Cryptocurrencies: To invest or not to invest...the muddle continues

India's cryptocurrency industry is once again in a regulatory flux following fresh concerns voiced by RBI Governor Shaktikanta Das. As banks keep crypto-related transactions at an arm's length, government intervention is urgently needed to frame guidelines for the sector

The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.

The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.

Image: Shutterstock

Ravi Venkatachalam has been keenly researching online, the characteristics of different cryptocurrencies to add to a now-expanding portfolio, which includes blue-chip, mid-cap stocks and some investments into mutual fund schemes. “My friends have dabbled in it and I’ve seen the sharp upswings in some cryptos. I did not want to miss out,” Venkatachalam (name changed), an IT engineer now pursuing a business administration degree from a business school, told Forbes India in end-May, speaking from his home in Central Mumbai.

After completing the eKYC, his account with WazirX, India’s largest cryptocurrency exchange based on monthly trading volumes, was verified by them. Venkatachalam set out to buy Dogecoins worth Rs10,000 from the WazirX trading dashboard, where he was directed to a Mobikwik wallet. He could not transfer funds using his Unified Payments Interface (UPI) and was unsuccessful in logging in at another crypto exchange CoinSwitch Kuber, which merely said “attempts were exceeded” through a mobile application link.

Bank transfers using UPI to buy cryptocurrencies are listed as an option but are unavailable. The National Payments Corporation of India (NPCI), which runs the UPI platform, has not banned cryptocurrency transaction but has left the onus on banks to decide.

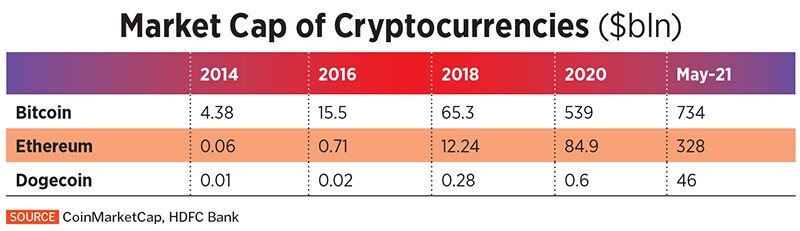

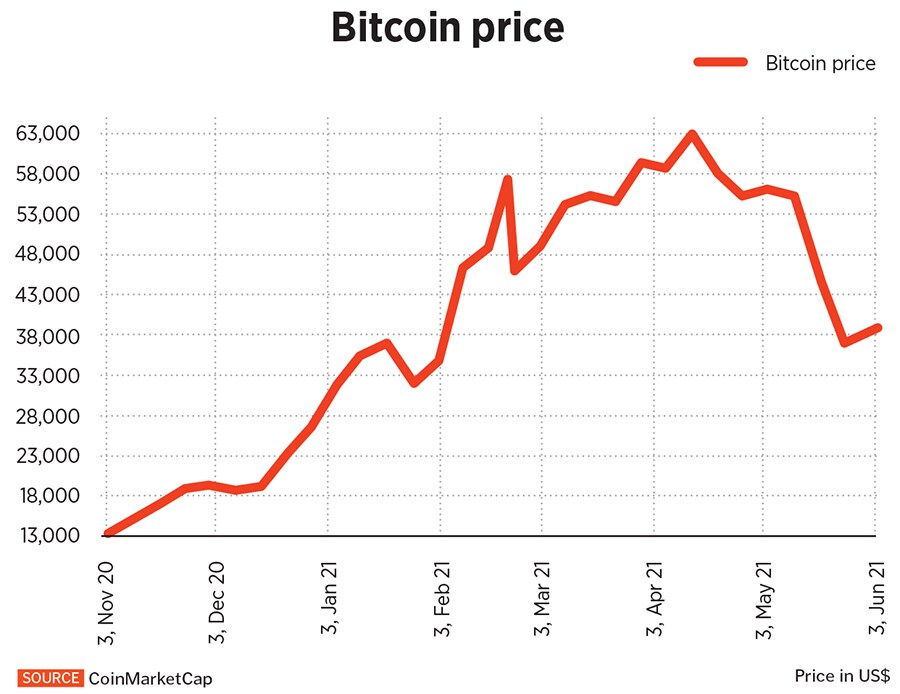

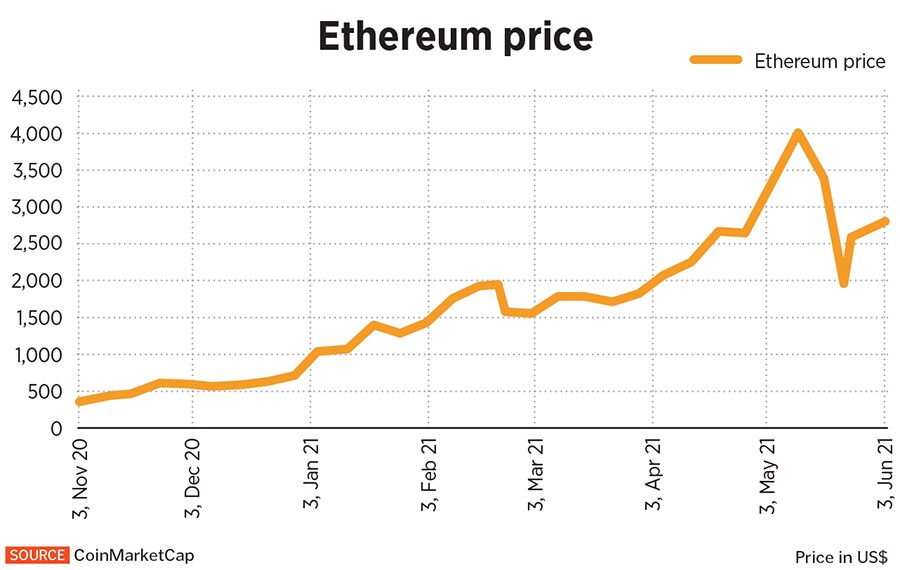

“I have been trying to buy Dogecoins since it was Rs9 ($0.11) and have been unable to either because of bank-related or interface issues. Now it is over Rs30 ($0.37), up 3 times in just a week, an opportunity I have missed out on,” Venkatachalam adds. In the month of May, Dogecoin prices more than halved to $0.29 by May 31, before bouncing back again to $0.37 (June 7), as it launched on the Coinbase exchange.