Buy. Build. Repeat: How PayU created a fintech ecosystem

How a string of buyouts, bold investment bets and aggressive ramp up helped online payments major PayU build a fintech ecosystem

L to R: Vijay Agicha, Global Head of Strategy & Growth; Prashanth Ranganathan, CEO finance; Anirban Mukherjee, CEO at PayU India, Khar, Mumbai; Image: Neha Mithbawkar for Forbes India

L to R: Vijay Agicha, Global Head of Strategy & Growth; Prashanth Ranganathan, CEO finance; Anirban Mukherjee, CEO at PayU India, Khar, Mumbai; Image: Neha Mithbawkar for Forbes India

For PayU, it was a tough choice to make in 2016. In fact, it’s never an easy one when it comes to build versus buy. Five years ago, though, South African internet and media conglomerate Naspers was in a slightly better position. Reason: In 2013, the Naspers-backed Ibibo snapped up online bus ticketing startup redBus, which added more heft to the flagship travel ecommerce brand Goibibo. Interestingly, it also widened its reach and play across India, and put it in a better position in its fight against the much-bigger rival MakeMyTrip. The move seemed pragmatic.

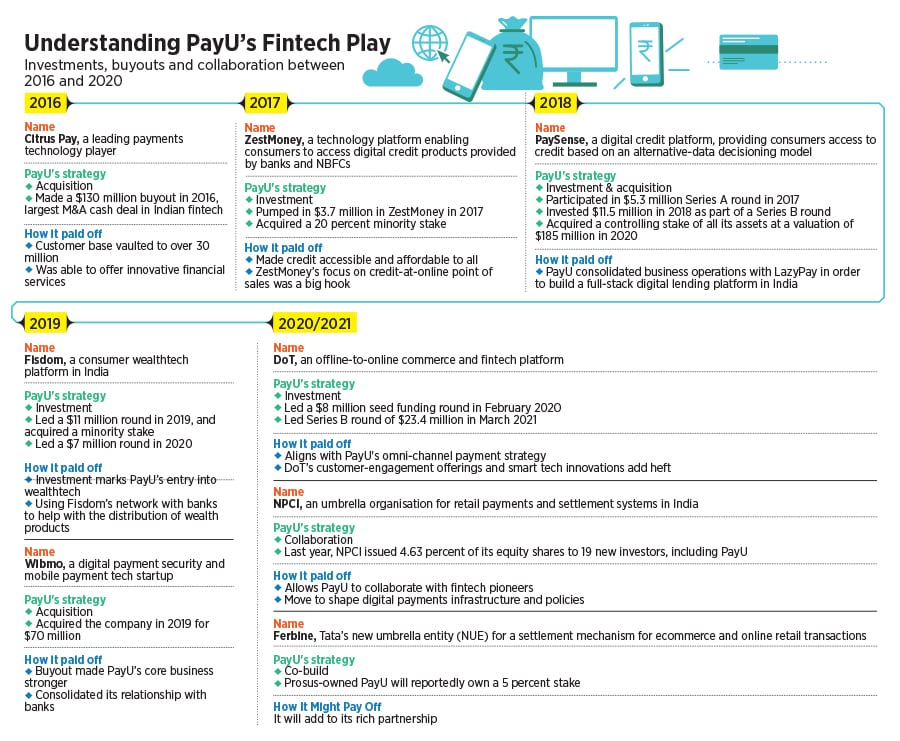

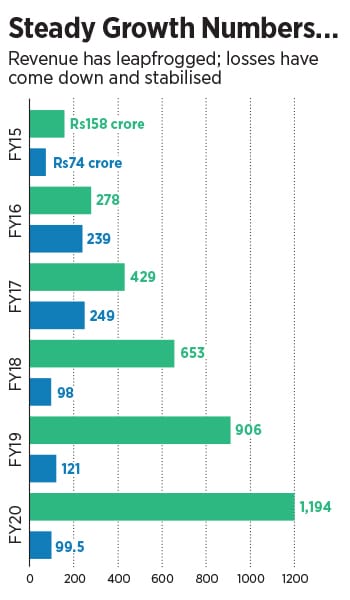

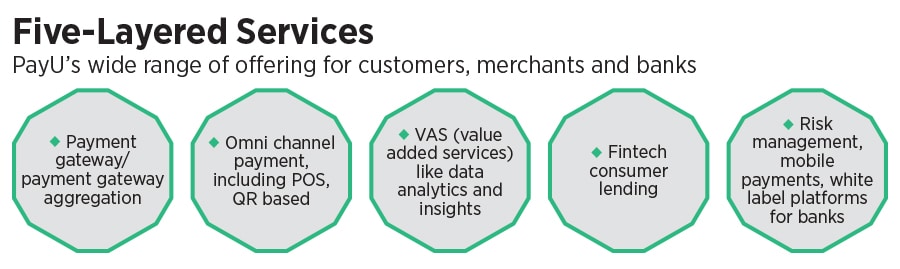

Three years later, it was déjà vu for Naspers, which owned PayU. Digital payments gateway brand PayU, which was demerged from Ibibo in 2014, had the option of either continuing to grow by building its own capabilities or accelerate the pace by shelling out shopping dollars. Though the former was an ideal choice, the latter was much more tempting and pragmatic. In September 2016, PayU bought rival Citrus Pay in a $130 million all-cash deal, the largest merger-and-acquisition deal in the fintech space in India. The result was staggering in terms of scale. The buyout vaulted PayU India’s customer base to 30 million, and made it the biggest payments player in the country. “We are excited about the opportunity to build a broader financial services proposition,” Laurent le Moal, global CEO of PayU, remarked.

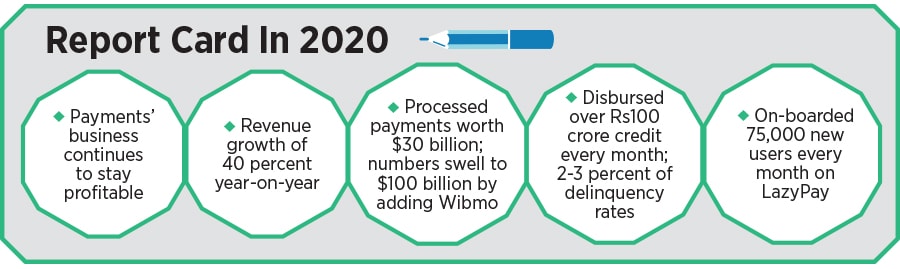

By the end of 2020, the broader financial play of PayU gathered enough steam. A year after buying Citrus Pay, PayU bought a 20 percent stake in consumer lending startup ZestMoney. The online payments biggie also put money in consumer lending platform PaySense, and eventually acquired the company last year. In 2019, it bought a minority stake in consumer wealth-tech startup Fisdom. A year later, another funding round was led by PayU in Fisdom, which provides a platform for investing in multiple products, including mutual funds, insurance, pension funds and digital gold (see box).