How long will India's shining economy hold amid the gradual global meltdown?

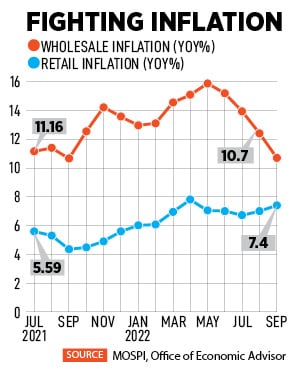

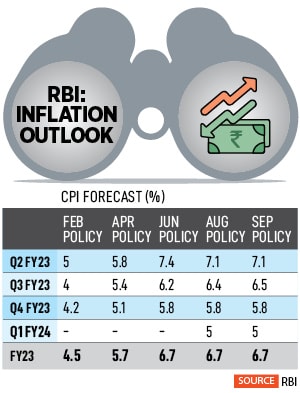

India is the bright spot in the global economy, but economists argue that the country is not decoupled from the world, and a 6 percent growth rate at a time when inflation is over 7 percent is worrisome

Several analysts and fund managers Forbes India interacted with are of the view that India will continue to outperform its peers.

Illustration: Chaitanya Dinesh Surpur

Several analysts and fund managers Forbes India interacted with are of the view that India will continue to outperform its peers.

Illustration: Chaitanya Dinesh Surpur

A ‘synchronised’ recession has gripped the global economy. In its latest World Economic Outlook report, the International Monetary Fund (IMF) trimmed its 2023 global GDP forecast to 2.7 percent from 2.9 percent in July, but retained its world growth forecast for the current calendar year at 3.2 percent. “The worst is yet to come,” it warns.

The IMF predicts a third of the global economy will contract in the calendar year 2023, and cautions that the world’s engines of production and consumption—China and US—will continue to see a decline in economic activity. China is expected to limp to recovery, and grow at 3.2 percent this year, whereas the US economy is likely to remain flat at 1.6 percent. Few European countries may see their economies shrink in the coming quarters.

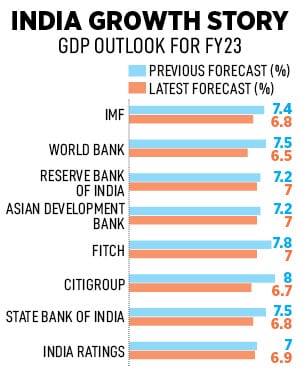

Most global banks and agencies have downgraded their growth outlook for India to below 7 percent. ‘A weaker-than-expected outturn in the period of April to June, and more subdued external demand’ have prompted the IMF to slash India’s FY23 GDP estimate to 6.8 percent from 7.4 percent earlier. The World Bank has cut its forecast by 1 percent to 6.5 percent, and the Citigroup has reduced it to 6.7 percent from 8 percent earlier.

The impact of the Russian invasion of Ukraine, a cost-of-living crisis stoked by stubborn inflation, and the slowdown in China have hit the global economy. Despite the grim outlook, India is the fastest-growing large economy in the world, and the jury is out on whether the country has decoupled from the world.

If equity returns is a benchmark, then India did outshine most peers in local currency terms. Most global equity markets fell between 20 percent and 25 percent in the current calendar year. Furthermore, domestic investors have held fort despite the prolonged spell of heavy selling by FIIs (foreign institutional investors) for nearly one year.

If equity returns is a benchmark, then India did outshine most peers in local currency terms. Most global equity markets fell between 20 percent and 25 percent in the current calendar year. Furthermore, domestic investors have held fort despite the prolonged spell of heavy selling by FIIs (foreign institutional investors) for nearly one year. Rakshit elaborates, “While India could fare well relatively, it faces headwinds from imminent global demand and trade slowdown, risks of higher-for-longer global inflation and interest rates, a strengthening US dollar, and enduring geopolitical tensions.”

Rakshit elaborates, “While India could fare well relatively, it faces headwinds from imminent global demand and trade slowdown, risks of higher-for-longer global inflation and interest rates, a strengthening US dollar, and enduring geopolitical tensions.” The US and the top five EU (European Union) nations account for approximately 30 percent of the country’s total exports. “A large part of the global exports is dependent on the US and Europe which, in turn, will have an indirect impact on India too,” adds Rakshit.

The US and the top five EU (European Union) nations account for approximately 30 percent of the country’s total exports. “A large part of the global exports is dependent on the US and Europe which, in turn, will have an indirect impact on India too,” adds Rakshit.