India M&A deal activity slides but 2024 outlook better: Experts

The funding winter, still high interest rates and sustained geo-political tensions due to wars impacted mergers and raising of fresh capital across the globe. In India, the 2023 data showed that companies are moving towards smaller deals. Healthcare, BFSI and green energy are likely to emerge as winners in 2024

But both experts agree that the investment climate and deals activity for India in M&A is likely to improve in 2024, particularly after the general elections early next year.

Image: Shutterstock

But both experts agree that the investment climate and deals activity for India in M&A is likely to improve in 2024, particularly after the general elections early next year.

Image: Shutterstock

The year 2023 might end on a sombre note for mergers & acquisitions (M&A) activity for India, with deal value being lower than levels achieved in 2022. But experts are confident that there will be a bounce back in 2024.

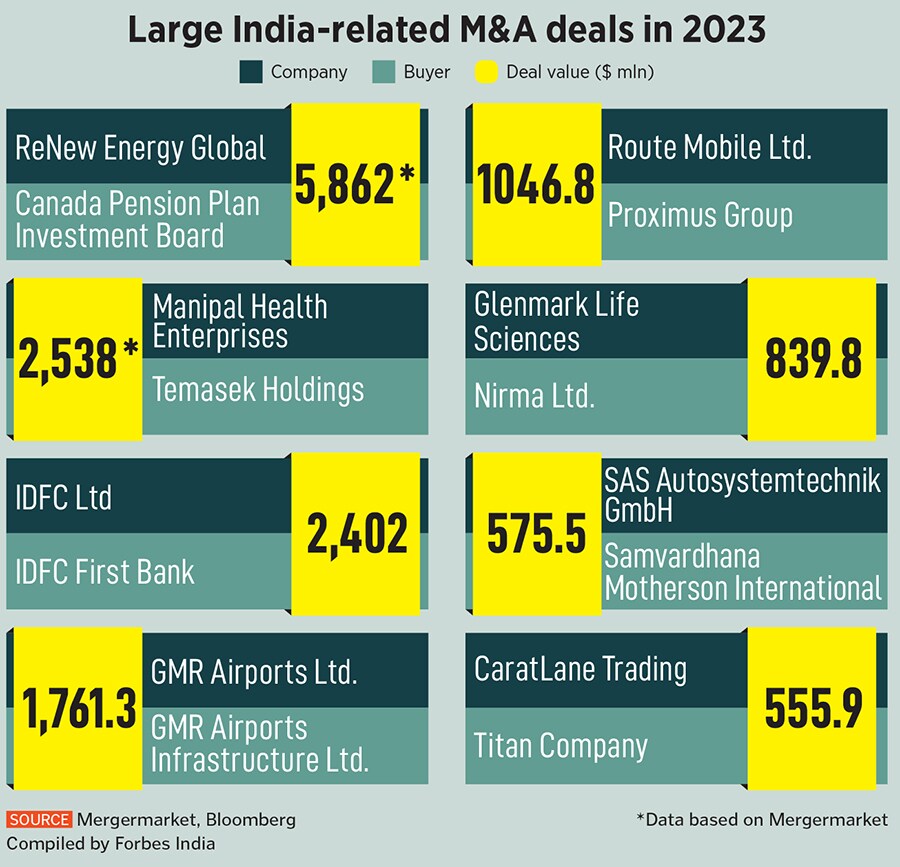

Bloomberg data shows that deal value for India fell 63 percent to $70.9 billion in comparison to $192 billion struck in 2022. A more worrisome trend is being witnessed in global M&A, with annual value down to $2.7 trillion—possibly the worst performance since 2013—based on data that Bloomberg has reported.

Geo-political tensions amid three wars, still high interest rates across various economies and the sustained funding winter have all weakened the investment climate for startups and companies seeking to raise fresh capital.

“The year did see a slowdown in terms of pure numbers, but this cannot be looked at in isolation. On a year-on-year comparative, if one removes the mega HDFC Bank-HDFC merger deal and the Ambuja Cements acquisition, the numbers look less skewed,” says Rajat Mukherjee, partner at Khaitan & Co.

“There is a funding winter but things have not fallen off the cliff. Valuations are getting more realistic from the euphoria of the tech-based push that we saw post the pandemic,” Mukherjee told Forbes India.

Private investors are taking a deeper dive into the deals ecosystem—in terms of corporate governance, meeting regulatory needs and investigation and due diligence relating to target businesses and founders. “Deals are taking longer to complete and valuations have corrected, compared to the last three years,” Mukherjee notes.

Private investors are taking a deeper dive into the deals ecosystem—in terms of corporate governance, meeting regulatory needs and investigation and due diligence relating to target businesses and founders. “Deals are taking longer to complete and valuations have corrected, compared to the last three years,” Mukherjee notes.