How Wipro's Thierry Delaporte plans to put the company back in leadership position

Thierry Delaporte has hired a new chief growth officer and is installing a cadre of 50 top account executives just twice removed from him to go after large deals

Thierry Delaporte

Thierry Delaporte

Image: Courtesy Wipro

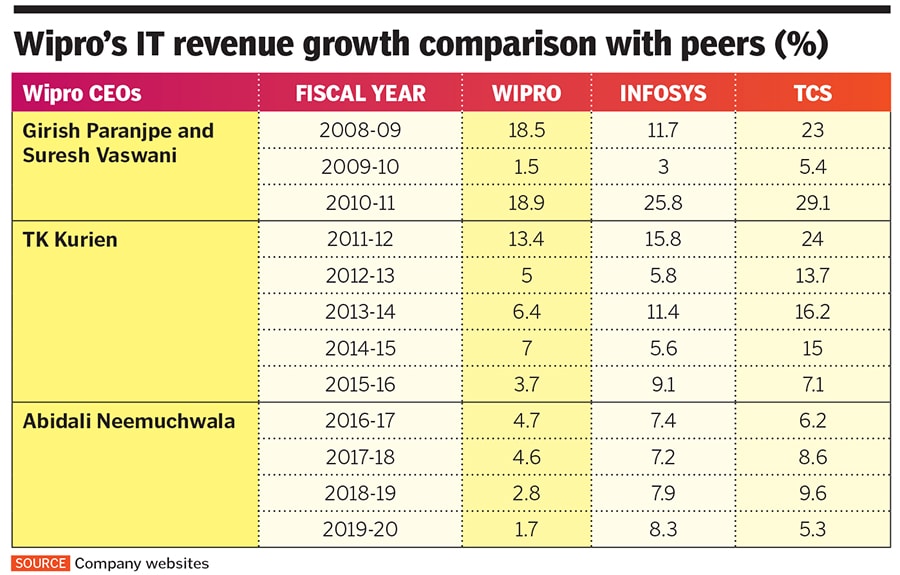

When Azim Premji unceremoniously replaced Wipro’s two co-CEOs, Girish Paranjpe and Suresh Vaswani, with TK Kurien, who was seen as a go-getter, at the beginning of this decade, it was a bit of a shocker in the Indian IT industry. It also signalled Premji’s determination to get Bengaluru-based Wipro back to industry leading growth.

Wipro saw mixed results under Kurien’s watch, and his successor Abidali Neemuchwala—an import from Wipro’s larger rival TCS—in turn, stepped down earlier this year, four years into his tenure as CEO, citing family reasons. Billionaire philanthropist Premji himself handed over the chairmanship of Wipro’s board to his elder son Rishad, last July. The only constant during this period has been the gradual, grinding reduction in Wipro’s growth rate.

However, there’s change in the air, and investors have taken notice. In fact, they’ve driven the stock up by close to 70 percent over the last six months, since Wipro named Thierry Delaporte, a former Capgemini executive, as CEO and MD. Delaporte was previously COO of Capgemini group and a member of its executive board.

