Hero and Hero versus Hero: Can Hero-Harley take on Royal Enfield?

When India's biggest commuter bike maker Hero MotoCorp joins hands with the world's biggest premium bike brand Harley Davidson to take on India's hero in the premium bikes segment, one can expect a blockbuster in the making. Can Harley's cheapest bike in India pose a serious threat to Royal Enfield, which has been cruising for decades?

Hero MotoCorp is trying to rev up its premium play and make a dent in the 350 cc-plus market with Harley’s cheapest bike in India—X440

Hero MotoCorp is trying to rev up its premium play and make a dent in the 350 cc-plus market with Harley’s cheapest bike in India—X440

There are two ways to gauge the direction in which the bike market is headed. The first is to take a close look at the latest performance of the big boys. Let’s start with Hero MotoCorp, India’s biggest two-wheeler maker and the hero of the commuter segment, which happens to be the largest in terms of volumes of bikes sold in the country. In June this year, Hero MotoCorp sold 404,474 motorcycles, which is a fall of 12 percent year-over-year (y-o-y) and a 17 percent decline in month-over-month (m-o-m) numbers, according to the latest auto sector monthly report by brokerage firm JM Financial.

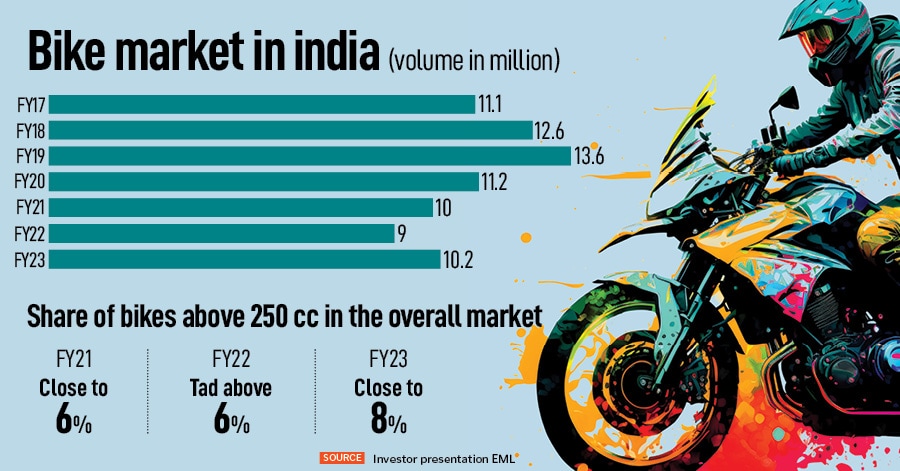

For the third-biggest player, Bajaj, it was a similar story. It sold 293,649 bikes, which translates into a 7 percent and 5 percent dip in y-o-y and m-o-m, respectively. For TVS, the second-biggest by volume in India, it was almost the same story. With 148,208 motorcycles sold in June, it was a growth of 1 percent y-o-y, and a dip of 9 percent m-o-m. There is one easy and a no-brainer takeaway from the report card. Bikes are sliding when it comes to y-o-y sales. But when it comes to overall fiscal data, India’s bike market increased from 9 million in FY22 to 10.2 million in FY23.

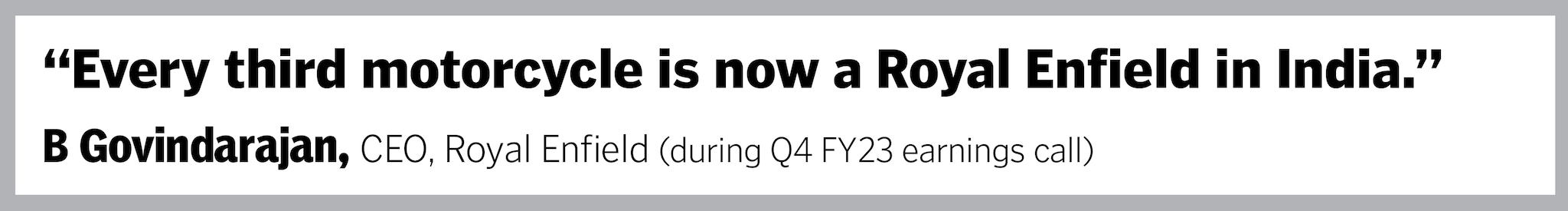

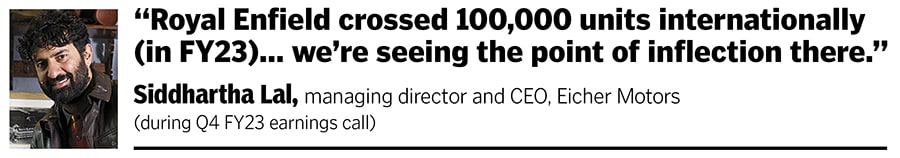

Well, there is another side of the story, and another conclusion to be drawn from the same set of data. Have a look at how Royal Enfield has fared. In June this year, India’s biggest premium bike maker sold 77,109 bikes, which is a 26 percent y-o-y jump. Though there is a slight dip in terms of m-o-m, which was 77,461 in May this year. Overall, the bike maker had a glowing report card in the last quarter of FY23. It posted sales of 214,685 motorcycles, up 17.9 percent from 182,125 motorcycles sold during the same period in FY22. One quick and easy conclusion is: The market and the bikes above 350 cc is growing. In fact, in FY23, the overall premium market of bikes grew at a faster clip than the commuter segment.

