How Air India's million little steps are taking it on a journey to find lost glory

Since it launched a turnaround program in September last year, Air India has gone on to place a record order for 470 aircraft while also pumping in money into technology, hiring, training, and infrastructure

Campbell Wilson, CEO and MD, Air India Image: Madhu Kapparath

Campbell Wilson, CEO and MD, Air India Image: Madhu Kapparath

It goes without saying. Campbell Wilson has one of the most difficult jobs in global aviation today. But that hasn’t bogged down the calm, self-assured executive, who made the shift to India last year from Singapore, despite all the scrutiny from millions of Indians. Wilson is overseeing the much-anticipated transformation of Air India, the airline once owned by the Indian government, that had recently returned to the Tata Group, after seven decades. Wilson was appointed by the Tata Group as the managing director and CEO of Air India in May last year.

Long before the Indian government took absolute control of the Air India, the airline was a force to reckon with globally, one whose on-board services and vibrant interiors along with its punctual service inspired numerous global airlines including Singapore Airlines and Cathay Pacific. But along the way, marked by decades of underinvestment and an ill-timed merger, the airline became something of a white elephant.

“It's been a fun experience,” Wilson says about the year he spent helming Air India. “I have been very, very busy, but it’s been very enjoyable.”

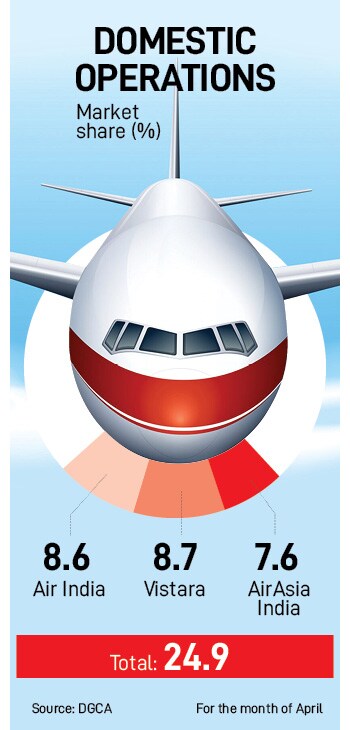

Wilson is tasked with something unprecedented in Indian aviation history. He is overseeing the merger of four different airlines into two, with a plan to rapidly grow their market share, both domestically and internationally. Air India and Vistara, the full-service carrier owned by the Tata Group and Singapore Airlines, are being brought under one umbrella as a full-service carrier while AirAsia India and Air India Express are being merged to build a low-cost arm under the Air India Express brand.

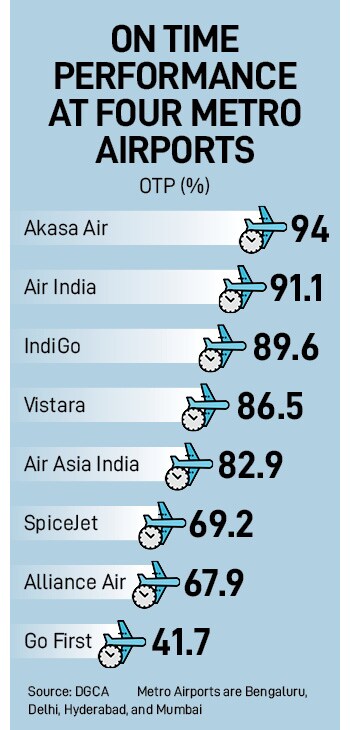

Even as he oversees that, Wilson is also trying to improve Air India’s ill-reputation by revamping the in-flight experience and punctuality, which has for decades suffered legacy and cultural issues. “The Air India turnaround continues to be one of the most challenging turnarounds in the history of global aviation,” Satyendra Pandey, Managing Partner, aviation services firm, AT-TV says. “At this point, it is a turnaround, transformation, and a merger of multiple entities. This while battling formidable competitors in India and overseas and chasing ever-elusive profitability.”

The first of the new aircraft will enter service in late-2023, with the bulk to arrive from mid-2025 onwards. The company is figuring out a viable plan for financing the aircraft and is expected to put out a request for proposal (RFP) for the sale and leaseback of the narrow-bodied aircraft. Of the total order, 400 aircraft are single-aisle aircraft which means that the aircraft would likely be used for domestic or short-haul international operations. Some will also be used for operations at the new low-cost arm comprising Air India Express and AirAsia India. The others are dual-aisle planes that will be used for long-haul operations.

The first of the new aircraft will enter service in late-2023, with the bulk to arrive from mid-2025 onwards. The company is figuring out a viable plan for financing the aircraft and is expected to put out a request for proposal (RFP) for the sale and leaseback of the narrow-bodied aircraft. Of the total order, 400 aircraft are single-aisle aircraft which means that the aircraft would likely be used for domestic or short-haul international operations. Some will also be used for operations at the new low-cost arm comprising Air India Express and AirAsia India. The others are dual-aisle planes that will be used for long-haul operations.  The merger is also a challenging one especially since the airlines have four sets of operating procedures and operating manuals approved by the regulator. “We are taking the opportunity to harmonize and extract the best practices from those to build an operating manual of the Air India group,” Wilson says. “We're very clear about our future with a full service and low-cost component within the group.”

The merger is also a challenging one especially since the airlines have four sets of operating procedures and operating manuals approved by the regulator. “We are taking the opportunity to harmonize and extract the best practices from those to build an operating manual of the Air India group,” Wilson says. “We're very clear about our future with a full service and low-cost component within the group.”  “Air India has been improving their foreign network especially to North America, and Europe, and logically an Australia expansion may be next in plan,” adds Longani. “They may not be very concerned about increasing frequency on some of the domestic routes. But what their end game is really about is the integration of Air India with Vistara in the full-service space, and on the other hand the streamlining of products in the low cost space with AirAsia India and Air India Express. That will be challenging for the likes of IndiGo, because they will look at mixing and matching the low cost carrier with the international operations which bring a lot of money, and when coupled with loyalty programs and connecting smaller cities to the international route, will make it a formidable player.”

“Air India has been improving their foreign network especially to North America, and Europe, and logically an Australia expansion may be next in plan,” adds Longani. “They may not be very concerned about increasing frequency on some of the domestic routes. But what their end game is really about is the integration of Air India with Vistara in the full-service space, and on the other hand the streamlining of products in the low cost space with AirAsia India and Air India Express. That will be challenging for the likes of IndiGo, because they will look at mixing and matching the low cost carrier with the international operations which bring a lot of money, and when coupled with loyalty programs and connecting smaller cities to the international route, will make it a formidable player.”