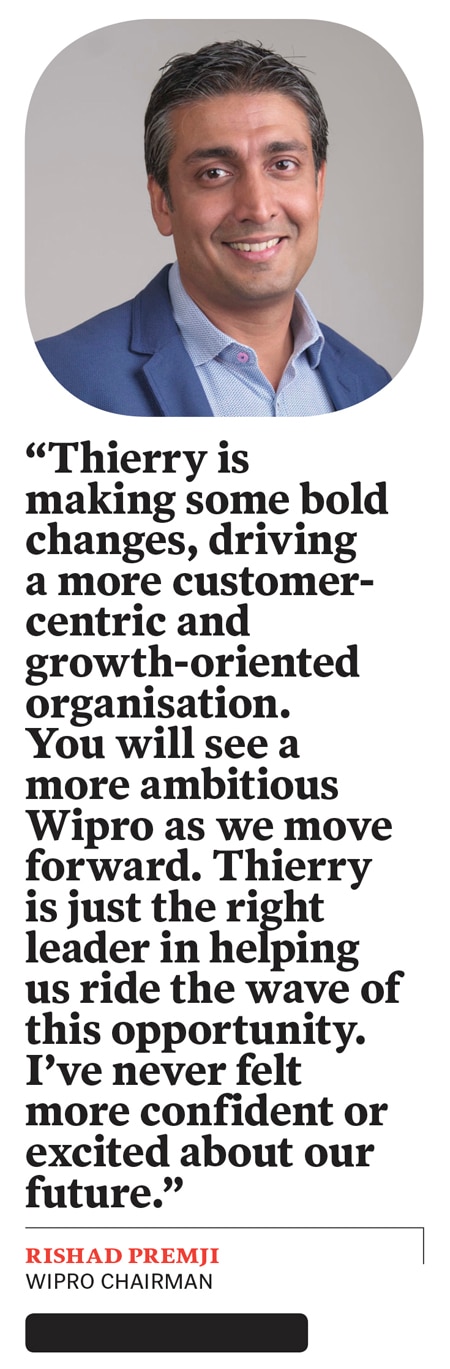

“The board and I are very excited about Thierry and his leadership,” chairman Rishad Premji tells Forbes India. “He is making some bold changes, driving a more customer-centric and a growth-oriented organisation. You will see a more ambitious Wipro as we move forward.”

The new and restructured Wipro will be ready for business as early as January, Delaporte told analysts last month in a conference. Not counting Brian Humphries at Cognizant—which is US-based, while it gets counted among the ‘India heritage’ IT companies—Delaporte is the first foreigner to lead a top Indian IT company over the last three decades. In those 30 years, Tata Consultancy Services, Infosys, Wipro, Cognizant and HCL Technologies rose to become multi-billion dollar companies.

One of the reasons Delaporte is where he is today is that the order of the companies listed above changed in the last decade. First Cognizant, and then, more recently, HCL Technologies, overtook Wipro, growing faster and becoming larger companies by revenue. Both have continued to grow much faster than Wipro, relegating it to fifth place. The successive CEOs at Wipro haven’t been able to change that.

Delaporte, 53, a Frenchman, leads Wipro from Paris, where he is based. The Covid-19 pandemic has prevented him from visiting Wipro’s headquarters in Bengaluru, but by early December, he had conducted over 130 interviews with Wipro’s most important customers, covering over 70 percent of the IT services company’s revenues.

“I see my mandate clearly as putting this outstanding brand and organisation back to where it belongs, which is leadership position,” he tells Forbes India. “I will not be surprised if you soon hear that we have won some large deals.”

On December 22, Wipro said it had won a five-year digital and IT contract from food industry wholesaler Metro AG, valued at an estimated $700 million over the period of the contract. Wipro's cloud and data centre services, workplace and network services, along with application development and operations, will provide Metro with “an integrated, flexible and robust digital infrastructure”, the Indian IT services company said. The contract includes an option to extend up to an additional four years, taking the total value to $1 billion.

“Partnering with Wipro allows us to simplify and streamline our IT landscape, and critically gives us access to innovation and the best digital practices,” Timo Salzsieder, chief information officer at Metro, said in a press release. As part of the deal, 1,300 IT staff from two IT units of Metro will transfer to Wipro. The move will help those Metro staff access leading edge innovation at Wipro and help their careers, Salzsieder said.

Consistently winning large contracts is something that Delaporte wants the 185,000-strong team at Wipro to internalise as the mantra to live by.

While local media reports in India have highlighted his foreigner status, Delaporte himself doesn’t subscribe to the notion that it will have any bearing on Wipro’s future. “I'm not French and Wipro is not Indian. We both are global,” he says. Wipro is an India-born company, but a global player present in 60 countries. And at the helm of this is a board of people, not only from India, but from America, and France, he points out.

“The chairman has taken a decision, not based on nationality, but really trying to look for who would be best positioned to continue to drive Wipro going forward,” he says. “I might have a French passport. Right. I have spent most of my career abroad, my wife is American and (we have) four kids born in different countries—they are truly global citizens.” He continues: “I have worked with global organisations for the last 25 years. I regularly hear people tell me, ‘Oh, you're the first French and non-Indian’— it's factually correct, but that's not how I feel. I've never felt, connecting with anyone from Wipro, that I was an outsider coming from a different world.”

