RBI fights daunting challenges with another 50 bps rate hike

Global geopolitical factors, a hawkish US Fed, plunging rupee, rising food prices weigh on the Reserve Bank's Monetary Policy Committee as it tries to fight inflation and support growth

Shaktikanta Das, governor, Reserve Bank of India (RBI)

Image: Punit Paranjpe / AFP

Shaktikanta Das, governor, Reserve Bank of India (RBI)

Image: Punit Paranjpe / AFP

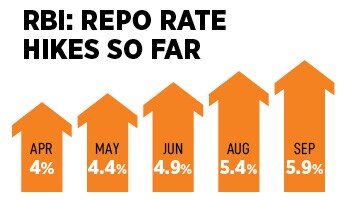

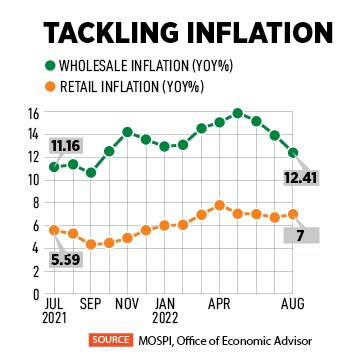

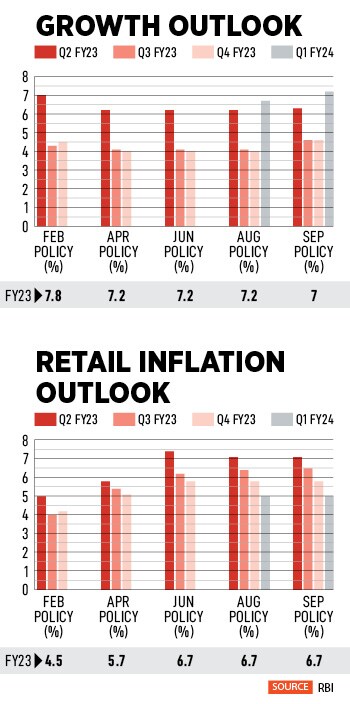

Confronted with “daunting challenges” the Reserve Bank’s Monetary Policy Committee announced a repo rate hike of 50 basis points and its decision to continue to focus on withdrawal of accommodation to tackle rising inflation while also giving growth a chance (see table). The central bank retained its retail inflation forecast at 6.7 percent but marginally lowered its growth outlook to 7 percent from 7.2 percent for the current fiscal year (table).

The coronavirus pandemic and the raging conflict in Ukraine have had a profound impact on the global economy. Most western countries are going through a slowdown coupled with high inflation levels. Relentless financial tightening, in the aftermath of an environment of ultra-accommodative liquidity, has further scarred the global economic outlook.

“The recent sharp rate hikes and forward guidance about further big rate hikes have caused tightening of financial conditions, extreme volatility and risk aversion. All segments of the financial market including equity, bond and currency markets are in turmoil across countries. There is nervousness in financial markets with potential consequences for the real economy and financial stability. The global economy is in the eye of a new storm,” cautions Shaktikanta Das, governor, Reserve Bank of India (RBI).

However, despite global challenges, the RBI believes the domestic economy continues to remain resilient. “There is macroeconomic stability. The financial system remains intact, with improved performance parameters,” Das adds.

However, despite global challenges, the RBI believes the domestic economy continues to remain resilient. “There is macroeconomic stability. The financial system remains intact, with improved performance parameters,” Das adds.

Investors had pencilled in a rate hike of 50 basis points and the overall tone of the policy was less hawkish than the street feared. At 1.40 pm the S&P Sensex was up nearly 1032 points to 57,442. The 10-Y bond yield inched up by 0.25 percent to 7.358.

In its own admission, the Reserve Bank of India agrees the inflation trajectory is unclear at this point. The RBI assumes crude oil prices will reduce to $100/ barrel in the second half of FY23 from $104/barrel in the first half of the current fiscal year. But there are a number of risks. One, global geopolitical developments which are heavily weighing on domestic prices.

In its own admission, the Reserve Bank of India agrees the inflation trajectory is unclear at this point. The RBI assumes crude oil prices will reduce to $100/ barrel in the second half of FY23 from $104/barrel in the first half of the current fiscal year. But there are a number of risks. One, global geopolitical developments which are heavily weighing on domestic prices.  Growth

Growth