Inside Amazon's game plan for India

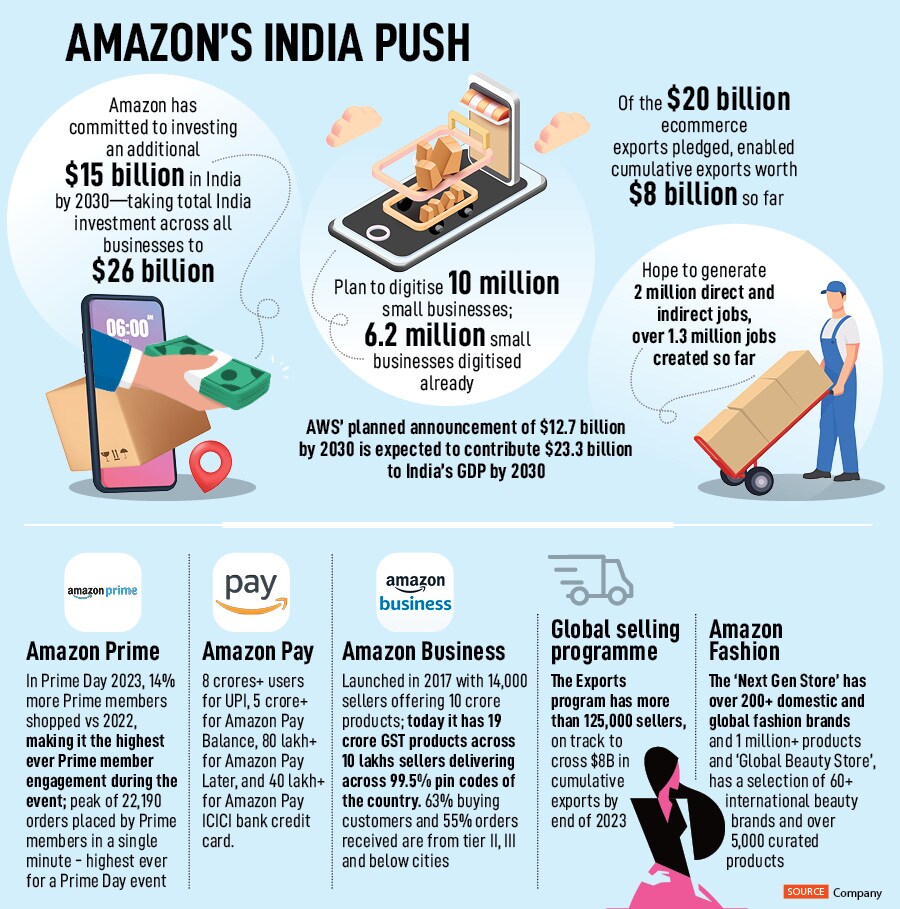

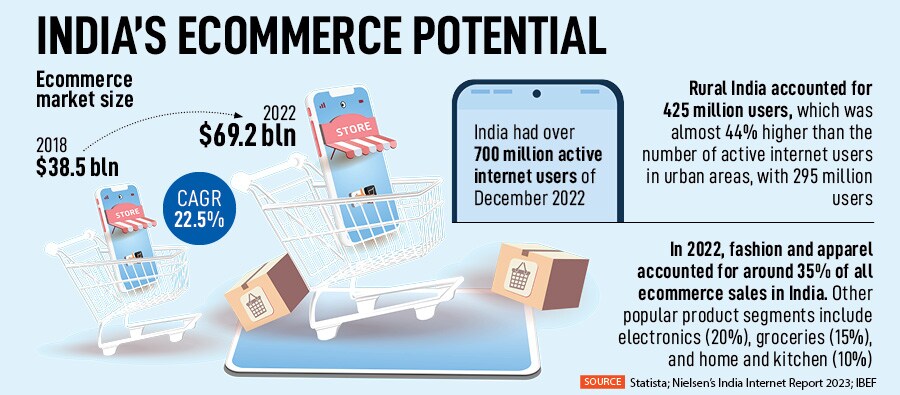

The ecommerce company has secured 100 million-plus customers in India, across verticals ranging from payments to exports. Despite regulatory hurdles, it is bullish on the Indian market and is making big investments for further expansion

Manish Tiwary, country manager, India Consumer Business, Amazon India; Image: Selvaprakash Lakshmanan for Forbes India

Manish Tiwary, country manager, India Consumer Business, Amazon India; Image: Selvaprakash Lakshmanan for Forbes India

Dhaval Patel plans the festive collection for his brand Navrang Handicrafts a year in advance. Patel started his retail store in Rajkot in 1990, and for years his sale would range between three to four products per day. Around the pandemic, for months there was no sale, and the small-scale entrepreneur had almost made up his mind to shut shop.

A few months later, someone suggested he list his products on Amazon through its Local Shops programme. Almost immediately, his sales went up by 50 percent. “We receive orders from every part of India, sometimes even cities that we’ve never heard of,” he says. To keep up with this demand, he’s had to expand.

Like Patel, there are over 12 lakh sellers in India who are now using Amazon as a platform to sell their products, not just in India but even globally. “For sellers—large and small—Amazon helps them reach a massive customer base,” explains Manish Tiwary, country manager, India Consumer Business, Amazon India.

The upcoming festive season in October and November is a particularly busy time. The ecommerce giant claims that last Diwali, it saw close to 30,000 sellers cross Rs1 lakh in terms of sales and almost 700 to 800 new product launches.

According to a recent study by Nielsen Media commissioned by Amazon India, 81 percent of consumers intend to shop online during this festive season and one in two consumers are willing to increase their spending this festive period compared to last year.