Meat & Greet: How Licious is spicing up its story

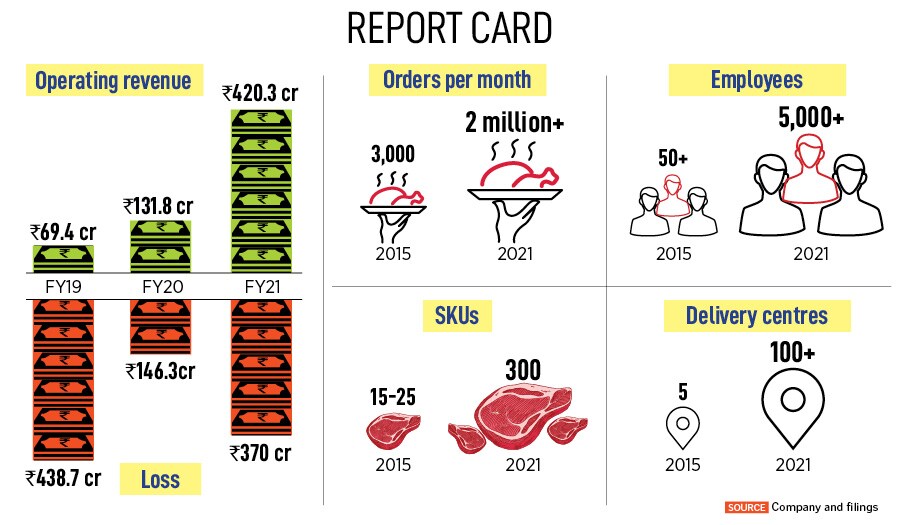

India's biggest meat and seafood brand aggressively ramped up its ready-to-cook division to take it to Rs 200 crore in two years. Can the meat unicorn keep up its gutsy run?

L to R: Vivek Gupta and Abhay Hanjura, Co-founders, Licious

L to R: Vivek Gupta and Abhay Hanjura, Co-founders, Licious

Image: Selvaprakash Lakshmanan for Forbes India

Over six years into the meat business, Abhay Hanjura and Vivek Gupta are no longer spring chicken! “Vegetarian eaters in India are not missing chicken,” reckons Gupta, who comes from a hard-core vegetarian family. His friend Hanjura interjects with a spirited argument. “What do our Western counterparts have,” asks the ‘branded butcher’ who has been working round the cluck—yes, in Hanjura’s LinkedIn world, the clock is replaced with ‘cluck’—to bring quality, variety and respect to the business of selling meat.

The Americans and Europeans, Hanjura continues with his high-pitched reasoning, don’t have many options. “Lettuce, beans, corns, peas. Right?” he says. Back in India, the vegetarians have kadhai panner, dal makhni, spicy aalo gobi. “They don’t even want to know how vegetarian chicken—plant-based meat—tastes,” he says, shredding the meaty logic built around the imminent rise, and threat, of fake meat. This kind of meat, he underlines, won’t make it big in India.

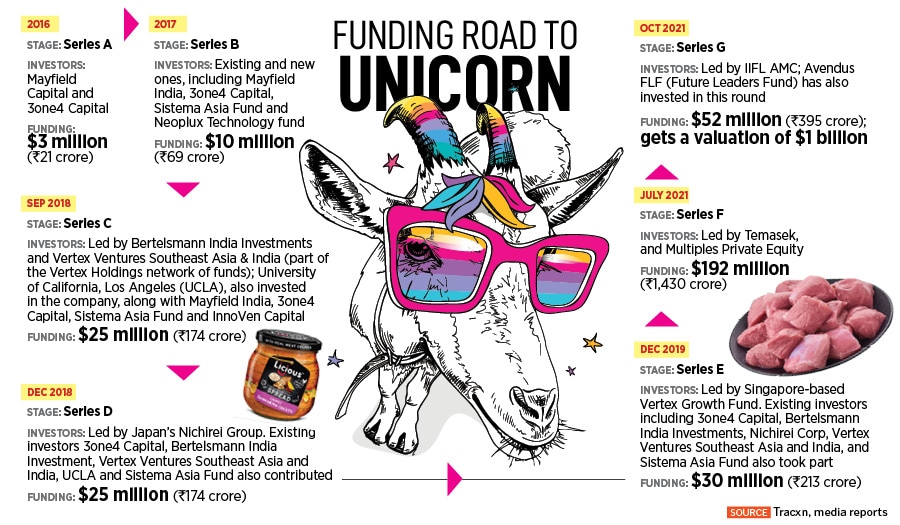

Well, the duo definitely know how to make real meat big in India. The friends started Licious in July 2015, slowly scaled it up during the initial years, and over the last two years made the most of the pandemic tailwinds to build their maiden venture into the biggest meat and seafood brand in India. In fact, in October 2021, India saw a unicorn emerge out of goat, fish and chicken when Licious raised $52 million (Rs 395 crore) in series G funding, to become the first direct-to-consumer (D2C) brand to enter the $1 billion valuation unicorn club.