Chinese Checkers: Can India outsmart Chinese handset players?

With tax authorities cracking the whip on top Chinese handset players for alleged tax evasion, India is well-placed to prop up the desi boys to mute the dragon's play in smartphones. But will the government make the right move?

Indian players got decimated and the smartphone market became synonymous with Chinese brands

Illustration: Chaitanya Dinesh Surpur

Indian players got decimated and the smartphone market became synonymous with Chinese brands

Illustration: Chaitanya Dinesh Surpur

Let’s start with a fact. The Chinese checkers board game traces its roots to Germany. Reportedly, the name ‘Chinese Checkers’ originated in the US as a marketing scheme by Bill and Jack Pressman in 1928. Now let’s talk about a fantasy, which is inextricably intertwined with this fact. Almost everybody perceives Chinese checkers to be a Chinese game.

Back home, in 2014-15, India was in the midst of a fine interplay between fact and fantasy. The fact was the emergence of a new breed of homegrown players led by Micromax, which toppled Nokia and Samsung to take pole position. There was wide exuberance. Analysts and industry observers predicted a MILK (Micromax, Intex, Lava and Karbonn) revolution across the country. The start was promising, MILK boiled, but it spilled after a few years. The fantasy ended when Chinese players vanquished the Indian clones.

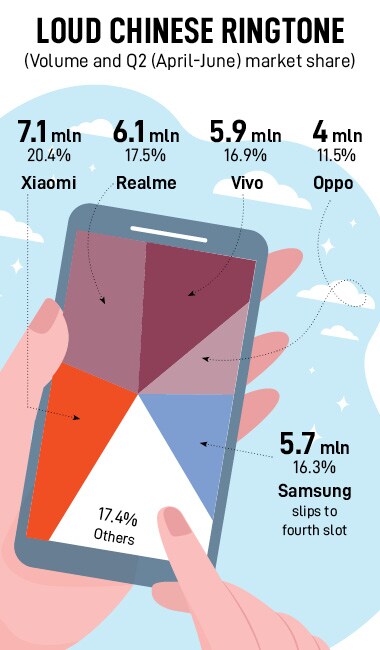

Over the next eight years, a new fact emerged. Indian players got decimated and the smartphone market became synonymous with Chinese brands. In the second quarter (April-June) of 2022, over 70 percent of the smartphone market in India was dominated by companies from the Dragonland. Out of this, 66.3 percent is cornered by just four players—Xiaomi, Realme, Vivo and Oppo—according to the mobile phone quarterly data provided by IDC.

Now let’s talk about fantasy, and its multiple strong versions. The first one—and this is a recurrent theme—emerges whenever tension between India and China flares up. There is a clamour for banning and boycotting Chinese goods. Interestingly, it flames out in days, if not months. Nothing changes at ground level. Then there are serious allegations of tax evasions against the Chinese firms. Union Finance Minister Nirmala Sitharaman recently informed the Rajya Sabha that the government is looking into cases of alleged tax evasion by Oppo, Vivo and Xiaomi. There was a huge hue and cry.

Now let’s talk about fantasy, and its multiple strong versions. The first one—and this is a recurrent theme—emerges whenever tension between India and China flares up. There is a clamour for banning and boycotting Chinese goods. Interestingly, it flames out in days, if not months. Nothing changes at ground level. Then there are serious allegations of tax evasions against the Chinese firms. Union Finance Minister Nirmala Sitharaman recently informed the Rajya Sabha that the government is looking into cases of alleged tax evasion by Oppo, Vivo and Xiaomi. There was a huge hue and cry.

Nothing, though, changes on ground. The Chinese smartphone players continue their dominance and Indian consumers continue to buy Chinese handsets (see box). While Oppo and Vivo didn’t respond to a list of questions sent by Forbes India, the Xiaomi spokesperson couldn’t be contacted.

