How A Velumani, a landless farmer's son, built Thyrocare into a billion-dollar behemoth before a surprise sell-off

The deal with PharmEasy, India's first e-pharmacy unicorn, will give Thyrocare an opening into B2C business and its founder an investing foray into the burgeoning healthtech sector

A Velumani, chairman and managing director of Thyrocare Technologies; Image: Joshua Navalkar

A Velumani, chairman and managing director of Thyrocare Technologies; Image: Joshua Navalkar

It’s been a long and tiring journey for A Velumani. But, at the end of it, the 62-year-old is a satisfied man.

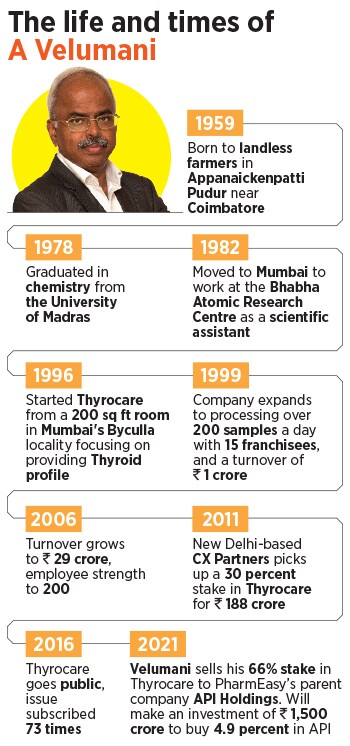

The son of a landless farmer, whose father couldn’t afford to buy him a pair of pants or slippers, Velumani has traversed some rather difficult terrains since starting out from the nondescript village of Appanaickenpatti Pudur near Coimbatore. Along the way, the bespectacled scientist had also redefined the medical diagnostic industry in the country.

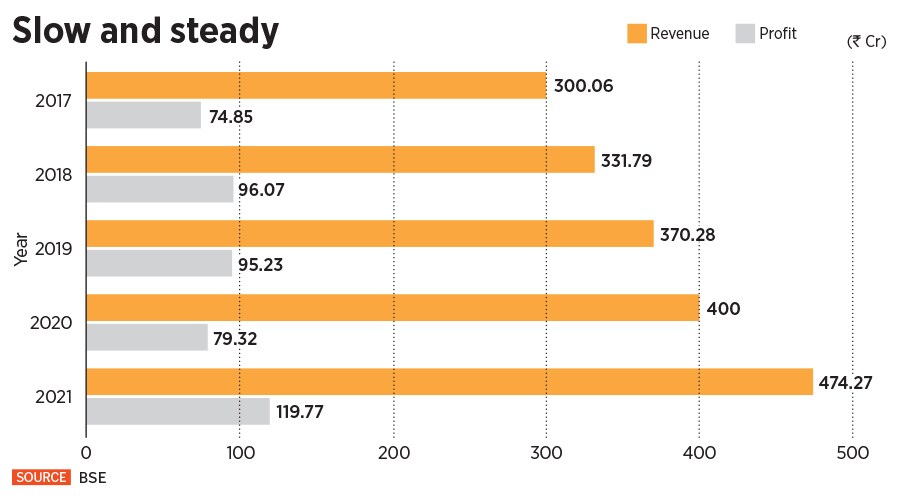

His 26-year-old company Thyrocare Technologies is one of India’s largest healthcare diagnostic chains that has been instrumental in India’s long drawn fight against Covid-19 for over a year now. “Mine is a story of grit, guts and glory,” Velumani, the chairman and managing director of Thyrocare Technologies had told Forbes India in an interview a few months ago. His company is today worth a staggering Rs 7,000 crore and Velumani’s own stake in that venture used to be around Rs 5,000 crore.

Until last week.

On June 25, Velumani surprised the world when he decided to sell his company to a relative newcomer in the health industry and a unicorn, PharmEasy, in one of the first instances of a startup buying a listed company. According to the deal, Velumani sells his 66 percent stake for Rs 4,546 crore to PharmEasy's parent company API Holdings. He will use Rs 1,500 crore of those proceeds to buy 4.9 percent in API, which will propel PharmEasy’s valuation from Rs 13,390 crore ($1.8 billion) to over Rs 29,700 crore (roughly $4 billion).

Around the same time, Velumani used to frequent the Central Library in Coimbatore. “It was my adda (hangout),”

Around the same time, Velumani used to frequent the Central Library in Coimbatore. “It was my adda (hangout),”