However, Delaporte does plan on making Wipro more selectively global, by bringing the entire company to focus on those markets that are most crucial to its future—the US, certainly, but also Europe. He will also ruthlessly push Wipro to jettison those areas and lines of service where it isn’t among the leading providers.

In the US, the company’s—and the Indian IT sector’s—biggest market, Wipro was going after some seven sectors and as many as 27 verticals across those sectors. Given its size of operations in the US, this may have been okay, but the company had tried to replicate the model in other markets too where it had smaller footprints, spreading itself too thin, Delaporte says. “We have to align that.”

In parallel with the sharpened focus on specific markets and verticals, Delaporte has also set a plan in motion to completely overhaul Wipro's organisational structure, turning it into a business with only four profit-and-loss lines from the 25 he inherited. He’s also reduced the top leadership from 17 to 10 and among them, his nearest deputies are even fewer.

Facing the market, the tip of the spear will be a lone individual, with the newly created designation of chief growth officer, and a crack team of 50 global account executives. These executives’ sole purpose will be to go after large contracts from Wipro’s biggest customers, and taking those relationships deeper.

Today such executives are five or six times removed from the CEO, basically cutting off the very people most critical to the growth of the company from the top leadership, he says. Delaporte's remedying this by hacking away layers to ensure that a global account executive is no more than twice removed from the CEO—or is a level three executive. Perhaps a step further down with smaller accounts, but “never beyond," he says.

Then there were too few of these executives as well. Among the top 200 people at Wipro, only three percent were global account executives, and Delaporte aims to increase that to 25 percent. “So it just sends a clear message that there's nothing more important than being an account executive in this organisation,” he says.

“And therefore the rest of the organisation is here to really serve him, to really make him stronger, providing him with all the weapons you need to deliver for the client every day.”

In this way, the new CEO also wants to institutionalise the culture of winning large contracts.

“Why is it that we have had fewer large deals in the past than some of our competitors have had? I know the answer. We do not have today, a large deal engine across the organisation,” he says. “We do win some large deals, but it's much more relying on someone in an account, finding an opportunity and being a hero,” he told analysts in November. “So we want to turn it into having an engine that goes after large deals and the chief growth officer will build this engine, working with the strategic market units.”

Wipro has great stories of customers where it has truly transformed some aspect of the customers’ business operations or other, he says. “We want to multiply it, institutionalise it. We want to make sure that we are moving from a culture of heroes to a very strategic, systematic focus on being THE partner in the transformation of our clients.”

Customers today want technology solutions to business problems, cutting across multiple practices, Rajan Kohli, a president at Wipro told analysts in November. Customers expect IT providers to be able to employ the latest software development methods such as DevOps—a method of building code for a service with the developers and the operations staff collaborating from the beginning. The old ways of selling IT outsourcing, offering to develop applications and maintain them are over, said Kohli, who is head of Wipro’s digital and consulting businesses.

Delaporte hinted he may have found his chief growth officer and candidates to fill some important positions he has in mind. It will take some months, however, to get them on board, he says. He has also seen a pick-up in senior executives reaching out to friends at Wipro, which he takes as a sign that “people believe that this may be the right time to join Wipro”, he tells Forbes India.

“Very clearly, the agenda is to drive both internal talent and get the best of breed externally, both at the strategic market unit level and at market facing levels,” Saurabh Govil, president and chief human resources officer at Wipro, told analysts at the November conference.

So with global account executives, technical experts, domain experts consulting experts and a host of other positions, Wipro is on the lookout. And “driving a very strong performance orientation” is another top priority. “You have to drive outcomes, perform and get rewarded. I think that will be a very clear shift we will see as we move forward, striking the balance between our deep values and bringing in the right performance,” Govil said.

