How HSBC India is gunning for growth and a bigger share

The bank is aggressively seeking to expand across various banking businesses in India, including the much-awaited re-entry into private banking, in its quest to acquire more customers in what is one of its biggest priority markets

Hitendra Dave, CEO, HSBC India. Image: Mexy Xavier

Hitendra Dave, CEO, HSBC India. Image: Mexy Xavier

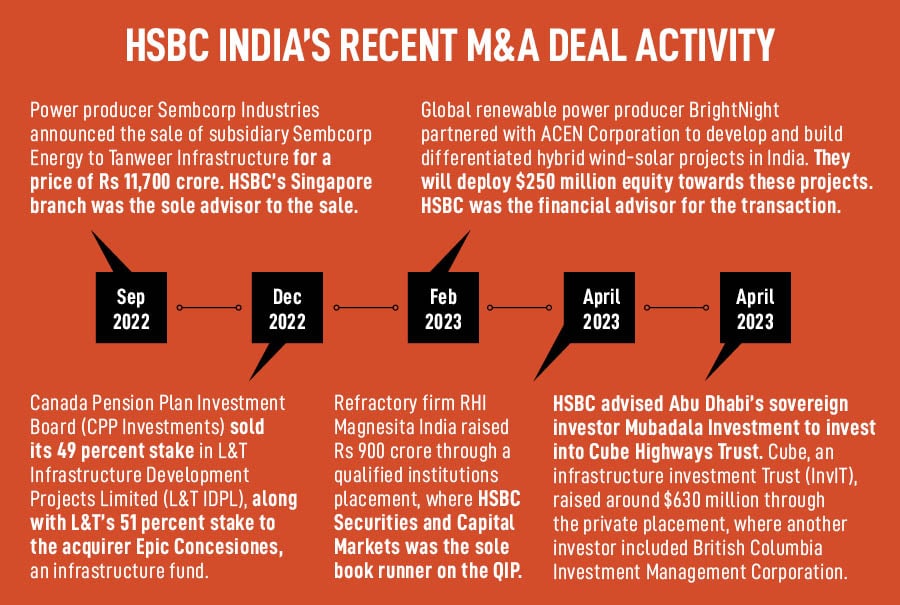

The year 2023 could be a pivotal one for HSBC in India with a strategy to muscle up three of its businesses here. This includes a re-entry into private banking to service ultra-high net worth individuals and family offices in India after exiting it eight years ago; energising the mutual fund business having completed the acquisition of L&T Mutual Fund in late 2022, and launching a digital personal loans channel, assisted by application programming interfaces (APIs). The bank is also exploring a strategy for a digital equity brokerage after it had shut its retail broking business in India in the previous decade.

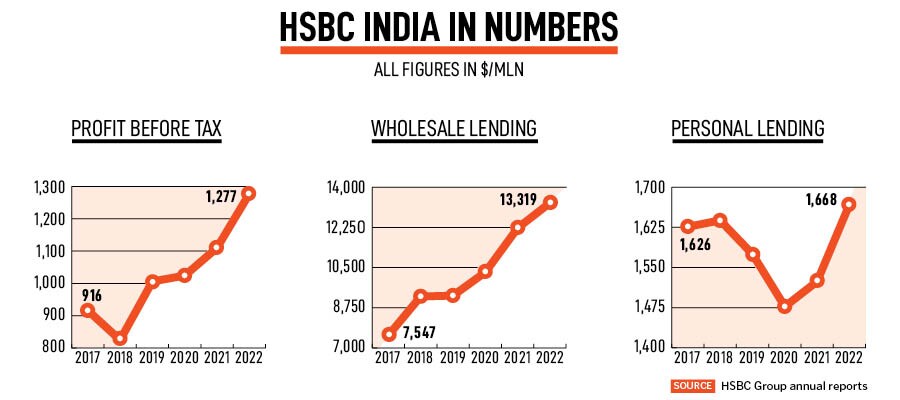

All of this makes sense for HSBC, which has long identified India as one of its priority markets. Nearly 80 percent of HSBC’s 2022 profit comes from Asia, where Hong Kong is its biggest market by profit and India operations, with a profit of $1.27 billion, is the fourth largest contributor (7.2 percent) to the 2022 profit for HSBC globally. The London-headquartered bank’s presence in India dates back 170 years and India is also HSBC’s largest employment market with 39,000 people (about 17 percent of the total workforce for HSBC), as of December-end 2022. In terms of revenue, corporate banking (64 percent) and treasury operations (22 percent) are the main contributors to its India revenues, according to India filings for the financial year ended March 2022.

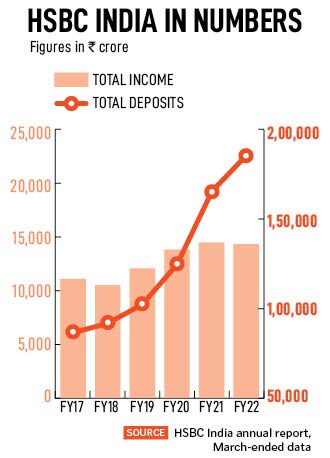

Thus, for HSBC India’s CEO Hitendra Dave, the aggression is part of the strategy to not just be a full-service foreign bank in India but also bolster its retail banking activity in India, which has lagged the bank’s traditionally strong wholesale lending activity. Retail banking contributed around 13 percent to HSBC India’s total revenues of Rs 14,301 crore (see table) and personal loans formed just 10 percent of total advances of Rs 82,339 crore in FY22, according to India filings for the financial year ended March 2022.

HSBC, which operates in India through a branch model (and not a wholly-owned subsidiary), reported a 15 percent rise in pre-tax profit (see table) for the year 2022. Earnings data for full FY23 is likely to be disclosed mid-year.

Also read: Uday Kotak urges banks to build "fortresses of resilience" in uncertain global environment

It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow”.

It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow”.