How India is taking UPI global

As UPI takes its first steps in going international Forbes India takes a look at what that entails

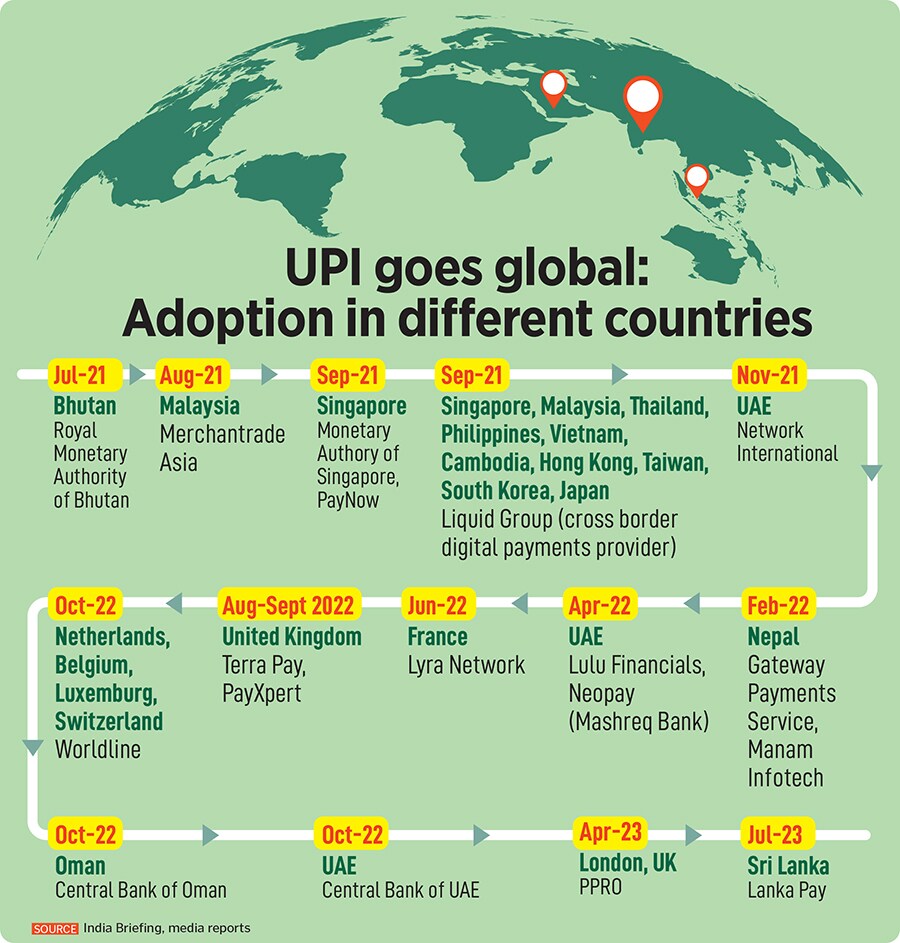

The move to accept payments in Singapore and other countries like Bhutan and Nepal is significant not only due to their economic links with India but also on account of the fact that UPI is being increasingly seen as a peer-to-global payment network.

Image: Shutterstock

The move to accept payments in Singapore and other countries like Bhutan and Nepal is significant not only due to their economic links with India but also on account of the fact that UPI is being increasingly seen as a peer-to-global payment network.

Image: Shutterstock

An Indian tourist in Singapore can now seamlessly pay via UPI for a coffee purchased or even a television. The National Payments Corporation of India (NPCI) International has tied up with Singapore’s PayNow and transferring money on the PayNow Virtual Payment Address (VPA) will be similar to domestic transfer on UPI. All a traveller would have to do is scan the QR code, enter his or her PIN and have the money debited via their app from their bank account.

The move to accept payments in Singapore and other countries like Bhutan and Nepal is significant not only due to their economic links with India but also on account of the fact that UPI is being increasingly seen as a peer-to-global payment network. (It still has a long way to go before it gets there though). Global payment networks are divided into three categories. There is Visa and Mastercard, accepted worldwide but with a dominant presence in north America and Europe and the China-based closed loop networks Alipay and WeChat Pay. And UPI.

The way an international UPI transaction works is like this. There would be an acquiring bank in Singapore. The payment would be routed via the domestic payment pipe (in this case PayNow). The system would then be designed to talk to the Indian system UPI and it would then get routed to the Indian bank via the UPI network and then to the customer’s account, explains Rao of HDFC Bank. The settlement of the transaction would happen in the reverse order.

The way an international UPI transaction works is like this. There would be an acquiring bank in Singapore. The payment would be routed via the domestic payment pipe (in this case PayNow). The system would then be designed to talk to the Indian system UPI and it would then get routed to the Indian bank via the UPI network and then to the customer’s account, explains Rao of HDFC Bank. The settlement of the transaction would happen in the reverse order.  Shukla points to the fact that once a critical mass is reached these transactions could see a hockey-stick like growth curve. Still, the refusal to share numbers points to a tacit acknowledgment of the fact that there is still some way to go in UPI usage outside of India.

Shukla points to the fact that once a critical mass is reached these transactions could see a hockey-stick like growth curve. Still, the refusal to share numbers points to a tacit acknowledgment of the fact that there is still some way to go in UPI usage outside of India.