Delaporte is also looking at acquisitions as a means of getting new talent in. Acquisitions will be much more central to Wipro’s way forward than before, he says. He has already bought four small companies—which is as many as Wipro bought in the three years before he came on board—and expects to accelerate the pace of acquisitions. Technology is changing rapidly and the acquisitions also help plug the gaps that Wipro might have in its portfolio. “Our acquisition strategy is really ambitious,” he says.

The much simplified structure of Wipro will release a lot of efficiency, saving money for the company, which can in turn be invested in acquisitions or in helping the global account executives or in critical talent development programmes, Jatin Dalal, president and chief financial officer at Wipro, told analysts. This is important because Delaporte doesn’t want to pay for his plan by diluting Wipro’s margins. Because once margins are reduced, it will be hard to push them back up, he says.

The push back to the top will happen in three stages, Delaporte says. “Accelerate the growth, step one. Get to the level of growth of our competitors, step two. And beat the market growth average, step three. That’s our journey.”

“Thierry has taken over at a very challenging time,” Peter Bendor-Samuel, founder of Everest Group, a consultancy in the US that advises corporations on their business tech strategies, tells Forbes India. While the pandemic prevented him from meeting his team in person, he has moved quickly to simplify and focus on Wipro. The new organisation is a good first step in reducing the complex governance of Wipro and focusing on growth. This should increase accountability and improve execution, Bendor-Samuel says.

Delaporte has also emphasised the need for leaders to be in the regions they are leading, which should help develop senior relationships with clients which are vital in the new, more complex, digital market.

“The absolute strength of Wipro is its passion for technology and innovation,” Delaporte says. Within the IT industry, there are some companies that are known to be very sales oriented, others that are very delivery focussed and some which are consulting led. “The true DNA of Wipro is technology. I knew about this before joining Wipro, but I was not aware of the volume of innovation.”

The way the world is transforming at the moment, the way industries and companies have accelerated their tech investments, forced by the pandemic… Wipro has a massive role to play in helping them get onto the cloud, the CEO says. Wipro has traditionally had a strong position on the tech infrastructure side, with strong relationships developed for years with the largest technology companies.

The company has also invested in building up its digital services portfolio. With its roots in engineering, and strengths in business operations technology, Wipro is well-positioned to tap the convergence of the two, he says.

The CEO’s biggest challenge will be to change the mindset of the rank and file of Wipro to focus on growth and to do it quickly, Bendor-Samuel says. The year 2021 is looking to be a year of strong recovery… it will be important that Wipro executes its strategy well to regain its growth position. However, it may take Wipro some time to get used to the new organisation and governance. Market recoveries are important times during which market shares can shift, and once they are over, such shifts become harder. This means, Wipro will have precious little time to embrace its internal changes, and focus on winning large contracts and delivering them well.

“I believe Thierry is just the right leader in helping us ride the wave of this opportunity,” says Rishad Premji. “I’ve never felt more confident or excited about our future.”

This will be another critical factor, Bendor-Samuel says. While Delaporte has both the background and personal attributes to be an effective leader of Wipro, it will be vital that he receives strong support from the board and the Premji family if the changes the new CEO is pushing for are to stick. “The organisation is likely to resist some of the harder changes and they will need to see that the Premjis are fully behind Thierry,” he says.

And the Premjis have the power to back their new CEO to the hilt, because they have de facto control over the company, which is still both highly profitable and majority owned by the family and their trust. Bendor-Samuel adds: “The further it gets behind the industry leaders, the harder it becomes for it to recover its industry leadership… it may end up being relegated to lesser status if it is unable to reignite growth.”

Delaporte clearly recognises the mindset challenge, which he picked out as priority alongside investing in existing talent and attracting the best from outside. “Driving change in the mindset of our employees, driving actively our talent agenda by investing in our people to really make them as strong as possible, to really equip them holds the key to success,” he says.

He envisions Wipro to be working for the most demanding clients and on the most complex projects. The most demanding clients will also be the ones changing their own industries, and the most complex projects will also likely be the most strategic. This will also attract the best talent, he says. “We want to be seen as the place to be, from a talent standpoint,” Delaporte says. Getting back to industry leading growth will do that.