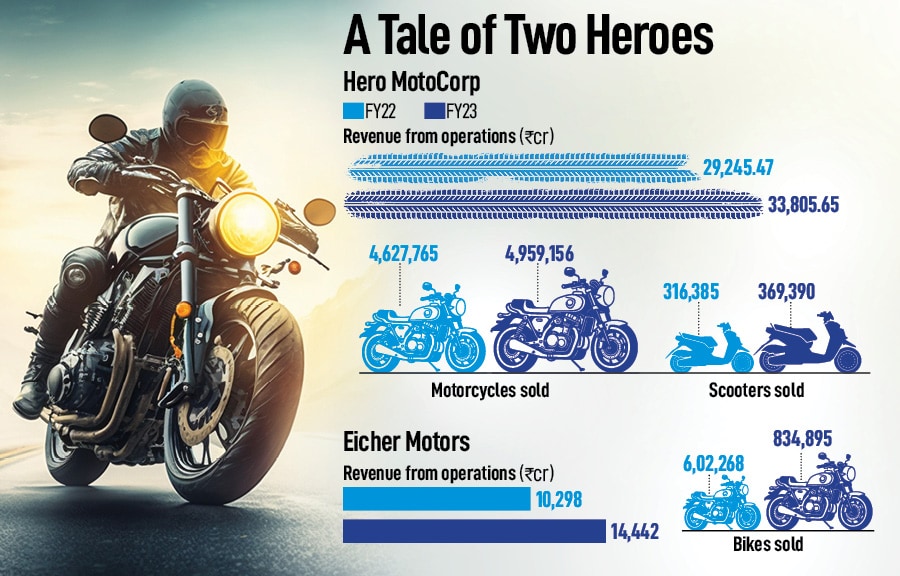

There is another way to slice and dice the bike market. This can be done by contrasting volume and value. Let’s start with Hero MotoCorp. In FY23, it sold 4,959,156 bikes, and posted Rs 33,805.65 crore in revenue from operations. Now contrast it with Royal Enfield, which sold 834,895 bikes and made Rs 14,442 crore in revenue from operations. Clearly, in terms of size, Hero is more than double the revenue and over six times bigger in volumes.

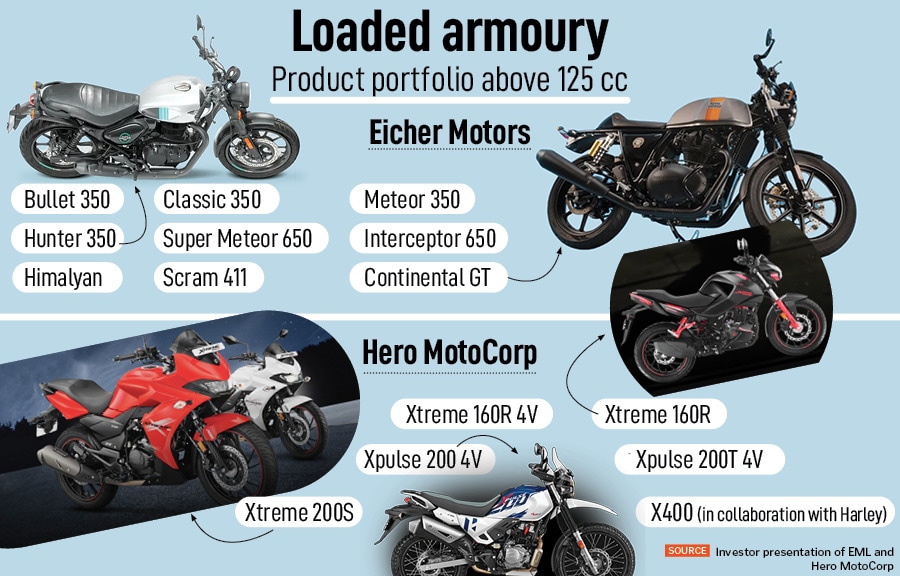

The battle lines are drawn. The game plan is clear. Hero already has volume in the mass segment. Now it wants volume in the premium segment to beef up its margin and PAT play. When asked about the strategy of the company over the next two-three years, Hero MotoCorp CEO Niranjan Gupta outlined the roadmap during the Q4 earnings call in May this year. “The focus on customers is what is going to create the market cap,” the CEO stressed. Customers’ love, Gupta explained, translates to more products being bought at a higher price premium and for a longer period of time. “And that with a viable business model creates a market cap. So in the end, that's going to be the focus,” he said, adding that the company will aggressively roll out more premium launches over the next few quarters. “There will be big launches, which will then ensure that we can build the right premium portfolio and get our market share,” he added.

The battle lines are drawn. The game plan is clear. Hero already has volume in the mass segment. Now it wants volume in the premium segment to beef up its margin and PAT play. When asked about the strategy of the company over the next two-three years, Hero MotoCorp CEO Niranjan Gupta outlined the roadmap during the Q4 earnings call in May this year. “The focus on customers is what is going to create the market cap,” the CEO stressed. Customers’ love, Gupta explained, translates to more products being bought at a higher price premium and for a longer period of time. “And that with a viable business model creates a market cap. So in the end, that's going to be the focus,” he said, adding that the company will aggressively roll out more premium launches over the next few quarters. “There will be big launches, which will then ensure that we can build the right premium portfolio and get our market share,” he added.