Private capital chasing mid-sized Indian banks

Most opportunities for private equity firms and foreign institutional investors came when the banks needed capital urgently. Now SFBs and mid-sized banks might seek fresh capital avenues for growth

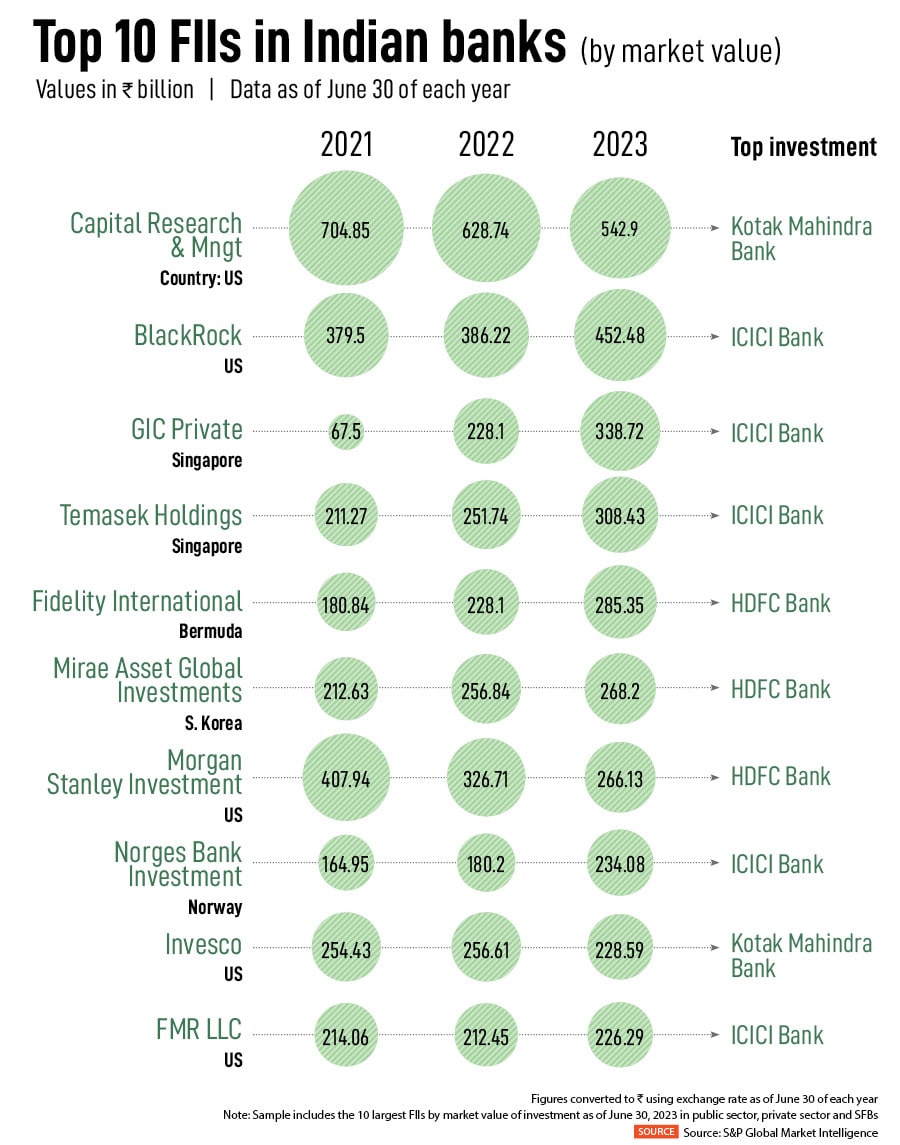

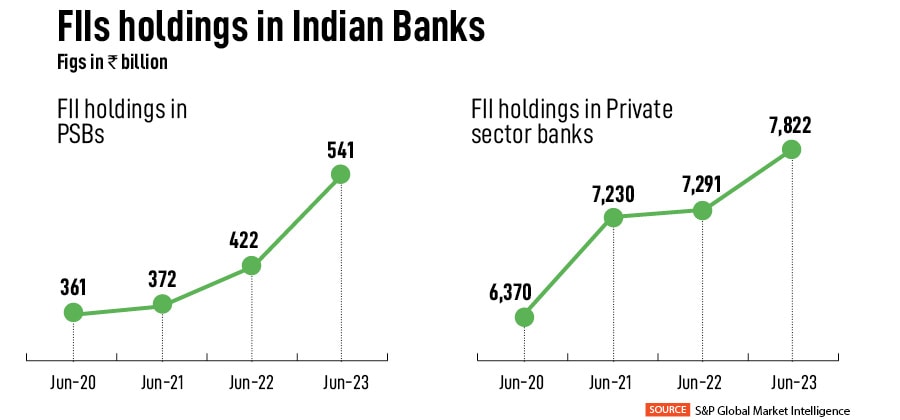

FIIs have always found Indian banks attractive stocks to invest in over the past 2-3 decades, who are finding more value in mid-sized banks

