Bitcoin ETFs: Positive shift in sentiment, marginal gain in opportunities

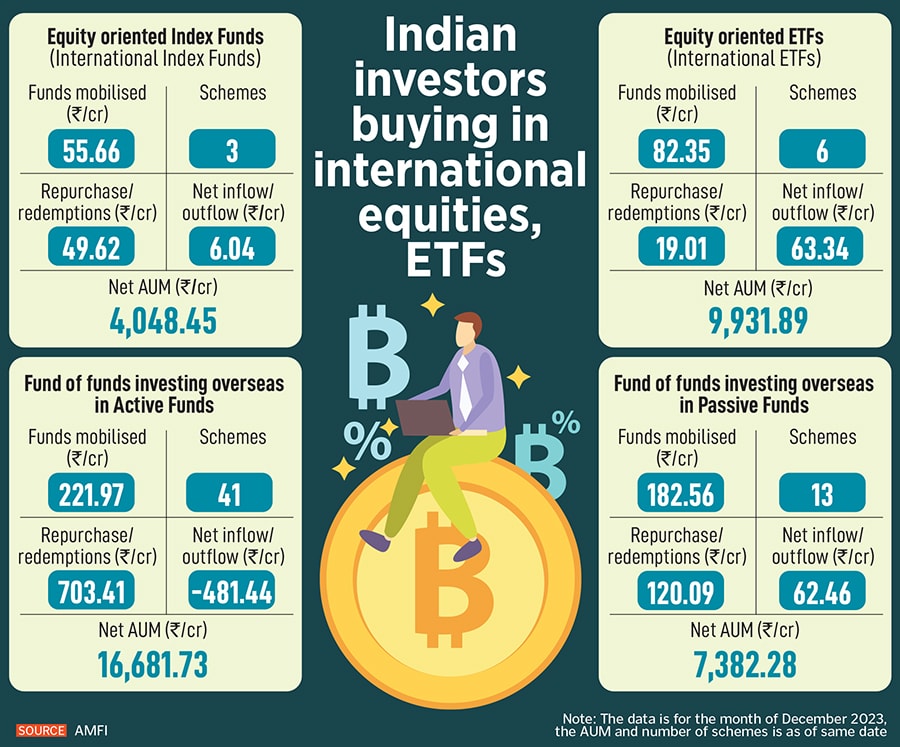

Trading volumes at local crypto exchanges rose in the build-up to the news of the SEC's approval towards trading of Bitcoin ETFs in the US. It has set the ground for more opportunities for investors in India to buy the ETF from international brokers

US Securities and Exchange Commission (SEC), on January 10, approved the trading and listing of Bitcoin exchange-traded funds (ETFs) from 11 large and well-recognised asset managers.

Images: Shutterstock

US Securities and Exchange Commission (SEC), on January 10, approved the trading and listing of Bitcoin exchange-traded funds (ETFs) from 11 large and well-recognised asset managers.

Images: Shutterstock

For crypto enthusiasts, entrepreneurs and investors alike, the New Year has opened with a bang after the US Securities and Exchange Commission (SEC), on January 10, approved the trading and listing of Bitcoin exchange-traded funds (ETFs) from 11 large and well-recognised asset managers.

2023 was largely a year that the digital assets ecosystem could forget, barring that Bitcoin spot jumped 157 percent in 2023, fuelled on expectations of the regulatory approval for ETFs. For the rest of the year, fortunes waned for large crypto exchange Coinbase, NFT trading volumes fell and crypto exchanges in India adopted different business models and diversified products to stay afloat.

What the game-changing decision of the SEC does for Bitcoin is that it has now received official recognition as a store value. It is now into the mainstream market. Bitwise, Grayscale, BlackRock, Valkyrie, Hashdex, Franklin Templeton, BZX, Invesco, VanEck, WisdomTree and Fidelity are the 11 institutions that are rolling out these funds—based on the Bitcoin spot price—for US-based investors only.

But despite this positive news, global Bitcoin spot fell nearly 10 percent to $42,591 on January 15, since the SEC announcement. As with all market and investor-sensitive events, the price has corrected after factoring in the ETF news. Bitcoin is expected to continue to face some pressure on price over the next few weeks, analysts say.

While much of the demand towards Bitcoin ETFs will be seen from US-based investors, including pensioners, the debate over how this news will impact the Indian crypto ecosystem and domestic investors is yet undecided.