RBI follows the US Fed's footsteps, hikes repo by 50 bps to fight inflation

In a "new-normal" move, India's central bank raises benchmark rate to its highest level since August 2019 while retaining its growth and inflation forecasts for FY23 with a continued focus on calibrated withdrawal of accommodation

The Reserve Bank of India (RBI) governor Shaktikanta Das answers a question during a press conference at the RBI headquarters in Mumbai on August 5, 2022. - India's central bank on August 5 hiked interest rates for the third time in four months, as Asia's third-largest economy contends with a widening trade deficit and weakening currency.

Image: Indranil Mukherjee / AFP

The Reserve Bank of India (RBI) governor Shaktikanta Das answers a question during a press conference at the RBI headquarters in Mumbai on August 5, 2022. - India's central bank on August 5 hiked interest rates for the third time in four months, as Asia's third-largest economy contends with a widening trade deficit and weakening currency.

Image: Indranil Mukherjee / AFP

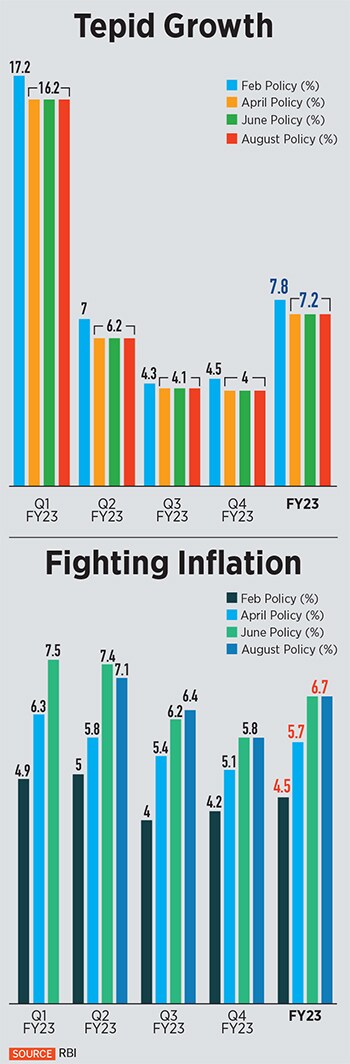

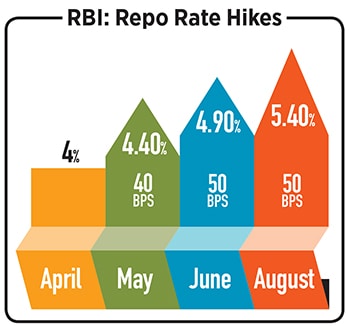

The Reserve Bank’s rate-setting panel unanimously voted to hike the repo rate by 50 basis points to 5.4 percent. After staying at a historic low of 4 percent for over one year, the benchmark rate is now back to pre-pandemic levels, and the highest since August 2019. Five of the six members voted to continue to focus on withdrawal of accommodation to rein in inflation while supporting growth. The central bank retained its GDP and inflation forecast of 7.2 percent and 6.7 percent respectively for the current fiscal year.

“Successive shocks to the global economy are taking their toll in terms of globalised inflationary surges, tightening of financial conditions, sharp appreciation of the US dollar and lower growth across geographies,” RBI Governor Shaktikanta Das explained even as he remained elusive on the neutral interest rate.

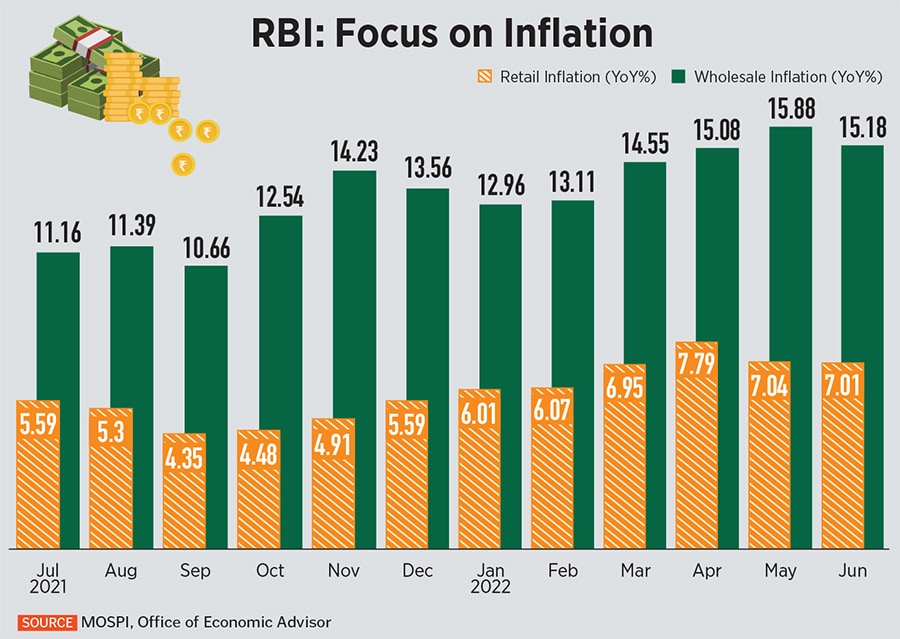

On the face of it, inflation has moderated with a downtrend in retail and wholesale price inflation over the past two months. Yet, core inflation (excludes food and fuel) remains sticky at over 6 percent, suggesting that it may be challenging to rein in headline inflation below 6 percent given the volatility in food and fuel supply. Extreme weather conditions and the change in sowing and seasonal patterns due to climate change are making it more difficult to predict food and energy prices and hence accurate inflation forecasts are tough.

Das cautioned that inflationary pressures are likely to remain broad-based and elevated. “Consumer price inflation has eased from its surge in April but remains uncomfortably high and above the upper threshold of the target. The volatility in global financial markets is impinging upon domestic financial markets, including the currency market, thereby leading to imported inflation,” he added.

Economists agree: Inflation in India tends to be sticky and since the pandemic large firms have gained pricing power and may begin to pass on higher input costs to consumers. HSBC India’s chief economist Pranjul Bhandari says the RBI must anchor inflation expectations. “For instance, it may have to experiment with new techniques like raising rates earlier rather than later in the cycle, as a way of keeping inflation expectations anchored without too much cumulative tightening,” she notes.

Besides, multi-decade high inflation levels in developed economies coupled with steep rate hikes by central banks are stoking fears of a global recession. This has contributed to the fall in commodity prices which has eased the import bill for India, but also heightens the likelihood of a fall in demand from other countries for India’s exports.

Besides, multi-decade high inflation levels in developed economies coupled with steep rate hikes by central banks are stoking fears of a global recession. This has contributed to the fall in commodity prices which has eased the import bill for India, but also heightens the likelihood of a fall in demand from other countries for India’s exports.

After watching inflation surge from the sidelines—much like most global central banks—RBI has sprung into action to increase rates and tame rampant inflation. Over two tightening moves in May and June, the Reserve Bank of India had raised the benchmark rate by a cumulative 90 basis points to 4.9 percent.

After watching inflation surge from the sidelines—much like most global central banks—RBI has sprung into action to increase rates and tame rampant inflation. Over two tightening moves in May and June, the Reserve Bank of India had raised the benchmark rate by a cumulative 90 basis points to 4.9 percent.