Image: Yes Bank: Manjunath Kiran / AFP; IDFC Capital First Bank: Indranil Aditya/NurPhoto via Getty Images

FIIs have always found Indian banks attractive stocks to invest in over the past 2-3 decades, who are finding more value in mid-sized banks

Image: Yes Bank: Manjunath Kiran / AFP; IDFC Capital First Bank: Indranil Aditya/NurPhoto via Getty Images

Earlier in September, US-based GQG Partners, a boutique investment firm, had through two separate deals hiked its stake in IDFC First Bank, one of the fast expanding mid-sized banks in India. IDFC First Bank, which had moved into the top 10 most valuable listed banks in India – has probably just slid out of that list amid weak market sentiment. But it is seeing enough interest from private and capital market investors, as a bank whose loan book and deposits growth is strong, while staying profitable.

The GQG deal, in some ways, is reflective of what private equity investors, family offices and foreign asset management companies, besides institutional investors are seeing in Indian private or public sector banks, large or mid-sized. It is a simple conviction that if you are long on India, you need to be long banks.

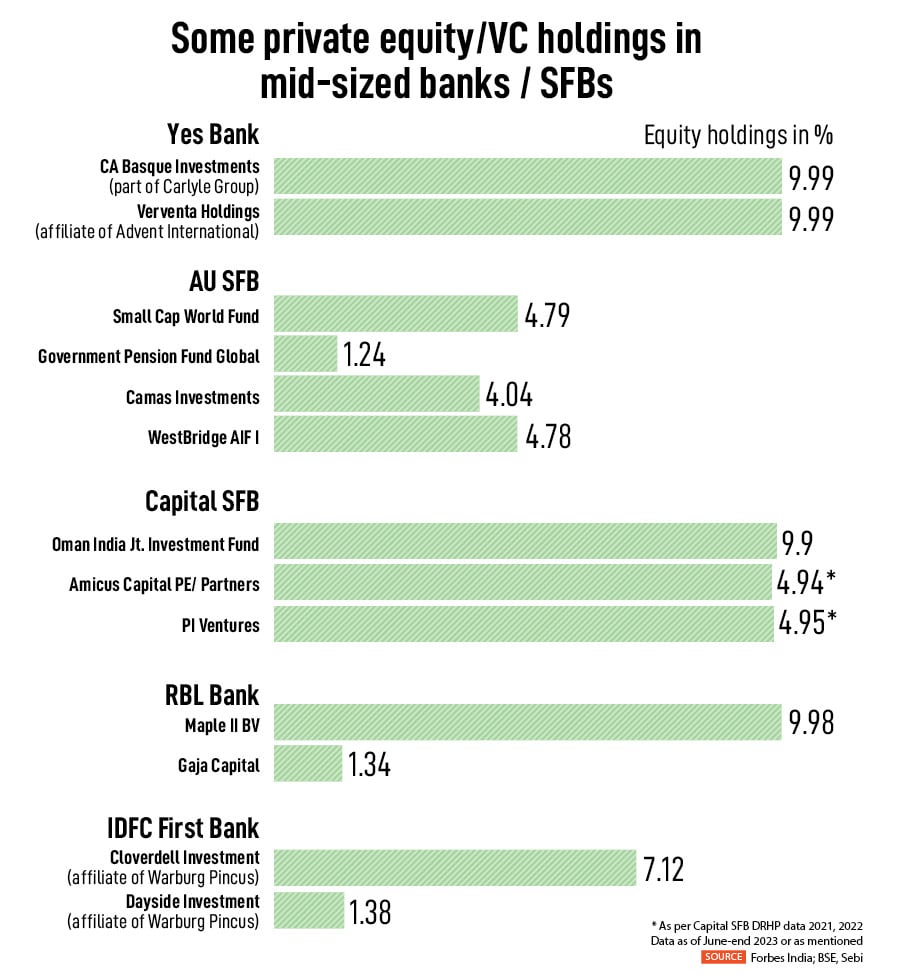

While FIIs have always found Indian banks attractive stocks to invest in over the past 2-3 decades betting on the India growth story; as has also been the case with private equity investors, who are finding more value in mid-sized banks such as Yes Bank, RBL Bank and Federal Bank.

But unlike FIIs, private equity cannot simply go out and buy stake in these banks. “They have to wait for the right opportunities where they can take substantial stakes. Those opportunities come very infrequently,” a senior partner with a private equity firm said, preferring to stay anonymous.

In the case if these mid-sized banks, the opportunities have typically arise due to some “dislocation” which could be when the bank is in some form of distress and is in need of recapitalisation.