BC TO PC: How HP toppled Lenovo to reclaim the PC crown during the pandemic years

It continues to widen the gap with its rivals in India thanks to its robust online presence, product innovations and upgrades, and winning the trust of customers

Image: Madhu Kapparath Ketan Patel, MD, HP India

Ketan Patel, MD, HP India

It was a different era till 2019. The contrast, though, gets most glaring in the computing world. The outsiders label the period as BC—Before Covid—which was typically characterised as an excessively sedate period of growth where ‘old desktops’ struggled in ICUs, and ‘young laptops’ crawled like infants. Ketan Patel tells us what was right, and not-so-right, in the PC (personal computer) world till 2019. He begins with the plusses. “HP has always been a credible brand,” contends the managing director of HP India. The brand, he underlines, had a huge credibility, vast presence and great performance. As far as the overall market was concerned, PC happened to be a stable business, India was looked upon as a promising country, and the American brand, which entered India in 1990, occupied pole position till 2018. “The journey was still credible, not incredible,” says Patel.

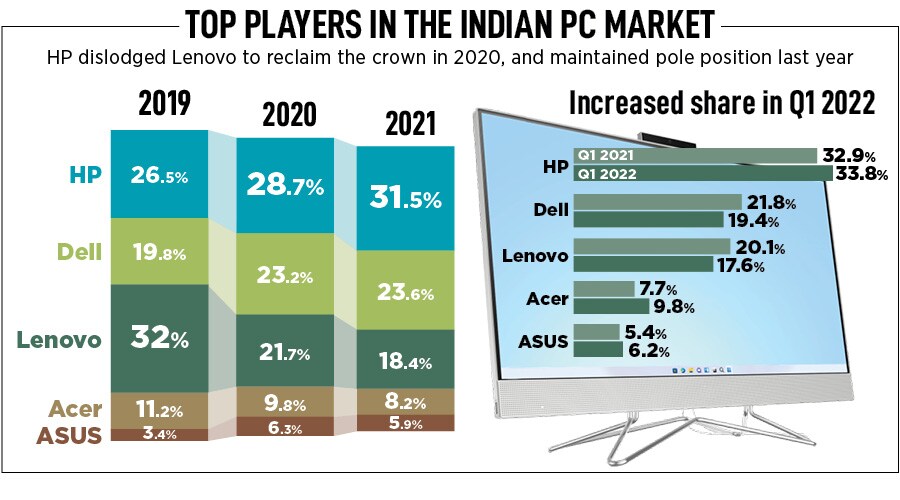

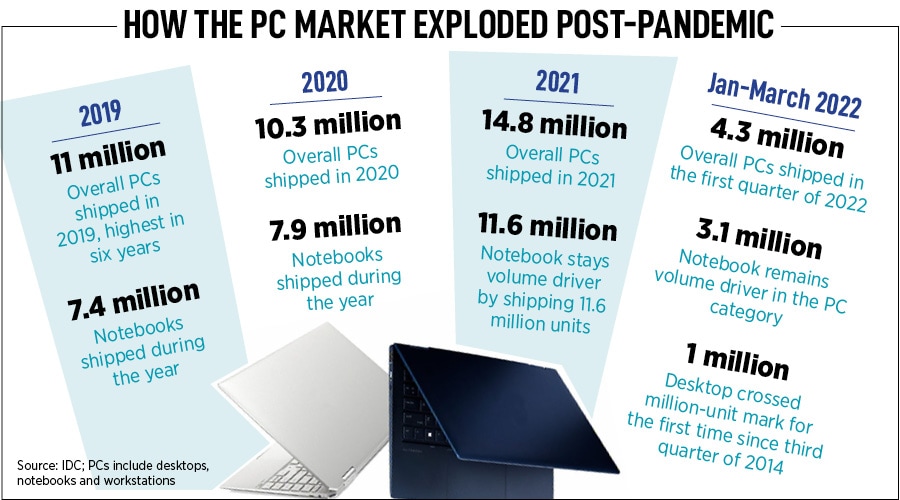

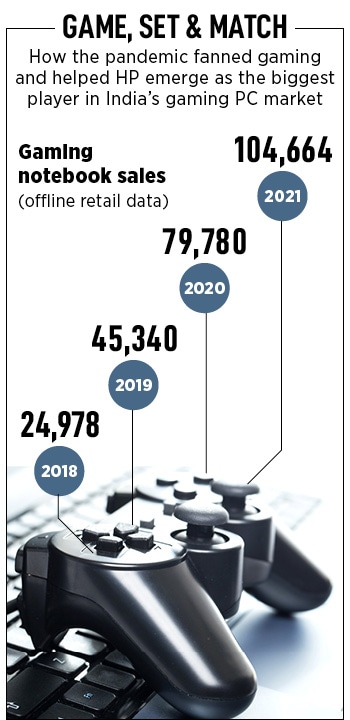

On the global front, though, something incredible happened in 2013. Chinese rival Lenovo toppled computing giant Hewlett-Packard (HP) to take the global crown. Six years later, in 2019, the dynamics in India reflected the global reality: HP ceded the top billing to Lenovo, which managed to grab 32 percent market share. HP came second with 26.5 percent, followed by Dell at a distant 19.8 percent. Interestingly, a loss in market share happened at a time when the overall market was stagnating. Desktops were becoming a thing of the past, and laptops were yet to become a necessity. This was the not-so-great reality about the Indian market, underlines Patel. The culprit to a large extent was mobile. Unlike most of the countries, where PC became the first device of internet, in India, smartphones played the lead role.

