Blanket ban unlikely, keep calm and crypto on

India's policymakers sent local crypto trade into a spin with reports of a proposed bill to ban private cryptocurrencies. Trade has stabilised and so have intermediaries, but the uncertainty on the road ahead

Indian government is considering to prohibit the use of private cryptocurrencies except ‘certain exceptions’ in an upcoming bill

Indian government is considering to prohibit the use of private cryptocurrencies except ‘certain exceptions’ in an upcoming bill

Image: Shutterstock

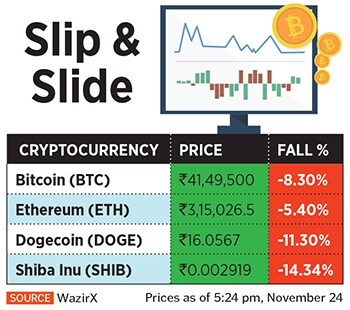

Indians investing in cryptocurrencies were spooked in early morning trade on Wednesday, with prices of Dogecoin and Shiba Inu tumbling on local crypto exchanges, following reports that the government is considering to prohibit the use of private cryptocurrencies except ‘certain exceptions’ in an upcoming bill. The government is working to table the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 in parliament during the winter session which starts November 29.

In afternoon trade, Bitcoin prices were down 8.4 percent at Rs 41,47,404, Ethereum down 6.04 percent at Rs 3,13,717, Dogecoin down 12.15 percent at Rs 15.99 and Shiba Inu down 16.11 percent at Rs 0.0028 at the WazirX cryptocurrency exchange. According to media reports, more than 10 crore Indians, including millennials, are said to have invested in cryptocurrencies.

Bitcoin, Ethereum: Private cryptos?

What got investors scrambling to book profit were the words ‘prohibit all private cryptocurrencies’. Does this mean the lwa will bring all existing investments to zero value? And are Bitcoin or Ethereum private or public cryptocurrencies?

What made interpretations and news uncertain is that the bill is not yet public and yet, the headline is similar to the bill the government had proposed to introduce in February. So has the bill or the language in it changed in any way? Impossible to ascertain at this stage.

“The signal we seem to get is that if cryptos are to be allowed, we cannot call it a currency or allow payments to be made through. It could be considered an asset class which investors could invest in at their own risk,” says Praphul Chandra, founder and chief scientist of KoineArth, a blockchain-based supply chain startup.

“The signal we seem to get is that if cryptos are to be allowed, we cannot call it a currency or allow payments to be made through. It could be considered an asset class which investors could invest in at their own risk,” says Praphul Chandra, founder and chief scientist of KoineArth, a blockchain-based supply chain startup.