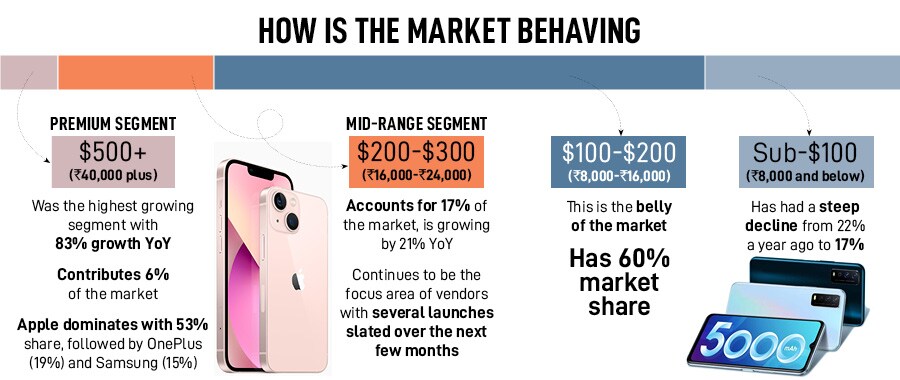

Now comes the latest fantasy cookie, which is being baked. The government is reportedly making a fresh attempt to reign in Chinese players. This time, though, the strategy is aimed at focusing on supply rather than influencing demand. There are talks about shunting Chinese players out of the under $150 (Rs12,000) smartphone segment. Does the move make sense? “Absolutely,” says a top ranking government official requesting anonymity. “Look at the market dynamics,” he points out. Around 60 percent of the market is between $100 and $200 (Rs8,000-Rs16,000). “This is the belly of the market. Once you are out of this, you start losing the game,” he contends, adding that once these players start losing volume, then it becomes an existential problem for them.

Now comes the latest fantasy cookie, which is being baked. The government is reportedly making a fresh attempt to reign in Chinese players. This time, though, the strategy is aimed at focusing on supply rather than influencing demand. There are talks about shunting Chinese players out of the under $150 (Rs12,000) smartphone segment. Does the move make sense? “Absolutely,” says a top ranking government official requesting anonymity. “Look at the market dynamics,” he points out. Around 60 percent of the market is between $100 and $200 (Rs8,000-Rs16,000). “This is the belly of the market. Once you are out of this, you start losing the game,” he contends, adding that once these players start losing volume, then it becomes an existential problem for them.

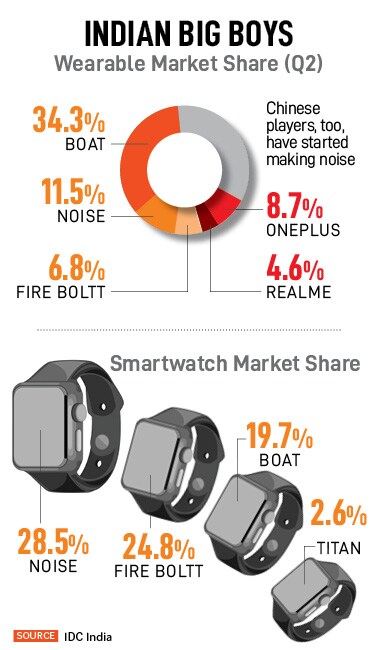

In spite of strong possibilities to prop Indian players in the entry-level smartphone segment, there are still gaping holes in the new ‘fantasy’ theory. “In a Chinese checkers game, there are places where marbles have to be fit,” says a senior smartphone analyst. To win the game, one has to get all the marbles to the opposite point of the star. “It’s easier said than done,” he reckons, requesting not to be named. The biggest flaw in the new theory to checkmate the Chinese, he underlines, is the assumption that the new Indian players can replicate their success. “One plus one is two and not eleven,” he says. The very fact that the Chinese dominate smartphones, and not wearables, proves the theory wrong. “You can’t copy and paste success from one category to another,” he points out.

In spite of strong possibilities to prop Indian players in the entry-level smartphone segment, there are still gaping holes in the new ‘fantasy’ theory. “In a Chinese checkers game, there are places where marbles have to be fit,” says a senior smartphone analyst. To win the game, one has to get all the marbles to the opposite point of the star. “It’s easier said than done,” he reckons, requesting not to be named. The biggest flaw in the new theory to checkmate the Chinese, he underlines, is the assumption that the new Indian players can replicate their success. “One plus one is two and not eleven,” he says. The very fact that the Chinese dominate smartphones, and not wearables, proves the theory wrong. “You can’t copy and paste success from one category to another,” he points out.