How Mahima Datla's Biological E is taking on vaccine behemoths in India

Mahima Datla is among a handful of women leaders in the Indian pharmaceutical sector. Going up against some of the largest vaccine makers in India, her company, Biological E, offered a worthy alternative during the Covid-19 pandemic, and cotinues to export vaccines to over 100 countries

Mahima Datla, Managing director, Biological E

Image: Vikas Chandra Pureti for Forbes India

Mahima Datla, Managing director, Biological E

Image: Vikas Chandra Pureti for Forbes India

Mahima Datla likes to think of herself as a “glass half full kind of person”.

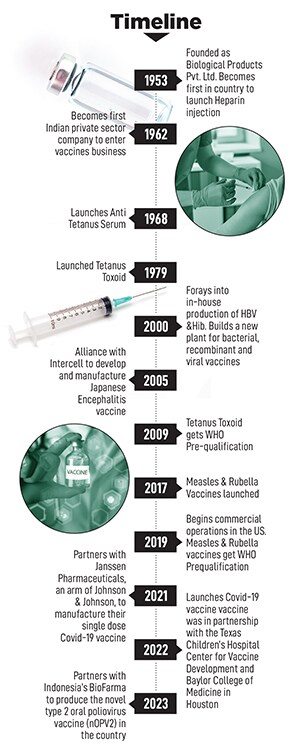

Calm, composed and looking for the positives in a situation, the last few years have been nothing, but life-altering for the 46 year- old. It all began sometime in 2020 for the soft-spoken and reticent head of Biological E, a 70-year-old pharmaceutical behemoth, when her company was suddenly propped up into the forefront in India’s defence against Covid-19. Going up against some of the largest vaccine makers in the country, Biological E offered a worthy alternative and helped build India’s Covid-19 war chest.

Corbevax, a vaccine made by Biological E, is the third-most administered Covid-19 vaccine in the country with 7.3 crore doses—Serum Institute’s Covishield administered over 174 crore doses. Nevertheless, Corebevax’s success and the government’s decision to purchase 30 crore vaccines from Biological E meant that the Hyderabad-based pharmaceutical company had announced its arrival. That vaccine was in partnership with the Texas Children’s Hospital Center for Vaccine Development and Baylor College of Medicine in Houston.

Even as that happened, a long-drawn family saga had come to its end game with the Supreme Court allowing Datla to retain control of the company. Datla’s mother had contested her father’s decision to hand over 81 percent share in the company to her daughter, in a case that had lingered for a decade.

“It was a huge weight off my shoulders and it’s not a sense of joy by any means but a sense of relief,” Datla says over a Zoom call. “Because there was this constant battle of trying to manage everything on the external front, wanting to keep certainty and not having the uncertainty of legal or litigation creep into the future of the company. So that was always a sword hanging over my head, and frankly, it was a huge relief to have it finally put to bed and in the best possible way.”

The company started by manufacturing Heparin injections, and by 1962 forayed into DPT (diphtheria, pertussis and tetanus) vaccines, thus becoming India’s first private sector vaccine maker. Four years later, Cyrus Poonawalla set up the Serum Institute of India (SII) in Pune, currently the world’s largest vaccine maker.

The company started by manufacturing Heparin injections, and by 1962 forayed into DPT (diphtheria, pertussis and tetanus) vaccines, thus becoming India’s first private sector vaccine maker. Four years later, Cyrus Poonawalla set up the Serum Institute of India (SII) in Pune, currently the world’s largest vaccine maker.