Freshly minted unicorn Cars24 steps on the gas

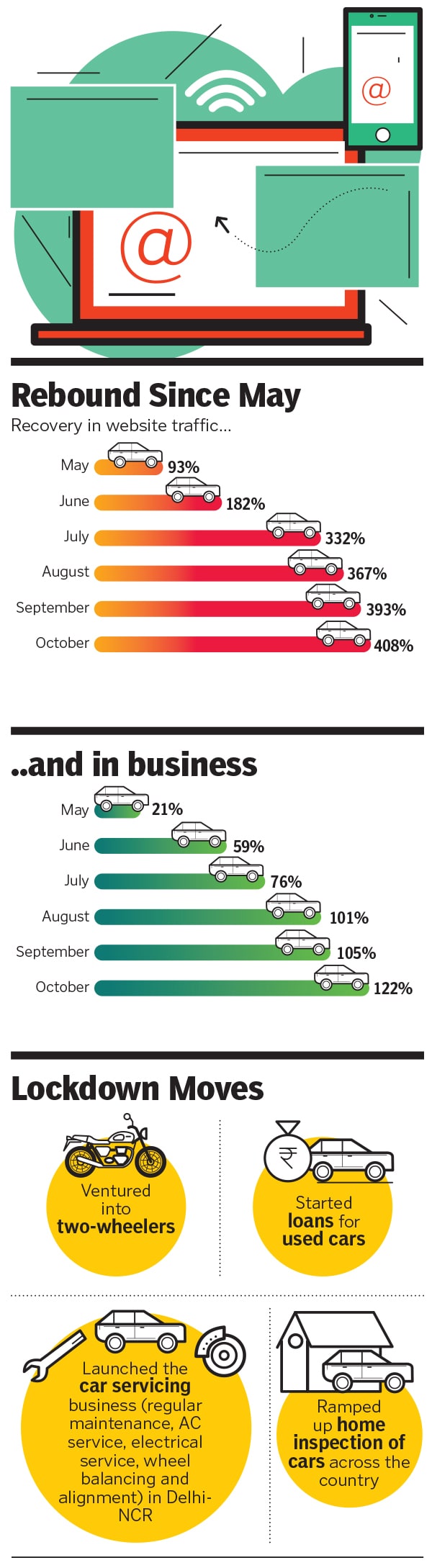

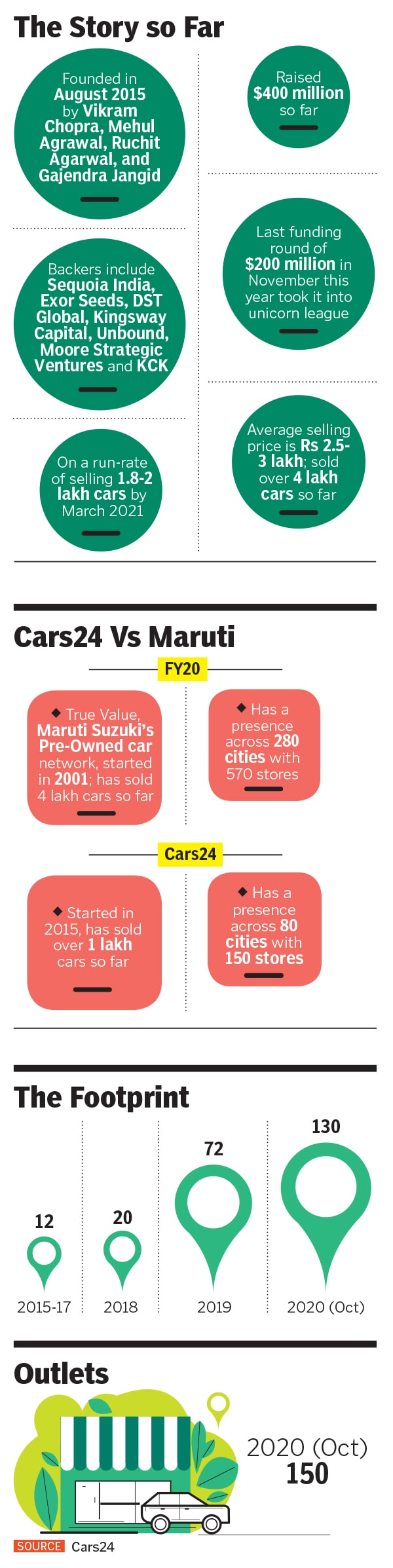

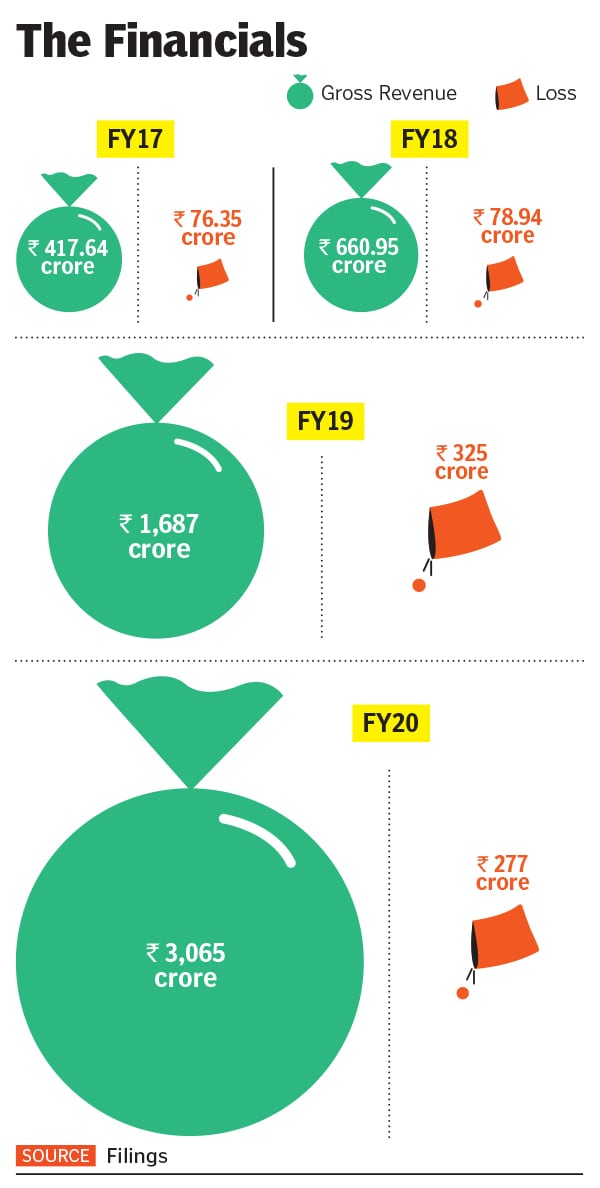

Cars24, India's first unicorn in the auto segment, has grown rapidly during the pandemic. Can it maintain its pace and focus?

Left to right: Cars24 co-founders Gajendra Jangid, Ruchit Agarwal, Vikram Chopra and Mehul Agrawal

Photo: Amit Verma

Vikram Chopra was always convinced about one common strand between life and poker: It's not about the cards you're dealt, but how you play your hand. In July 2015, when Chopra and his co-founder and friend Mehul Agrawal stepped down from leadership roles at online home furnishing brand FabFurnish, the duo knew they hadn’t played the cards well. The venture ended in a raw deal for them. Both exited.

In August, along with friends Ruchit Agarwal and Gajendra Jangid, they returned to the drawing board and co-founded online used-car platform Cars24—a high-stakes bet considering they were among the late movers in the segment. The start wasn’t great: Cars24 sold 18 cars in its first month.

A year later, in November 2016, Chopra—an avid poker player—was dealt another bad hand: Demonetisation. “We had no idea how things would pan out,” recalls Mehul. “Cash went out of the system and revenues nosedived,” adds Ruchit. In July 2017, came another challenge: Goods and Services Tax. The tax rate for new and old vehicles was the same, at 28 percent.