Cut to March 2020. Offices shuttered, schools shut down, supply chain got disrupted and life started revolving around PCs. The BC era was forced to make a sudden transition to a PC (post-covid) world where having a laptop became a must to ensure that one had roti, kapda and makaan. HP made the most of the pandemic tailwinds. To meet a sudden spike in demand and bypass the infrastructure gaps, charter planes full of PCs were flown to the master warehouse in Chennai, from where distribution across the country was undertaken. “We went all out to ensure that life for consumers, retailers and enterprise users didn’t get disrupted,” says Patel.

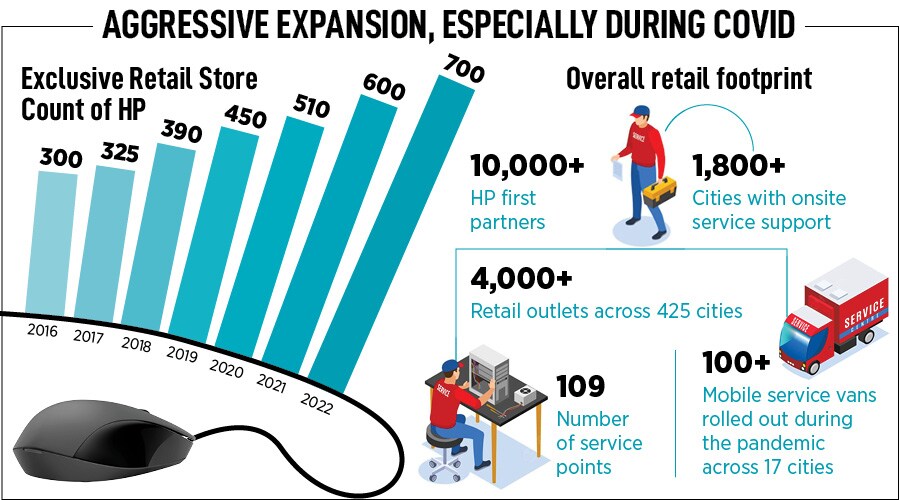

Back in India, marketing and branding experts reckon that HP’s hyper obsession with customers helped it immensely. From rolling out servicing vans to introducing new features in the products to expanding the retail footprint, the brand stayed with consumers. “It is like Maruti, a trusted brand not only for quality product, but for customer after-sales and service,” says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. During the pandemic, most of the laptop players just wanted to sell. HP, on the other hand, was bundling products with trust. “It did magic,” she adds.

Back in India, marketing and branding experts reckon that HP’s hyper obsession with customers helped it immensely. From rolling out servicing vans to introducing new features in the products to expanding the retail footprint, the brand stayed with consumers. “It is like Maruti, a trusted brand not only for quality product, but for customer after-sales and service,” says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. During the pandemic, most of the laptop players just wanted to sell. HP, on the other hand, was bundling products with trust. “It did magic,” she adds.