Poshn's agritech gambit is reaping a rich harvest

An IIM grad and XLRI alum have cracked the agri-trading code for SMEs, notching up furious growth for their commodity distribution and financing platform. Can Poshn continue to feed its aggressive appetite?

Bhuvnesh Gupta (left) and Shashank Singh, Cofounders, Poshn

Bhuvnesh Gupta (left) and Shashank Singh, Cofounders, Poshn

May 2021, Gurugram. Shashank Singh and Bhuvnesh Gupta were going against the grain. And it made ample sense to the co-founding duo, who were a year into their second venture. In fact, it had been just 60 days since the friends resigned from their respective jobs and started taking care of Poshn on a full-time basis. They were confident of hitting the jackpot from the very first month. “What all does one need to raise money,” asked Gupta during one of his funding parleys with his co-founder.

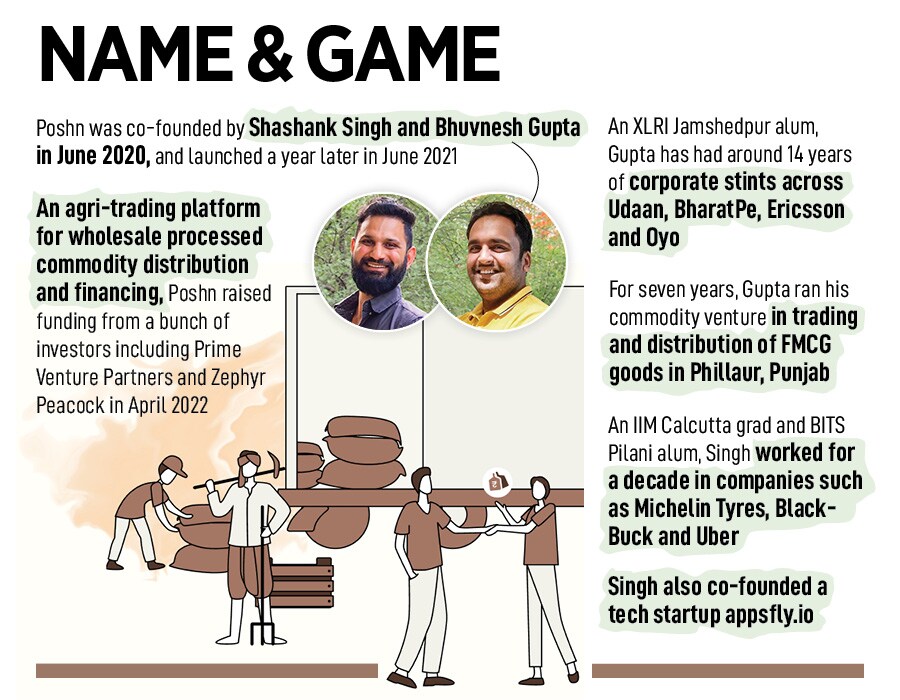

The first-generation entrepreneurs started working on Poshn on a part-time basis in June 2020, and were now ready to take their agri-trading platform for wholesale processed commodity distribution and financing to the agri processors, distributors, SMEs and investors in a grand way. “Do we have all the ingredients,” probed Gupta, an XLRI grad, who had around 14 years of corporate experience in companies like Udaan, BharatPe, Ericsson and Oyo. He, in fact, had spent seven years running a commodity venture in trading and distribution of FMCG goods in Phillaur, Punjab.

Singh, for his part, was confident. “Only three things needed, mate,” he grinned, and answered in a reassuring tone. “Pedigree, a good product and some kind of recurring revenue,” reckoned Singh, who had worked for a decade in companies such as Michelin Tyres, BlackBuck and Uber, and had co-founded a tech startup Appsfly.io before going back to the corporate world. “We have all three in perfect doses.”

To be fair, the co-founders did have the ‘right kind’ of funding ammunition. If the XLRI and IIM tag was a great educational pedigree to flaunt, then running a venture and long corporate careers gave the duo the edge over rookie and first-time founders. “My friends told me that VCs [venture capitalists] have a hidden bias for such a blend,” Singh continued with his self-assuring reasoning. After working on the tech stack for a year and fixing it for all possible glitches, Poshn had a reasonable offering. And yes, the fledgling startup also ticked the recurring-revenue box. “We had an ARR (annual recurring revenue) of $1 million,” says Singh.

It turned out to be too much of an ‘ask’, and VCs started declining to invest in the startup. After a few months of futile pitching, the co-founders got a reality check. It had been more three quarters since they had quit their job, the bootstrapped venture was running out of money, and there were still no takers. “Getting repeatedly declined was like third-degree torture,” recalls Singh.

