by the US Federal Reserve to tame inflation despite growing signs of an impending recession. Rising prices of commodities have also been attributed to the falling rupee. Only commodity-linked, high-yielding emerging currencies like the Russian rouble, Mexican peso and Brazilian real have been strengthening this year so far.

How forex fluctuations may hit margins

According to Manish Jain, fund manager, Coffee Can PMS, Ambit Asset Management, rupee depreciation is beneficial for the margins of some export-oriented sectors like IT services, auto, and pharma. However, what dampens the spirit is the adverse impact of two things: Growth slowdown due to impending recession in the USA and European Union, as demand and spending fall; and the impact of cross-currency movement, with the rupee strengthening against the euro and British pound. “This means that even for export-oriented companies, the positive impact shall be largely limited, which is reflected in limited excitement in the markets. Over the medium term, we expect things to settle down as India remains on strong footing and the US should recover soon enough. We would maintain our positive stance on IT services and auto,” says Jain.

With Europe expected to witness a deep recession, auto, IT, and pharma companies catering to European markets may get negatively impacted, say experts. “With the rupee appreciating against the euro, these companies will face a double whammy, since on the currency front also they are not well placed if they bill their revenues in euros,” says Master.

With Europe expected to witness a deep recession, auto, IT, and pharma companies catering to European markets may get negatively impacted, say experts. “With the rupee appreciating against the euro, these companies will face a double whammy, since on the currency front also they are not well placed if they bill their revenues in euros,” says Master. In contrast, the dollar index has been getting strong. This year, it has gained 16 percent, while it jumped 7 percent in the previous year, after a fall of 7.3 percent in 2020.

In contrast, the dollar index has been getting strong. This year, it has gained 16 percent, while it jumped 7 percent in the previous year, after a fall of 7.3 percent in 2020.