Paytm moderates Buy Now, Pay Later lending, but overall impact marginal

The demand for big-ticket lending, onboarding of new lending partners will be watched closely. Analysts forecast a path towards profitability by FY26

Paytm does its lending activity through tie-ups with banks or non-banking financial companies (NBFCs).

Image: Shutterstock

Paytm does its lending activity through tie-ups with banks or non-banking financial companies (NBFCs).

Image: Shutterstock

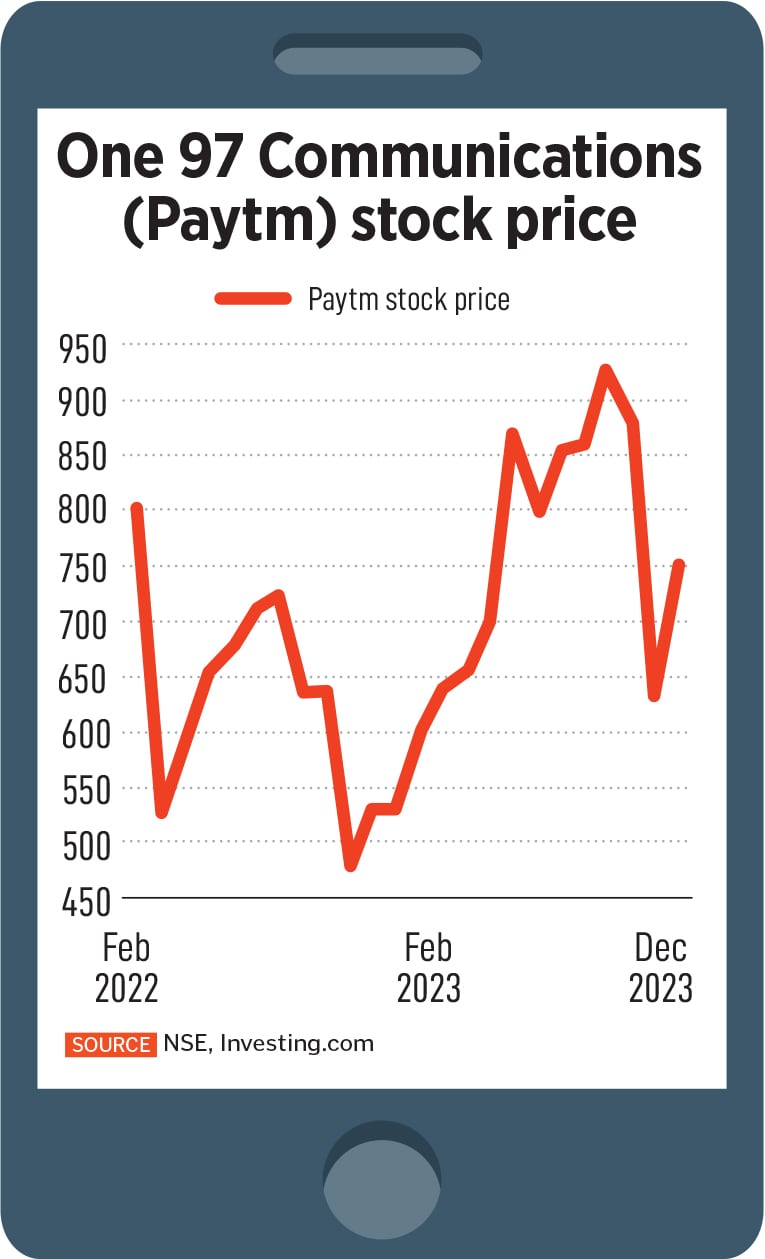

The payments and financial services company, Paytm, under parent One 97 Communications, continues to ride into slightly unchartered territory as it has rejigged its lending portfolio more towards merchant loans and high-ticket personal loans, after exiting the highly dissected buy now pay later (BNPL) lending segment.

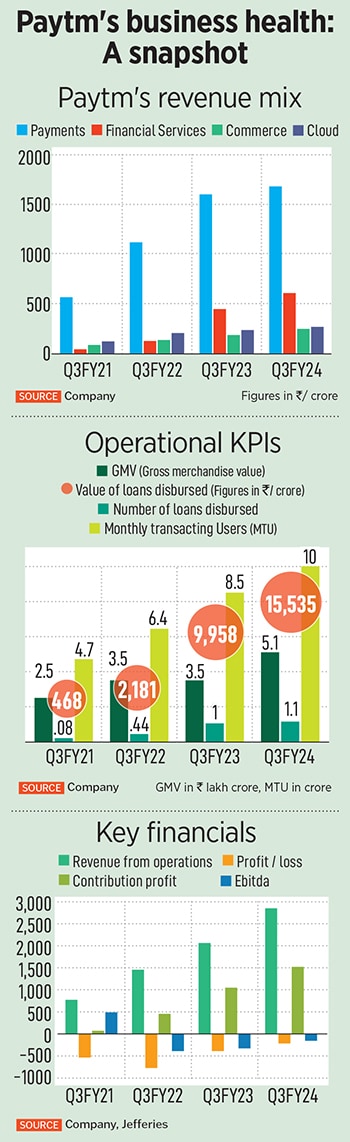

While some of the financial optics from its Q3FY24 earnings announced last week are positive–ebitda losses continued to narrow as contributing profit outpaced operating costs and GMV levels improved–there are elements of its lending book that will depend on credit behaviour of customers as they move towards buying higher-size ticket loans with Paytm’s lending partners.

Paytm does its lending activity through tie-ups with banks or non-banking financial companies (NBFCs). The unknown piece here is the acceptance and clearance of Paytm’s new lending partners in coming quarters, which will be watched by the regulator and investors both.

Paytm has had a chequered history in terms of regulations and clearances in the recent past. In October 2023, the Reserve Bank of India (RBI) had imposed a penalty of Rs5.39 crore on Paytm, for non-compliance with the central bank’s e-KYC provisions. In March 2022, the RBI barred Paytm Payments Bank from onboarding new customers; due to “certain material supervisory concerns observed in the bank” The Paytm Payments Bank is hopeful that these restrictions will get lifted by March this year.

“Certain future clearances and licenses to be sought from the RBI and new platform partners which they will onboard for the high ticket loans will be watched very closely,” a senior executive at a payment-focussed fintech firm told Forbes India, on condition of anonymity.

But analysts say disbursements under Paytm postpaid moderated on expected lines and 4QFY24 will have full impact.

But analysts say disbursements under Paytm postpaid moderated on expected lines and 4QFY24 will have full impact. In December 2023, media had reported that One 97 Communications had fired over 1,000 employees across multiple divisions, to lower employee costs, possibly in the three months to December. Employee costs (excluding ESOPs) for Paytm rose for the three-months ending December 2023 to Rs809 crore, compared to Rs584 crore for the corresponding period, a year earlier.

In December 2023, media had reported that One 97 Communications had fired over 1,000 employees across multiple divisions, to lower employee costs, possibly in the three months to December. Employee costs (excluding ESOPs) for Paytm rose for the three-months ending December 2023 to Rs809 crore, compared to Rs584 crore for the corresponding period, a year earlier.