IT services Q3 earnings: Five takeaways from the top companies

India’s top IT services companies’ December quarter earnings show that demand remains strong, but a spending slowdown is coming

Part of the International Tech Park in White Fields, one of the IT centers in Bangaluru.

Image: Frank Bienewald/LightRocket via Getty Images

Part of the International Tech Park in White Fields, one of the IT centers in Bangaluru.

Image: Frank Bienewald/LightRocket via Getty Images

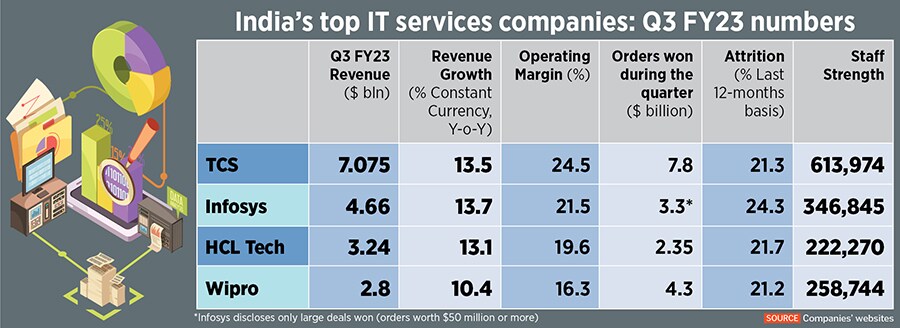

India’s top IT services companies reported their fiscal third-quarter earnings last week, posting strong growth in what is generally seen as a slow period of the year due to the holidays.

The numbers, taken together with the commentary from the companies’ top executives, also show that an imminent slowdown is widely expected, with delays in spending decisions, even though the need for tech services remains strong.

Here are five takeaways as we head into 2023.

1. Demand remains strong for cloud and automation

Infosys, India’s second-biggest IT services company, beat analysts’ expectations for its fiscal third-quarter revenues and profit, on the back of strong demand and adoption of its cloud services and automation solutions.Revenue for the three months ended December 31, rose 2.4 percent from the previous quarter in constant-currency terms, which eliminates the effect of currency rate variations. Sales rose 13.7 percent to $4.66 billion for the December quarter versus $4.25 billion for the same quarter a year ago, Infosys said in a statement.