Inside India Quotient, the VC firm that won big with ShareChat

Founding partners Madhukar Sinha and Anand Lunia are now raising their fourth fund to invest in Indian startups, having backed a handful of winners whose potential was not so apparent to many early on

Image: Neha Mithbawkar for Forbes India

Image: Neha Mithbawkar for Forbes India

Vellvette Lifestyle, founded in 2012, took its time making a mark, after raising seed funding of about Rs. 1.5 crore from venture capital firm India Quotient, which was raising its own first fund. The Mumbai company did not go far with its initial plan of selling curated make-up and personal care products from well-known brands on a subscription basis.

By 2015, Vellvette’s co-founders, wife and husband Vineeta Singh and Kaushik Mukherjee, changed tack and decided to make their own brand of cosmetics — SUGAR. Some investors did not believe it would work. The subscription-based ecommerce venture was something they were comfortable with, whereas, back then, a digital-led Indian consumer brand was “non-fundable,” Singh recalled in a recent interview with Forbes India.

“A couple of angel investors exited at the very next round of funding, but India Quotient continued to back us,” she says. Founding partners Madhukar Sinha and Anand Lunia’s belief in the entrepreneurs is seeing the kind of returns that VCs bet on. In February, Sugar Cosmetics announced a new round of funding, at $21 million, and in the process boosted its value to about $100 million.

Despite the pandemic, Singh, also the CEO, expects physical retail to be a big distribution channel for the digital-led company and she plans to go from being present in 10,000 stores today to 40,000 stores. India Quotient’s first investment in Vellvette is now valued at nearly 50 times over, based on a part exit in February.

“Sugar Cosmetics was a late bloomer among our portfolio companies from our first fund, which is doing extremely well,” Sinha, co-founder of India Quotient, said in a recent interview with Forbes India. “And that is our big winner from the first fund.” VC firms bank on one or two companies at best to return their entire fund many times over. “Sugar Cosmetics is that company in our fund I,” Sinha said. “We invested early in them and we just sold some equity in the company to return most of our first fund, and we are still sitting on a lot of unrealised gains.”

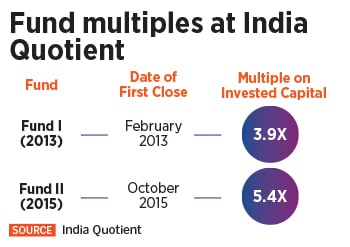

On returns, Sinha says the metric of ‘internal rate of return’ is an inferior one compared with the number of times a VC firm is able to multiply the investors’ money. “We are in the business of multiplying wealth,” he says. On that front, money from the first fund has probably multiplied five times, and fund three, which is yet to even be fully deployed, is marked up by 1.8-1.9 times based on subsequent rounds of investments that have brought in other investors.

On returns, Sinha says the metric of ‘internal rate of return’ is an inferior one compared with the number of times a VC firm is able to multiply the investors’ money. “We are in the business of multiplying wealth,” he says. On that front, money from the first fund has probably multiplied five times, and fund three, which is yet to even be fully deployed, is marked up by 1.8-1.9 times based on subsequent rounds of investments that have brought in other investors.