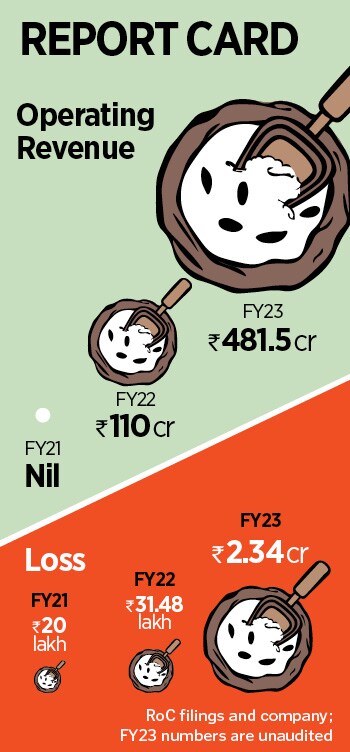

It turned out to be too much of an ‘ask’, and VCs started declining to invest in the startup. After a few months of futile pitching, the co-founders got a reality check. It had been more three quarters since they had quit their job, the bootstrapped venture was running out of money, and there were still no takers. “Getting repeatedly declined was like third-degree torture,” recalls Singh.  The co-founders soon reaped a rich harvest. Poshn closed the first fiscal, FY22, with an operating revenue of Rs110 crore, and posted a loss of Rs31.48 lakh. A month later in April 2022, Poshn raised its maiden institutional round of funding of $4 million from a clutch of investors including Prime Venture Partners and Zephyr Peacock.

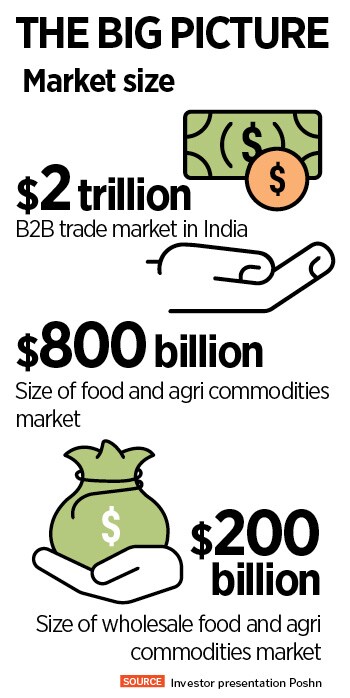

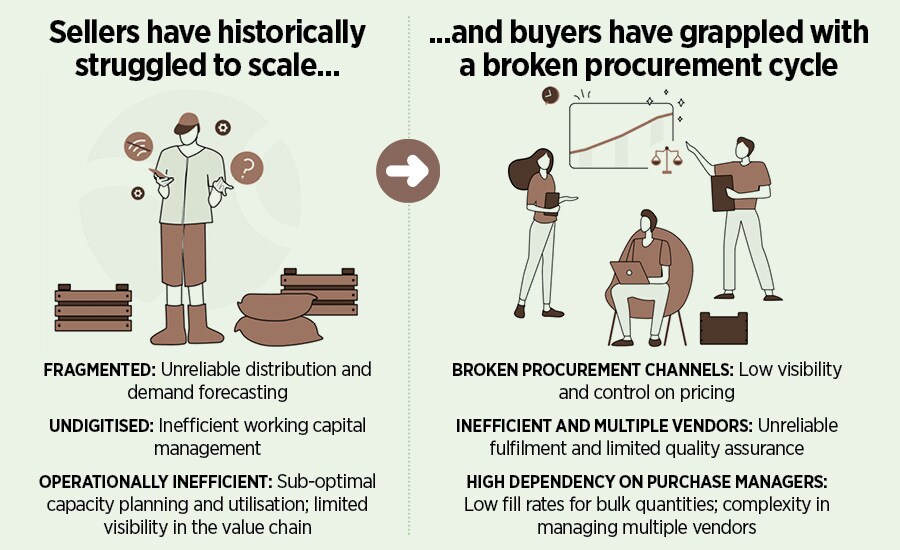

The co-founders soon reaped a rich harvest. Poshn closed the first fiscal, FY22, with an operating revenue of Rs110 crore, and posted a loss of Rs31.48 lakh. A month later in April 2022, Poshn raised its maiden institutional round of funding of $4 million from a clutch of investors including Prime Venture Partners and Zephyr Peacock. Poshn is operating in this space and addressing the challenges faced by hundreds and thousands of food processing units and more than two million wholesale buyers, adds Somani. “The company is also solving for the financial needs of various stakeholders,” he underscores. The startup, he lets on, has also frugally scaled its way to meaningful traction. Poshn’s operating revenue jumped over four times to Rs481.5 crore, claims Singh, sharing the unaudited numbers for the fiscal. The loss, meanwhile, has increased to Rs2.34 crore.

Poshn is operating in this space and addressing the challenges faced by hundreds and thousands of food processing units and more than two million wholesale buyers, adds Somani. “The company is also solving for the financial needs of various stakeholders,” he underscores. The startup, he lets on, has also frugally scaled its way to meaningful traction. Poshn’s operating revenue jumped over four times to Rs481.5 crore, claims Singh, sharing the unaudited numbers for the fiscal. The loss, meanwhile, has increased to Rs2.34 crore.